In 2024, Bitcoin (BTC) and gold have taken different paths, each offering unique opportunities and challenges for investors. Bitcoin, known for its high return potential and capped supply of 21 million coins, attracts those looking for growth and an inflation hedge.

However, its volatility, recently exacerbated by sell-offs from the Mt. Gox exchange and German authorities, remains a concern. By July, its price fell to around $57,000, overshadowing earlier highs.

In contrast, gold has surged amid global uncertainties, closing May at an all-time high. Geopolitical tensions in the Middle East, Ukraine, and political shifts in Europe have reinforced gold’s status as a stable investment.

Its universal acceptance, high liquidity, and role as a safe haven make it a dependable asset during economic crises. The expansion of the BRICS trading bloc and the division between Eastern and Western nations further boosted its appeal.

In this context, with Bitcoin as a digital asset and gold as a traditional safeguard, Finbold sought insights from ChatGPT-4o, OpenAI’s advanced AI model, to determine which might excel in the coming months.

ChatGPT’s analysis: Bitcoin vs. Gold investment prospects

According to ChatGPT-4o, the choice depends on risk tolerance and investment goals. Investors with a high-risk tolerance and a long-term investment horizon should consider Bitcoin.

With its fixed supply and potential for high returns, Bitcoin appeals to those seeking growth and an inflation hedge.

Technological advancements and increasing acceptance as a digital asset further enhance its attractiveness. However, investors must be prepared for significant volatility influenced by market sentiments, regulatory changes, and geopolitical events.

Conversely, conservative investors seeking stability and long-term wealth preservation should consider gold. Its historical performance as a safe haven during economic and geopolitical crises, high liquidity, and universal acceptance make it an ideal choice.

However, diversification is crucial for managing risk in any investment portfolio. By including both Bitcoin and gold, investors can balance the high growth potential and volatility of Bitcoin with the stability and security of gold.

This mix can help protect against market downturns while still offering opportunities for significant returns, catering to both aggressive and conservative investment strategies.

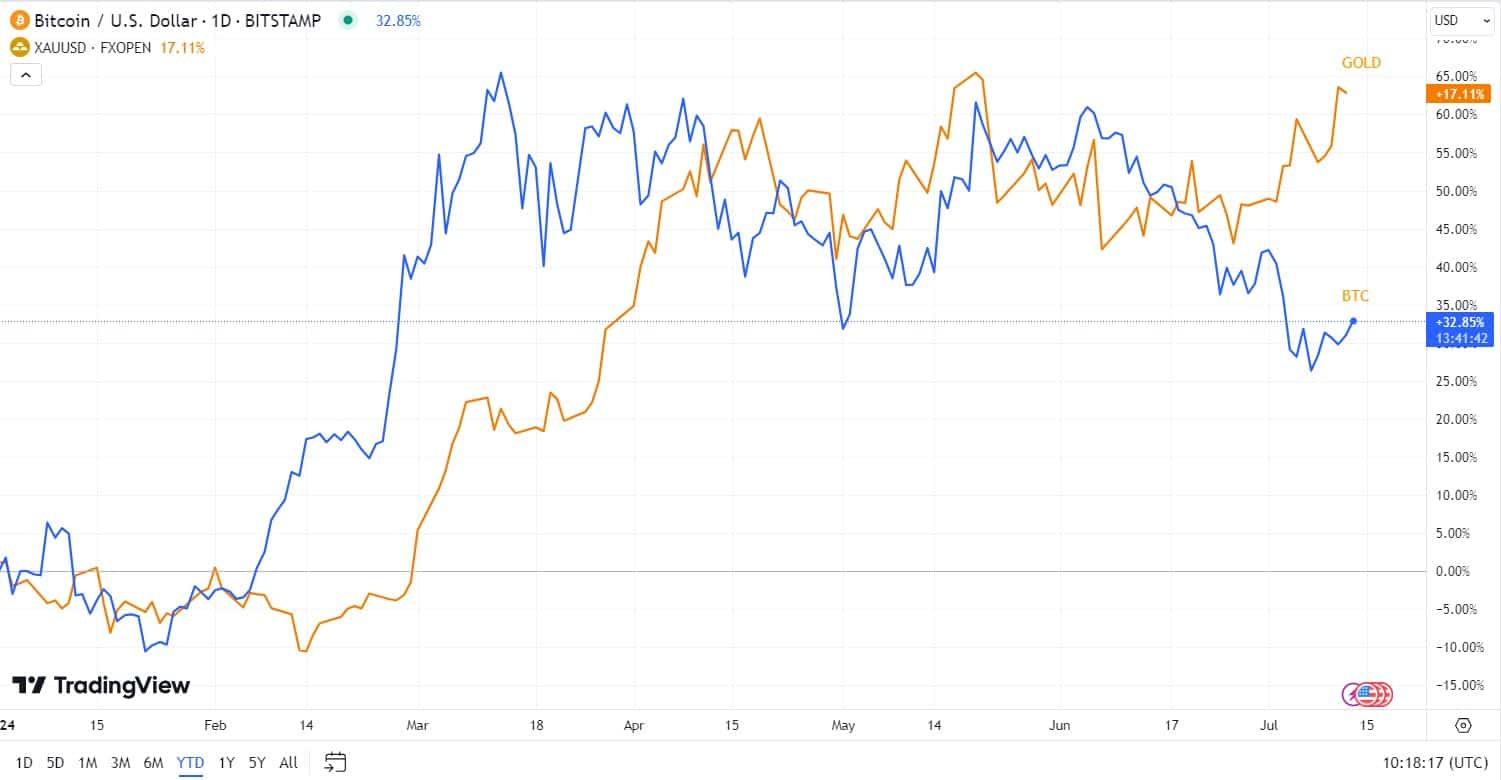

Bitcoin and Gold recent price performance

As of 2024, Bitcoin and gold have shown distinct year-to-date performance. Bitcoin has experienced a significant rise, with a YTD increase of 32%, highlighting its volatile yet high-growth nature.

Currently, Bitcoin is priced at approximately $58,698. In contrast, gold, renowned for its stability and role as a safe haven asset, has gained 17% YTD, with its current price around $2,410 per ounce.

In conclusion, both Bitcoin and gold present viable investment options depending on an investor’s risk tolerance and financial goals.

Combining these assets in a diversified portfolio can offer both growth potential and stability, making it a strategic approach for navigating the unpredictable financial landscape of 2024.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com