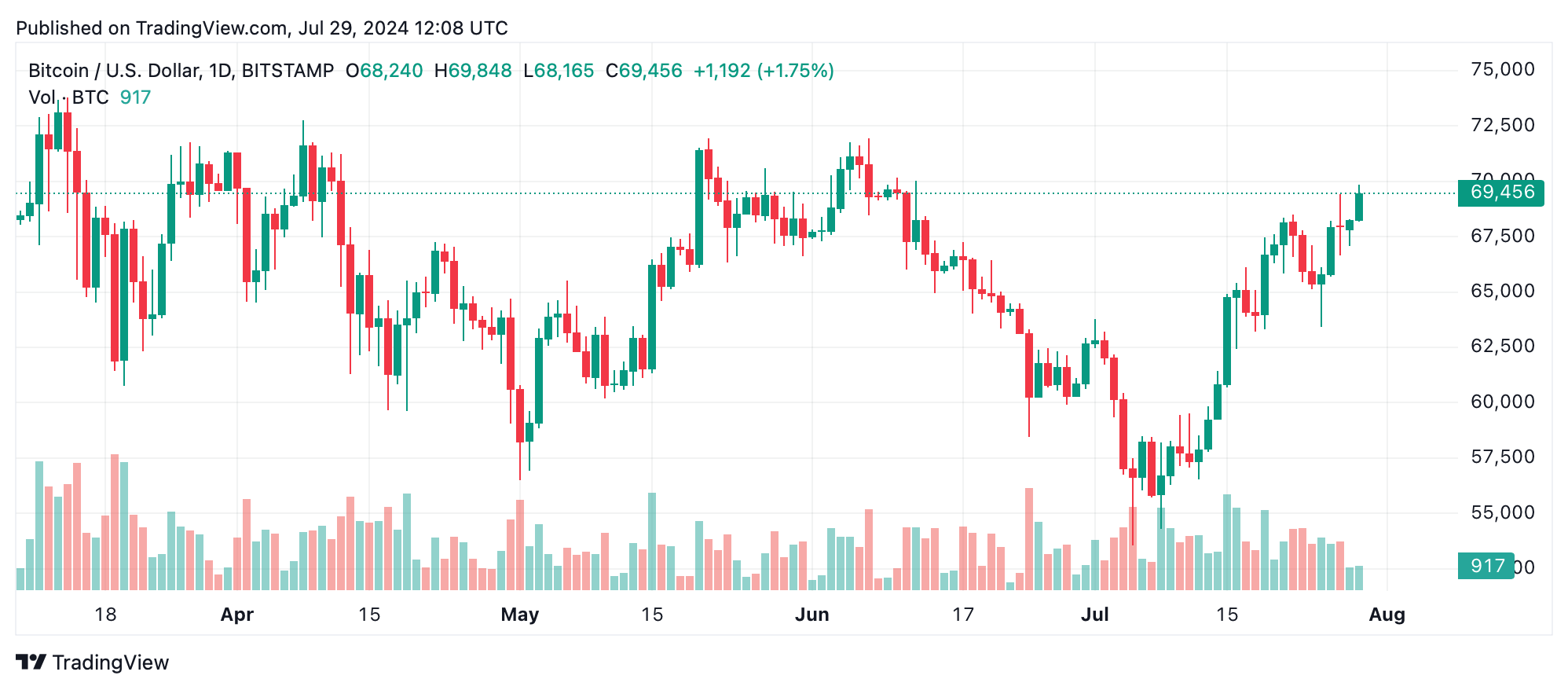

On July 29, 2024, bitcoin continues its bullish trend, demonstrating significant strength across multiple time frames. As of today, bitcoin is trading at $69,456 with a 24-hour price range between $67,618 and $69,842. Key technical indicators suggest that bitcoin’s upward momentum is likely to persist.

Bitcoin

Bitcoin’s 1-hour chart indicates a steady uptrend with prices consistently moving above key exponential moving averages (EMAs). The 10-period EMA at $67,134 and the 20-period EMA at $65,462 both suggest buying pressure. These short-term EMAs provide strong support levels, indicating that the current bullish momentum is backed by significant trading volume.

The 4-hour chart corroborates this positive outlook, showing bitcoin well above its medium-term moving averages. The 50-period EMA at $64,315 and the 100-period EMA at $63,636 both register as strong buy signals. This alignment of multiple EMAs across different periods further supports the sustained bullish trend.

Daily chart summaries reinforce this trend, highlighting bitcoin’s resilience and strength. Both the daily simple moving average (SMA) and EMA signals are firmly in buy territory. The 200-period EMA at $59,378 and the 200-period SMA at $60,884 offer long-term support, suggesting that bitcoin’s price is unlikely to fall below these levels without significant market changes.

Oscillators present a more nuanced picture. The relative strength index (RSI) stands at 68, indicating that bitcoin is approaching overbought conditions but remains neutral. The commodity channel index (CCI) is at 109 and the awesome oscillator (AO) also remains neutral. However, the moving average convergence divergence (MACD) level at 1,805 signals a buy, providing further confirmation of bullish momentum.

Bull Verdict:

Given the strong buy signals across multiple moving averages and the positive momentum indicated by key oscillators, bitcoin appears poised to continue its upward trajectory. Traders might consider this an opportune time to enter the market or add to existing positions.

Bear Verdict:

Despite the overall bullish indicators, caution is warranted as some oscillators, like the RSI, suggest bitcoin is nearing overbought territory. A potential price correction could occur if market sentiment shifts or if profit-taking ensues, making it crucial for investors to monitor these signals closely.

news.bitcoin.com

news.bitcoin.com