The Stock Exchange of Hong Kong (HKEX) will reportedly launch Asia’s first-ever Bitcoin inverse product later this month.

Dubbed CSOP Bitcoin Futures Daily (-1x) Inverse Product (7376:HK), the fund is designed to provide inverse exposure to BTC’s price movement.

Key Details of the Fund

According to famous Chinese reporter Colin Wu, the upcoming Bitcoin inverse product will launch on July 23, 2024, making it the first of its kind in Asia.

Exclusive: On July 23, the Hong Kong Stock Exchange will launch Asia's first Bitcoin inverse product, named CSOP Bitcoin Futures Daily (-1x) Inverse Product (7376 HK), which directly invests in the nearest expiring monthly Bitcoin futures traded on the CME. The trustee is HSBC…

— Wu Blockchain (@WuBlockchain) July 19, 2024

Notably, the product will directly invest in the nearest expiring monthly Bitcoin futures contracts traded on the leading global derivatives marketplace, the Chicago Mercantile Exchange (CME).

Under this initiative, investors can speculate on the price actions of nearest-to-expiry Bitcoin future contracts without actually holding the cryptocurrency.

Furthermore, Colin Wu revealed that the Asia arm of HSBC Institutional Trust Services Limited will serve as the trustee for the fund’s oversight.

7376:HK Will Track S&P Bitcoin Futures Index

Meanwhile, according to Bloomberg, the upcoming fund is designed to track the inverse daily movement of the S&P Bitcoin Futures Index before accounting for fees and expenses.

This implies that when the price of the S&P Bitcoin Futures Index surges by a particular percentage on a given day, the value of the 7376:HK fund will decrease by approximately the same rate, and vice versa.

Upon the fund’s launch, Bloomberg would track the fund’s price action via its market data platform. In the meantime, the market data for 7376:HK is marked as “pending” in anticipation of its upcoming listing.

Institutional Clients Gain More Indirect Exposure to BTC in Hong Kong

The development marks another significant step towards providing Hong Kong-based institutional clients with indirect exposure to cryptocurrencies.

Recall that Hong Kong welcomed six spot-based Bitcoin and Ethereum exchange-traded funds in April 2024. Three Chinese firms Bosera Asset Management, China Asset Management, and Harvest Global Investments, issued the spot crypto ETFs on the Hong Kong Stock Exchange.

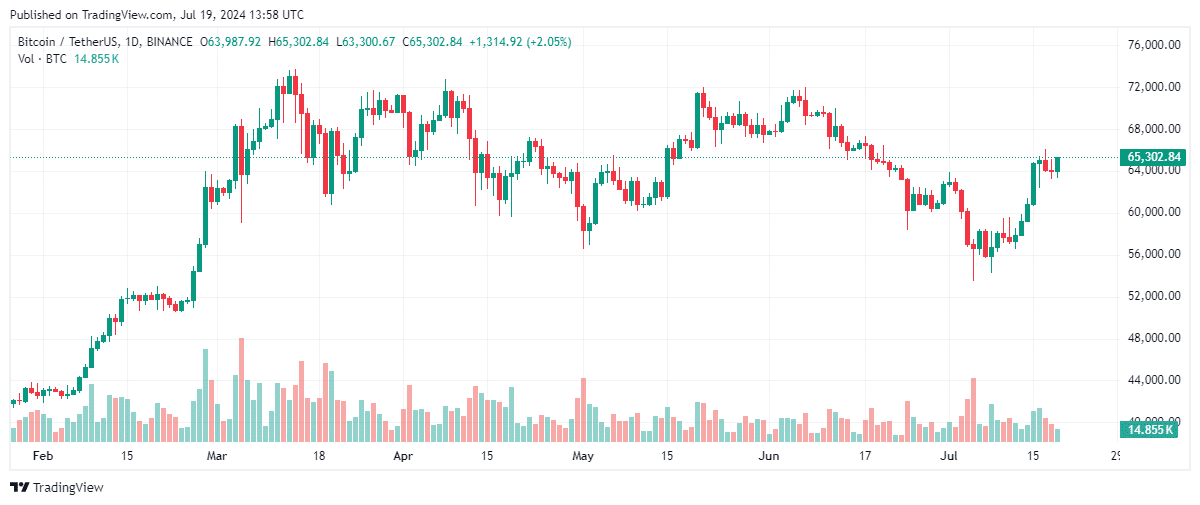

In the meantime, Bitcoin’s price has revisited the $65,000 territory after rallying 1.02% in the daily charts. At press time, Bitcoin is trading at $65,302, reflecting a weekly surge of 12.96%.

thecryptobasic.com

thecryptobasic.com