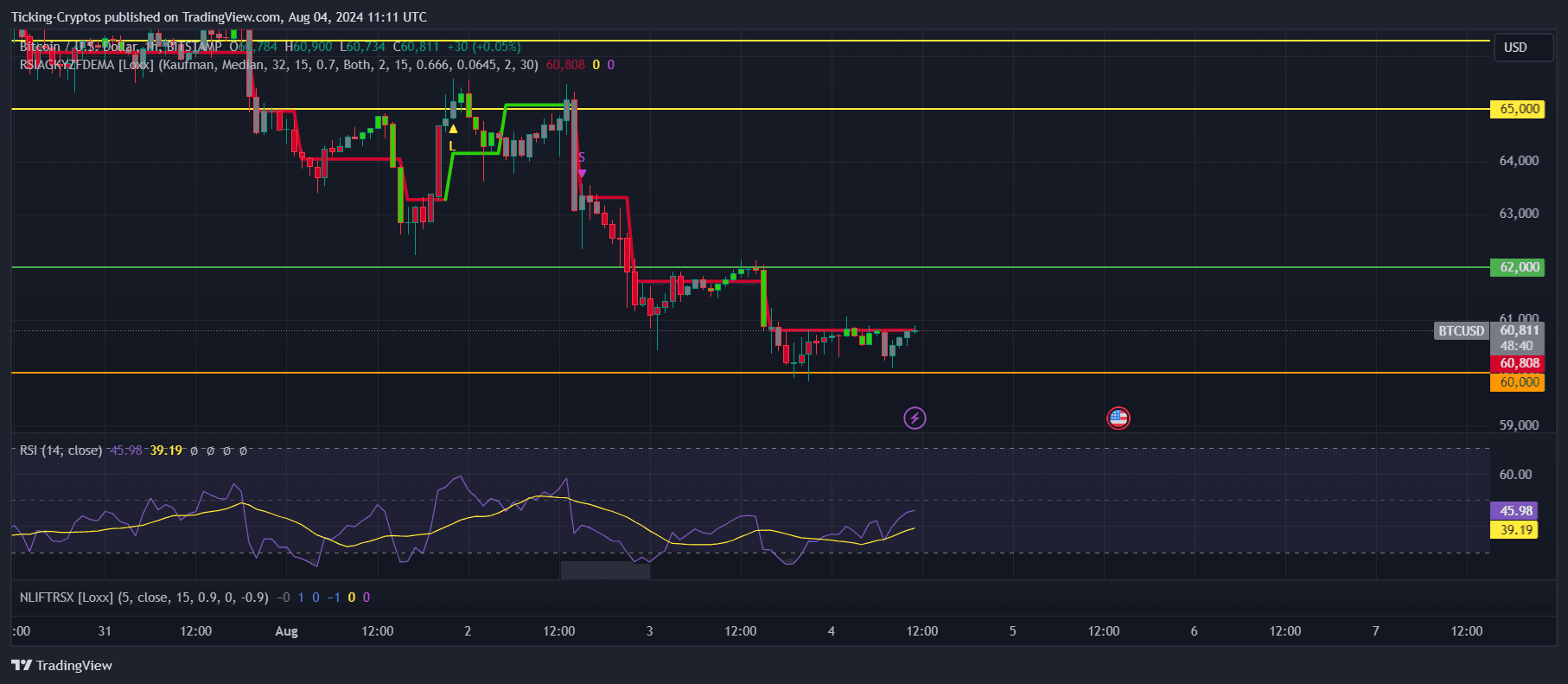

Bitcoin ($BTC) saw a sharp decline from a high of $67,500 to a current value of approximately $60,750 within the past seven days. This drop has raised concerns and speculations among investors and analysts alike. With the $60,000 mark acting as a strong support level, will Bitcoin hold steady or plunge further?

Why did Bitcoin Crash?

Bitcoin's recent price drop can be attributed to a mix of market sentiment and broader economic factors. Bitcoin crashed from $67.5K to around $60,750, reflecting a significant 10% loss. This sharp decline has led many to scrutinize the potential triggers and implications for the broader crypto market.

Bitcoin Support Price at $60,000: The Line in the Sand

The $60,000 price level has emerged as a critical support zone for Bitcoin. Historically, this area has acted as a psychological and technical barrier, often influencing traders' decisions. If Bitcoin maintains its position above this support, we could see a consolidation phase or a potential rebound. However, a breach below this level may signal further bearish momentum, potentially driving the price down to the next support around $54,000.

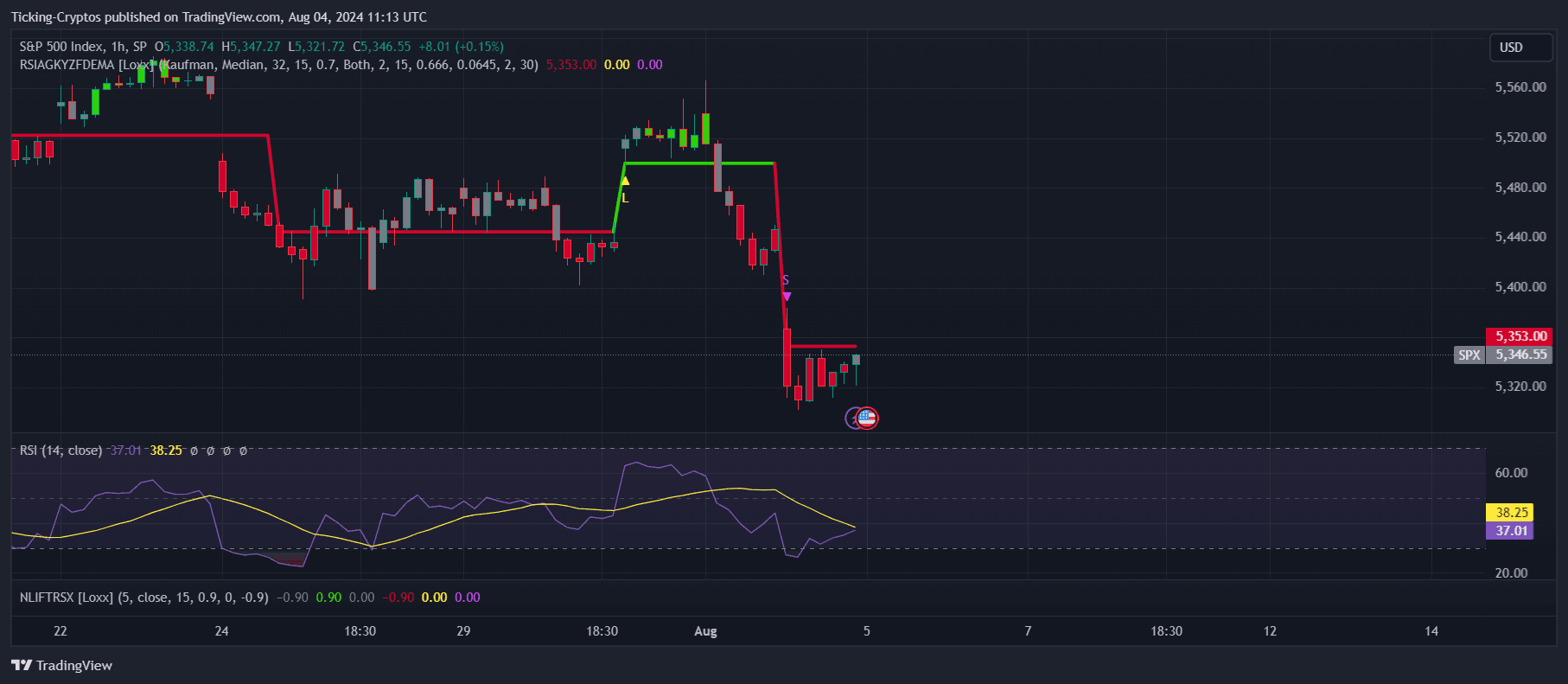

Tech Stocks and Crypto Correlation

The recent downturn in the crypto market coincided with significant losses in the US tech stock sector. In the past five days, the S&P 500 ($SPX) fell by over 2%, while the Nasdaq recorded losses of around 4%. This decline in tech stocks may have contributed to the negative sentiment in the crypto market, as investors often view these assets as interconnected. The broader economic environment, including rising interest rates and inflation concerns, has also played a role in shaping market dynamics.

$SPX_2024-08-04_14-13-47.png">

$SPX_2024-08-04_14-13-47.png">

Bitcoin Price Prediction: Outlook: Bullish or Bearish?

As Bitcoin stabilizes around the $60,000 mark, market participants are closely monitoring key indicators and market trends. On the bullish side, a strong defense of the $60,000 support could lead to a recovery, with potential targets above $65,000. On the bearish side, a breakdown below this level could trigger a sell-off, pushing prices towards $54,000 or lower.

cryptoticker.io

cryptoticker.io