A crypto analyst has suggested that investors should be prepared for a possible Bitcoin (BTC) rally towards the end of the year despite the current bearish sentiment.

Particularly, the analyst with the pseudonym Stockmoney Lizards noted in an X post on July 13 that technical analysis suggests bullishness for Bitcoin.

The analyst centered his prediction on Bitcoin’s interactions with the lower border of the weekly Bollinger Band, a tool often used by traders to identify overbought and oversold conditions.

According to Stockmoney Lizards, Bitcoin has touched the lower border of the weekly Bollinger Band thrice since November 2022. Historical data from the past two instances suggest that significant price increases could be on the horizon.

Can Bitcoin replicate past instances?

The first touch in November 2022 resulted in a 100% increase over seven months, as Bitcoin experienced a substantial rally, doubling its price. The second touch in June 2023 led to an even more impressive surge, with Bitcoin tripling in value over the same period, achieving a 200% increase in seven months.

In July 2024, Bitcoin touched the lower border of the Bollinger Band for the third time. While some short-term downside is possible, historical patterns suggest a robust upward movement, indicating a strong year-end finish for Bitcoin.

The expert noted that analysis shows cyclical behavior, with each touch of the lower band historically followed by significant price rallies. Overall, the analyst emphasized that it is not a time for investors to be fearful but to recognize the opportunity for potential gains.

“Even if we could see a bit of downside in the short-term, this is not the time to be afraid. Strong year-end finish ahead,” the expert said.

Indeed, if Bitcoin ends the year strongly, the movement will align with the bullish post-halving rally.

Notably, Bitcoin was aiming to reach another all-time high. Still, the asset has derailed due to bearish sentiments, such as the inflow of capital into the market from the Mt. Gox repayment and the German government’s selling of Bitcoin.

Bitcoin’s short-term play

However, there remains some optimism in the market that Bitcoin could make short-term gains, considering that the German government has reportedly sold its last Bitcoin holdings. At the same time, the spot Bitcoin exchange-traded fund (ETF) is recording notable capital inflows.

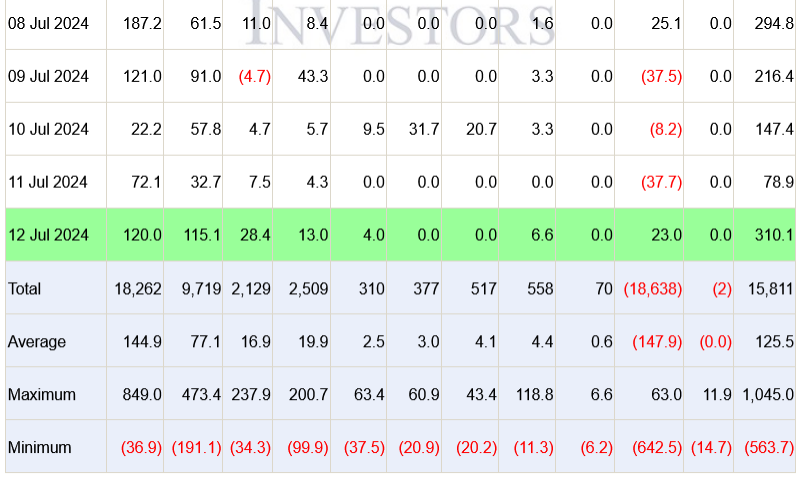

According to the latest data, U.S.-based ETFs recorded over $310 million in inflows on July 12, marking their best-performing day since June 5.

Meanwhile, Bitcoin is showing signs of optimism on the weekly chart. At the time of reporting, the maiden crypto firmly held above the $58,000 mark, trading at $58,406, having gained over 2% in the last 24 hours.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com