The start of 2024 brought renewed euphoria for Bitcoin (BTC) as the world’s premier cryptocurrency continued the late 2023 rally, saw the approval of the first-ever BTC exchange-traded funds (ETFs) in the U.S., and was heading toward another halving event.

The convergence of events spurred the coin toward highs not seen in years and led to expectations that upcoming developments – especially the now-passed April halving – would see Bitcoin finally rise to and above $100,000.

The most bullish hopes have, however, been somewhat betrayed as BTC saw its current yearly highs – just above $73,000 – in March. Trading has since been choppy but ultimately sideways.

Still, looking at the coin’s historical performance, some silver lining presents itself. Indeed, though historical halvings have sent BTC rocketing to unprecedented highs, the going has also, for the most part, usually been slow.

When will Bitcoin see this cycle’s peak?

If Bitcoin continues trading as could be expected based on past performance, this cycle’s highs may not come, as crypto expert Ali Martinez on X pointed out, for another 400 or so days—approximately 530 days after the April halving.

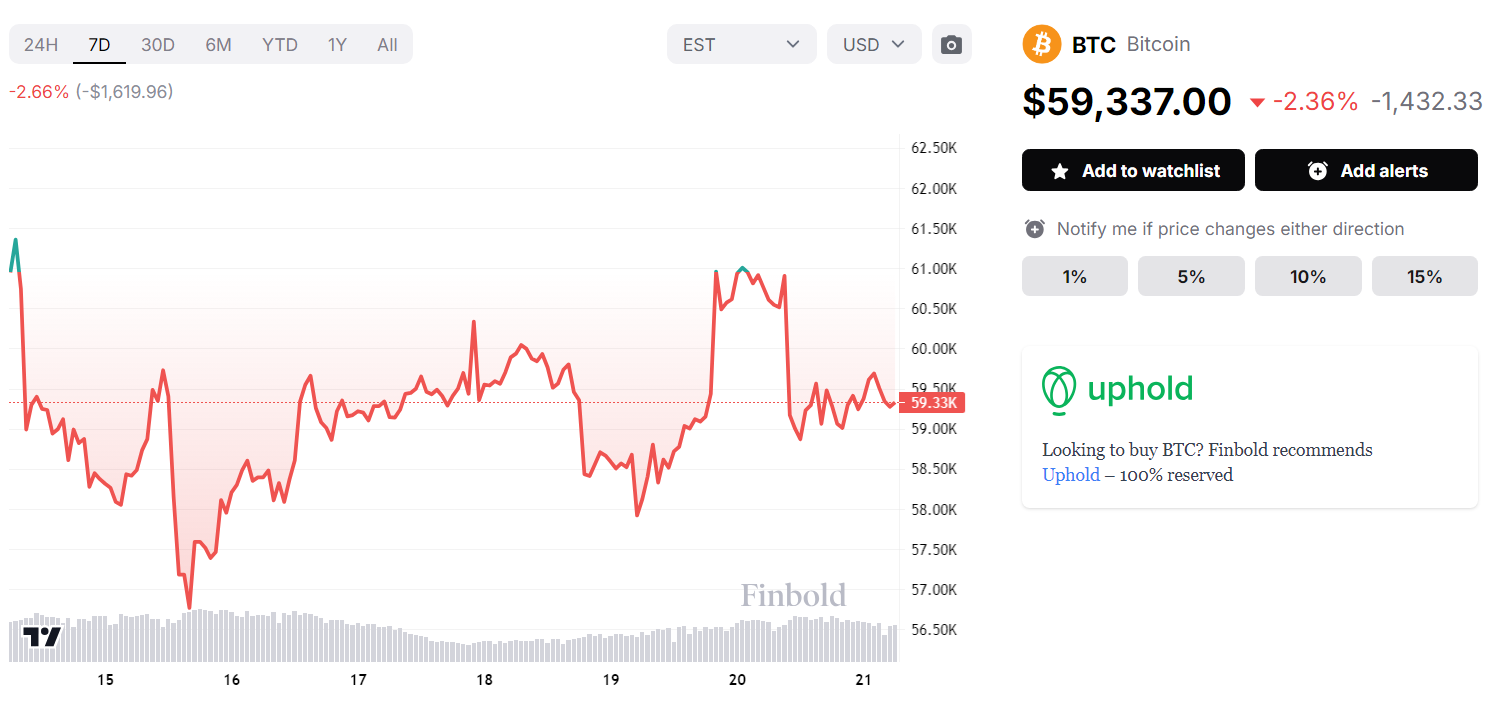

For example, BTC’s latest larger moves – on August 20 and 21 – saw the coin climb to about $60,000, only to fall to approximately $58,000 and then climb to Bitcoin price today of $59,337.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com