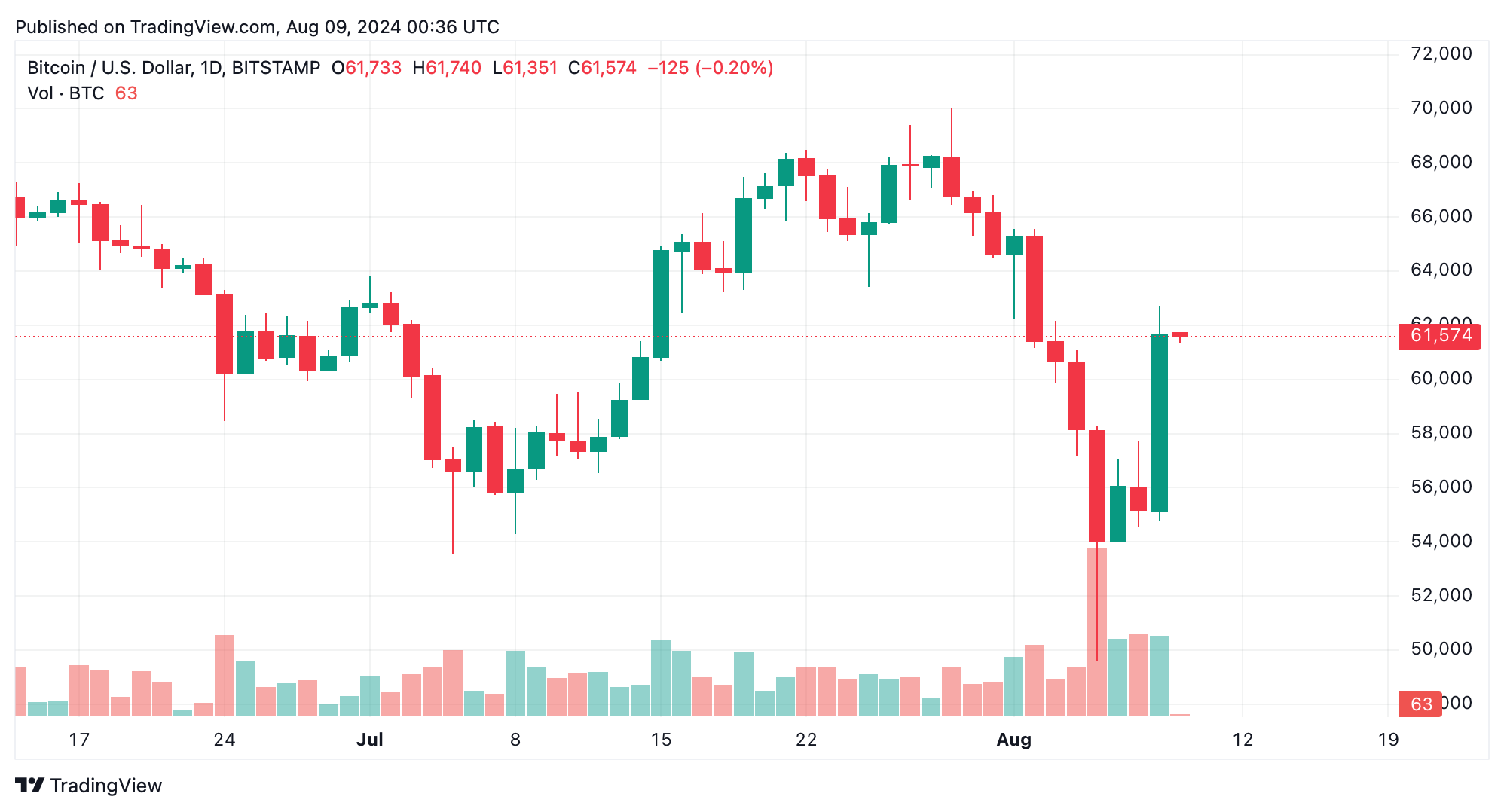

On Thursday, bitcoin (BTC) leaped to a high of $62,729, representing a more than 26% jump from its Aug. 5 low of $49,577, recorded just three days earlier. The broader cryptocurrency market, which encompasses over 10,000 digital currencies, saw an 11.29% rise over the past 24 hours, with many assets enjoying double-digit gains.

Bitcoin Hits $62,729 Intraday High as Dozens of Crypto Assets See Double-Digit Gains

The crypto economy is making a robust recovery following a steep decline over the weekend and a rough start to the week on Monday. On that day, BTC dipped to a level not seen since February 2024, touching $49,577 per coin. Three days later, it rallied by 26% to reach an intraday high of $62,729, and by 8 p.m. EDT on Aug. 8, BTC was trading at $61,611 per coin. In the past day, BTC has climbed 11.2% against the U.S. dollar.

Ethereum (ETH) also had a strong day, climbing 13.5% over the 24-hour period. ETH hit $2,723 before settling at $2,668 per coin by 8 p.m. BNB posted a more modest 7.99% increase, toncoin (TON) surged by 13.6%, solana (SOL) rose 11.2%, and dogecoin (DOGE) enjoyed an 11% boost as well. Amid the day’s trading activity, the U.S. spot bitcoin exchange-traded fund GBTC experienced a significant $182.94 million reduction, according to sosovalue.xyz stats.

Meanwhile, Wisdomtree’s BTCW, a fund that has seen much lower cumulative net inflow compared to its rivals, managed to attract $118.52 million. Over on the ETH side, Grayscale’s Ethereum Trust (ETHE) faced outflows of $19.83 million on Thursday. However, the Grayscale Mini Ethereum Trust (ETH) accumulated $5.02 million. Thursday’s data from other funds remains incomplete, leaving the total net inflow or outflow for the entire group uncertain.

news.bitcoin.com

news.bitcoin.com