Usually, the halving of Bitcoin creates the conditions for a significant increase in the price of the cryptocurrency, but this time everything could be different.

In fact, compared to the first 3 halvings in the history of crypto assets, in this latest block reward halving event, things did not go as expected.

Bitcoin has updated its all-time high even before the four-year update, while 4 months later it sees a bear price performance..

What can we expect now? Let’s see everything in detail below.

Summary

The fourth halving in the history of Bitcoin

On April 19, 2024 the umpteenth Bitcoin halving aired, an event known par excellence as the best catalyst for the price increase of the criptovaluta.

This is the fourth halving of the block reward in the history of the crypto asset.

Every 4 years in fact, or rather every 210,000 blocks, the Bitcoin network performs an update that reduces new coin emissions by 50%.

This time the halving has reduced the presence of new circulating from the canonical 6.25 BTC per block (approximately every 10 minutes) to 3.125 BTC.

We are talking about a decrease of 450 BTC per day, equivalent to a value of 26.3 million dollars. In a year, this amounts to over 9.5 billion dollars of potential selling pressure removed from the crypto market.

Now the next halving is expected in 2028, when the block reward will drop to 1.5625 BTC, further contributing to making the digital asset increasingly valuable and difficult to mine.

The 4th #Bitcoin halving is complete!

— Binance (@binance) April 20, 2024

Block rewards are now 3.125 #BTC

The countdown has been reset – see you in 2028 🫡 pic.twitter.com/s0Wcl19A8p

As mentioned, generally the Bitcoin halving is associated with a bull movement in the price of the coin. This is because, in a context where quotations move according to the demand/supply ratio, a reduction in supply certainly has a positive impact.

This does not mean, however, that necessarily every decrease in supply (not the circulating one, but the “new” supply) has corresponded to an increase in prices.

In fact, in parallel to this scenario, there must also be an increase in demand to effectively support the rise in the markets.

We remind you that Bitcoin is not a deflationary asset, as it is mistakenly described: rather, it is an asset with a limited supply, with a programmed linear reduction inflation.

The price of cryptocurrency after the first months post-halving

If in the first 3 halvings in the history of Bitcoin, (2012, 2016, 2020), the halving of the block reward triggered a substantial increase in the price of the crypto, this time it could be completely different.

The halving of 2024 indeed represents a unique event of its kind, not so much on the software update side but rather in relation to the context of the quotations.

A posteriori possiamo osservare come già prima della fatidica data del 19 aprile 2024, Bitcoin had already updated its all-time high to 74,000 dollars.

In the previous 3 dates, the cryptocurrency had instead set a new price record after a few months (not before).

This time the cryptocurrency has experienced a strong rally in the months leading up to the halving, anticipating one of the most “discounted” movements in the market.

This is because probably the traders, knowing the historical price trend in conjunction with the halving, have chosen to buy in advance.

Nevertheless, there are those who believe that we are still early in the bull market of the current market cycle. Generally, Bitcoin reaches a new high 530 days after the halving.

It's been 119 days since the 2024 #Bitcoin halving. In the last two cycles, $BTC hit a market top around 530 days post-halving.

— Ali (@ali_charts) August 19, 2024

If history repeats, we're still in the early stages of this cycle! pic.twitter.com/Yxxo7DLfsg

In the world of finance, the terms “bull” and “bear” are often used to describe market trends. A “bull” market is characterized by rising prices, while a “bear” market is marked by falling prices. Understanding these concepts is crucial for investors.

Four months after the halving, however, Bitcoin prices are down by about 10%, highlighting a completely “off” timing compared to the asset’s historical performance.

Since April, the trend of the entire cryptocurrency sector has been bearish, well below users’ expectations.

It is not certain that another bull phase will occur in the coming months, just as it is not certain that there will be a new all-time high AFTER the last halving.

Bitcoin halving bull run :pic.twitter.com/VWoyFNQQHQ

— naiive (@naiivememe) August 19, 2024

What to expect now? The macro data and future price forecasts of Bitcoin

Definitely the halving of this cycle represents the most difficult to analyze, both for the effect on the price of Bitcoin and for the macroeconomic context of the financial markets.

In the previous three halving events, there was in fact a macro-level situation completely different from the current one.

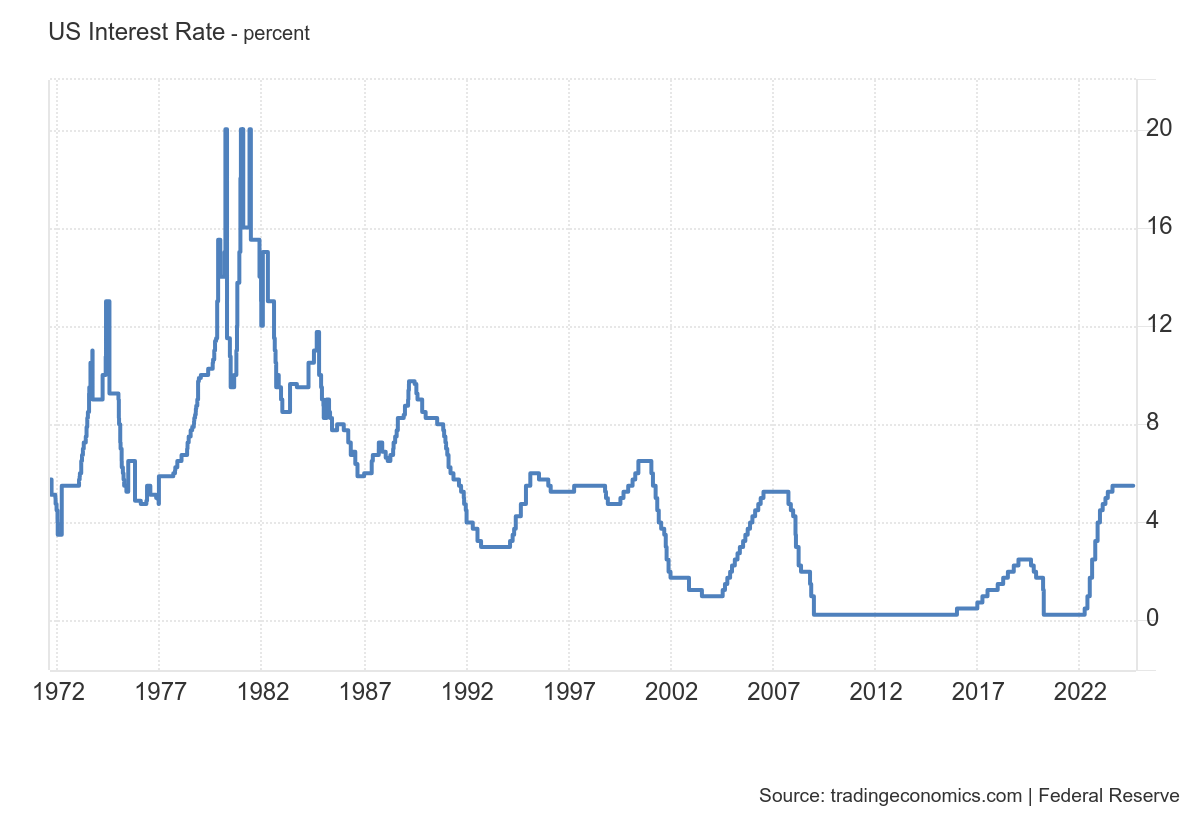

First of all, in the years 2012, 2016, and 2020, the interest rate of Government Bonds in the USA has always fluctuated between 0.25% and 0.50%, with a brief rise during 2019.

In April 2024, however, the so-called “FED Fund Rate” were as high as 5.5 percentage points, indicating one of the most restrictive monetary policies of the last 20 years.

Furthermore, geopolitical tensions with open wars in Middle East and in Ukraine further complicate the picture, making it even more difficult to compare the latest halving with the previous ones.

What to expect now? By taking a look at the projections of interest rate cuts in the USA, we can estimate a rise in the crypto market as early as next month.

In September, in fact, investors expect a cut of at least 50 basis points, followed by a probable further cut of 25 points in the subsequent FOMC.

In conjunction with this reversal from a “tightening easing” trend to a “quantitative easing” trend, inflation in the United States is gradually diminishing.

In the past few days, the index of the increase in consumer goods prices has indeed fallen below 3% for the first time in several months.

In anticipation, we can therefore expect a rise in the price of Bitcoin throughout Q4 2024. Indicatively, in these 3 months, the cryptocurrency could update its all-time high, bringing the cyclical effect of the halving back to normal.

Attention in any case to possible black swans from here to the coming months, with potential postponement of the price increase in Q1 2025.

The first post-halving target is that of 100,000 dollars, with possible spikes even above this record figure.

#BTC

— Rekt Capital (@rektcapital) August 18, 2024

Bitcoin is ~125 days after the Halving

Bitcoin tends to breakout into the Parabolic Phase of the cycle some ~160 days after the Halving

If history repeats, Bitcoin could be just over a month away from breakout

That's late September$BTC #Crypto #Bitcoin pic.twitter.com/iy7xmDjuso

en.cryptonomist.ch

en.cryptonomist.ch