Since March, Bitcoin’s price has been consolidating in a wide range and gradually declining. This rangebound movement might eventually lead to a long-term bullish trend.

Technical Analysis

By TradingRage

The Daily Chart

On the daily chart, the price has recently broken below the 200-day moving average, located around the $63K mark.

Yet, the market has rebounded from $50K and has retested the 200-day moving average but has been rejected to the downside.

Currently, the price is likely to test $56K. If the level holds, the market could once again rally toward the 200-day moving average and probably higher, which could lead to the beginning of a new bull run.

The 4-Hour Chart

The 4-hour timeframe demonstrates a possible recovery scenario, as the price has rapidly bounced higher from the $52K support level following last week’s drop.

Yet, the market is struggling to break above the $61K resistance level at the moment and is creating a bullish flag pattern.

If it’s broken to the upside, an upward move toward the $64K level would be highly likely in the short term. On the other hand, if the pattern fails, things could quickly get worse, and the market could decline to the $52K level once more.

On-Chain Analysis

By TradingRage

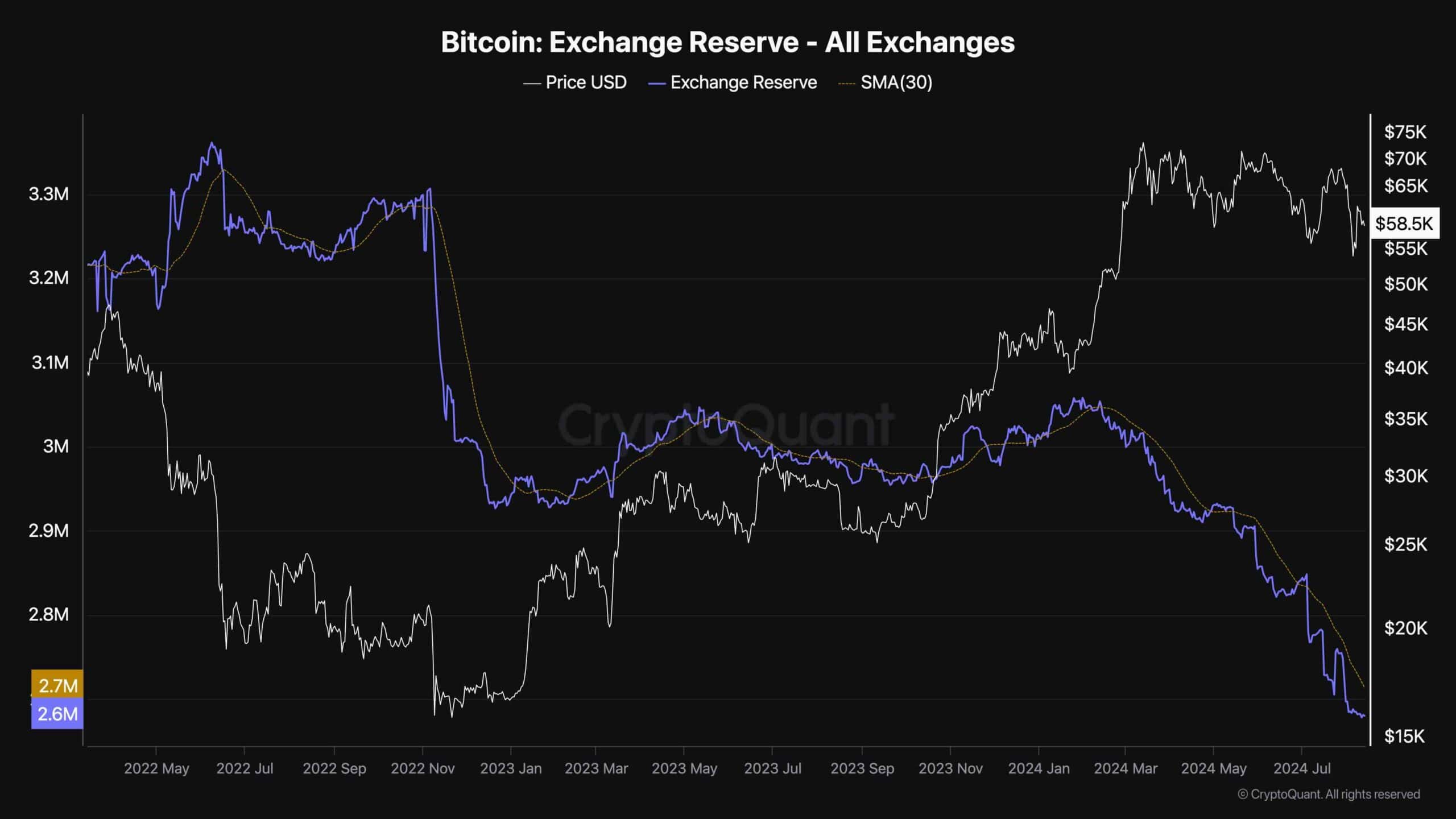

Bitcoin Exchange Reserve

While Bitcoin’s price action is not convincing, some fundamental network metrics, due to a considerable decline in supply, are pointing to a potential price rally in the coming months.

This chart displays the Bitcoin exchange reserve metric and its 30-day moving average. The metric measures the amount of BTC held in exchange wallets. The number of these coins can be considered a proxy for supply, as they are readily held on exchanges and can be sold quickly.

As the chart suggests, however, the exchange reserve metric has been on a steep decline since the beginning of 2024, indicating an aggregate accumulation behavior by investors. This is a good sign and can lead to a supply shock in the near future, which could result in a price surge for BTC.

cryptopotato.com

cryptopotato.com