Bitcoin’s price has been dropping aggressively lately, pushing below a significant support level. If a recovery does not happen soon, things can get much worse for the crypto market.

Technical Analysis

By TradingRage

The Daily Chart

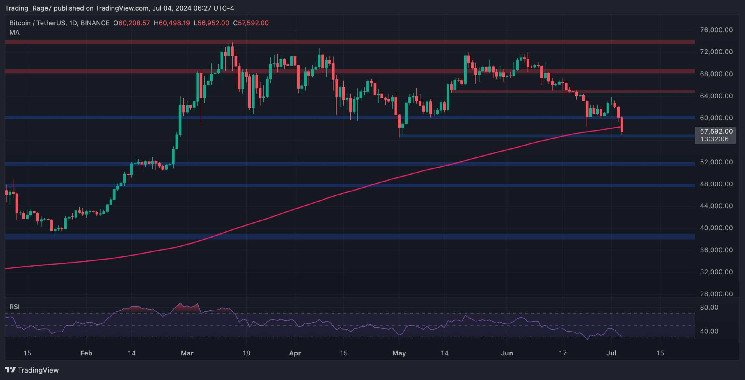

As the daily chart demonstrates, Bitcoin’s price has failed to hold above the significant $60K support level and has also broken below the 200-day moving average, located around $58K.

This is an extremely worrying signal, as the 200-day moving average is known to hold the price during Bitcoin bull markets.

Therefore, if the $57K support level fails to prevent a further decline and the price fails to recover back above the 200-day moving average, a much deeper drop will become more probable.

The 4-Hour Chart

On the 4-hour timeframe, the price has quickly dipped below $57K following the breakdown of the $60K support zone.

Meanwhile, this level is seemingly preventing a deeper decline, and the RSI indicator has also entered the oversold region. These signs are pointing to a potential recovery or at least a pullback toward the $60K level in the short term.

Sentiment Analysis

By TradingRage

Bitcoin Funding Rates

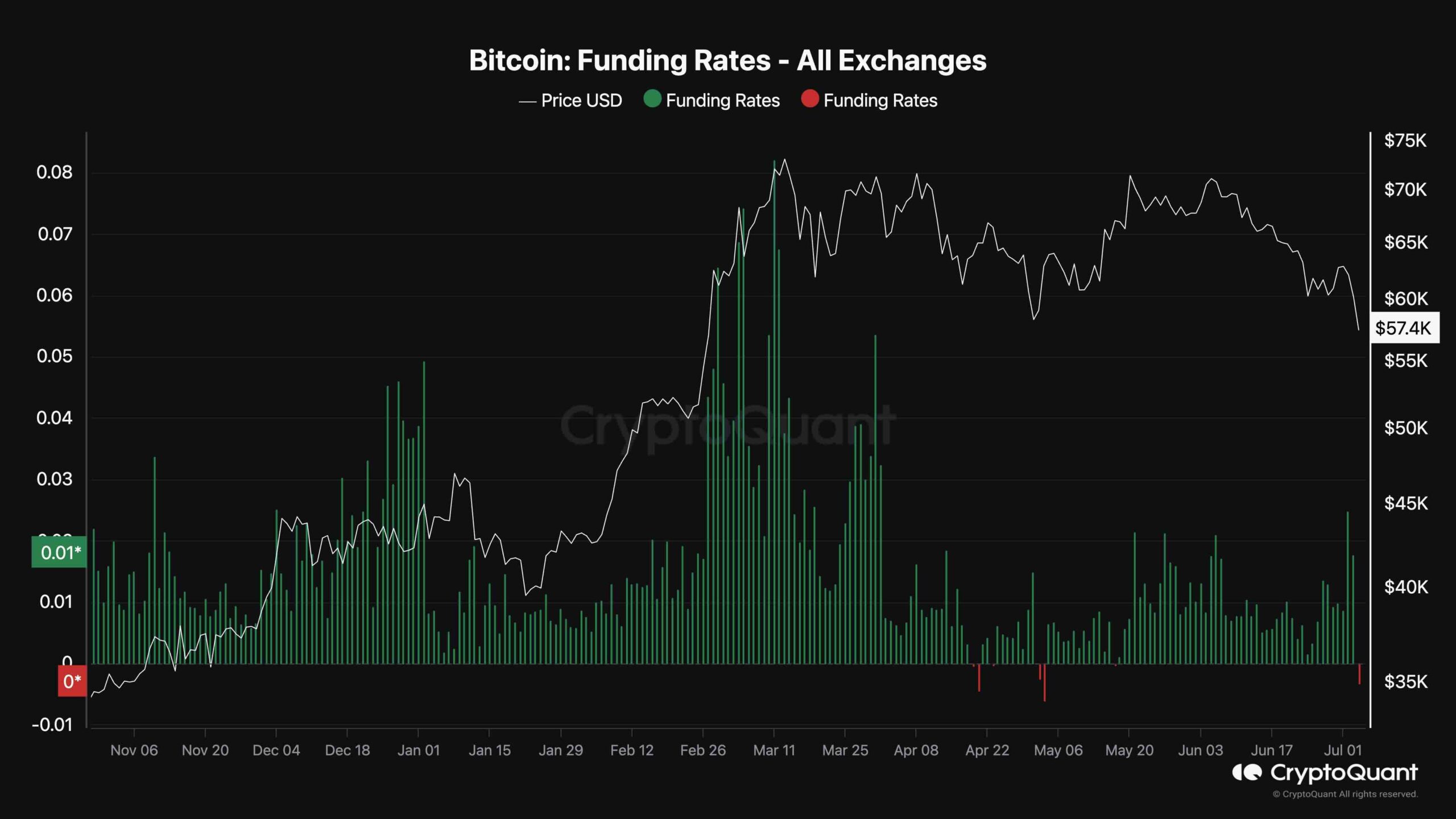

As the BTC price is dropping aggressively, many market participants are exiting their long positions either willingly or with their stop losses getting hit. Some futures market traders are also opening short positions, as the Funding Rates metric shows.

The Funding Rates indicate whether the buyers or sellers are executing more orders on aggregate. After months of decline, the funding rates are currently negative.

While this is a worrying signal, it might also be considered the first sign of the price finding a bottom, similar to previous instances in which the metric has displayed negative values.

Therefore, while caution is recommended, a short liquidation cascade might also happen in the coming days, which could see the price recover quickly.

cryptopotato.com

cryptopotato.com