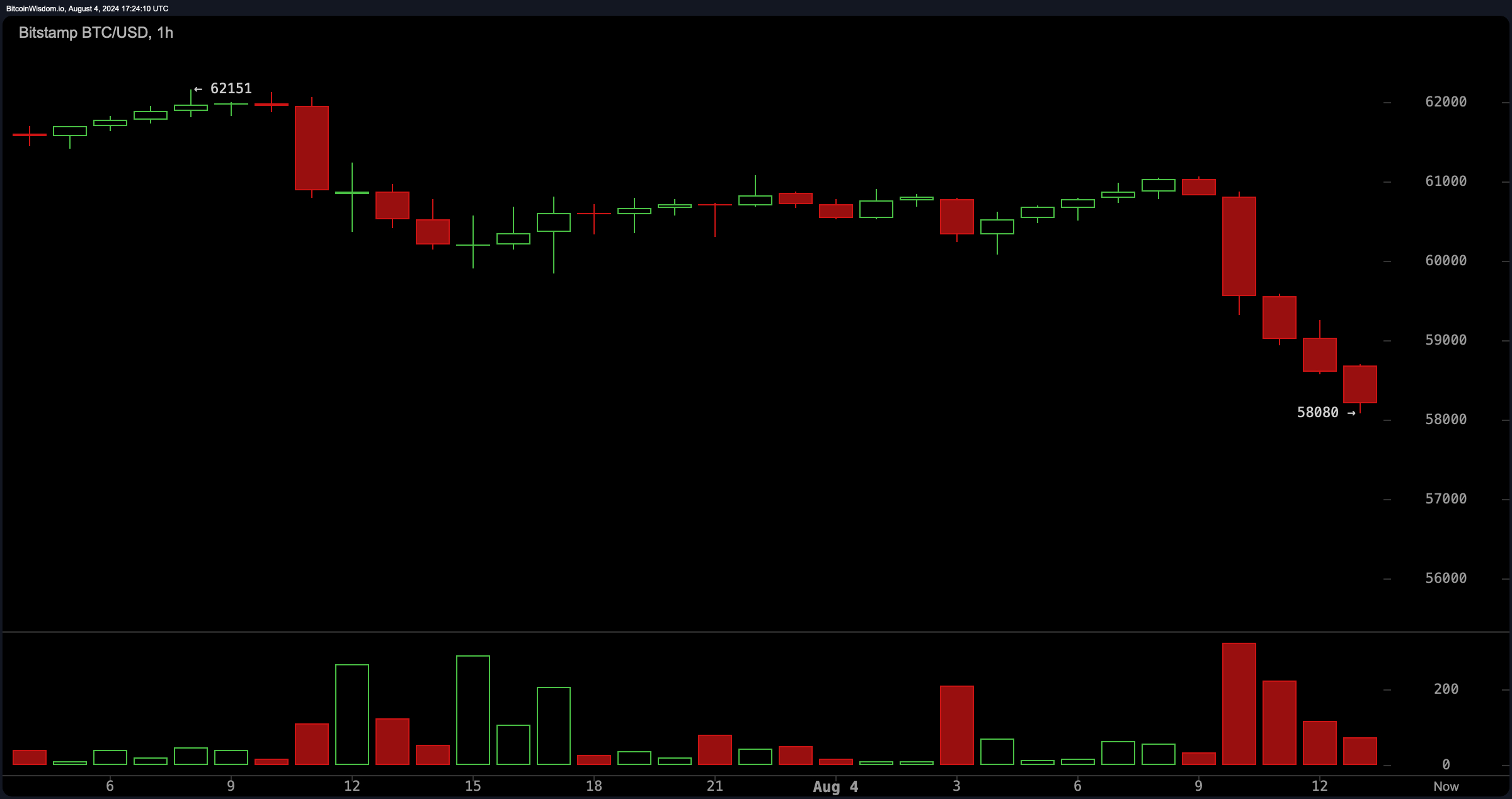

The price of bitcoin (BTC) fell below the $59,000 threshold on Sunday, hitting a low of $58,080 per unit. Over the past 24 hours, bitcoin’s value has decreased by 3.5% against the U.S. dollar, and it has dropped 13% over the week.

Bitcoin Slides Below $59K

At 1:24 p.m. EDT on Sunday, bitcoin dropped to a low of $58,080 per coin. As of now, the top cryptocurrency is hovering just around the $58,200 to $58,500 range. It has been a challenging week for bitcoin, as its value has declined from the $70,000 zone seen six days ago on July 29 to its current low. Global trade volume has decreased, now 13.21% below the levels seen during Saturday’s trading sessions.

Interestingly, while bitcoin was trading just below $59,000 at 12:45 p.m., when it was trading at $58,963 per unit worldwide, on Upbit in South Korea, it was trading 4.14% higher at $61,408 per unit. On the South Korean exchange Bithumb, BTC was priced slightly lower at $61,354 per coin. The South Korean won is the second most traded fiat currency against bitcoin (BTC) this weekend, accounting for 2.19% of all BTC trades, trailing only the U.S. dollar and stablecoins.

Moreover, just before 1:30 p.m. EDT, a substantial number of crypto derivatives positions were liquidated, with $222.99 million in positions wiped out over the past day. Of these, approximately $190.59 million were long positions, including $52.05 million from BTC longs and $59.11 million from ETH longs. Additionally, $16.91 million in solana (SOL) long positions were erased. In total, around 95,616 traders were liquidated in the last 24 hours, with the largest loss occurring on Bitmex, where a trader with an ETH position lost approximately $6.29 million on Sunday.

The recent downturn in bitcoin’s price, coupled with significant liquidations, reflects a broader uncertainty in the cryptocurrency market. While global trading volumes have dipped, the discrepancy in BTC prices across exchanges highlights the continued influence of regional markets, particularly in South Korea. This volatility underscores the importance of closely monitoring market dynamics as bitcoin navigates through these turbulent conditions.

news.bitcoin.com

news.bitcoin.com