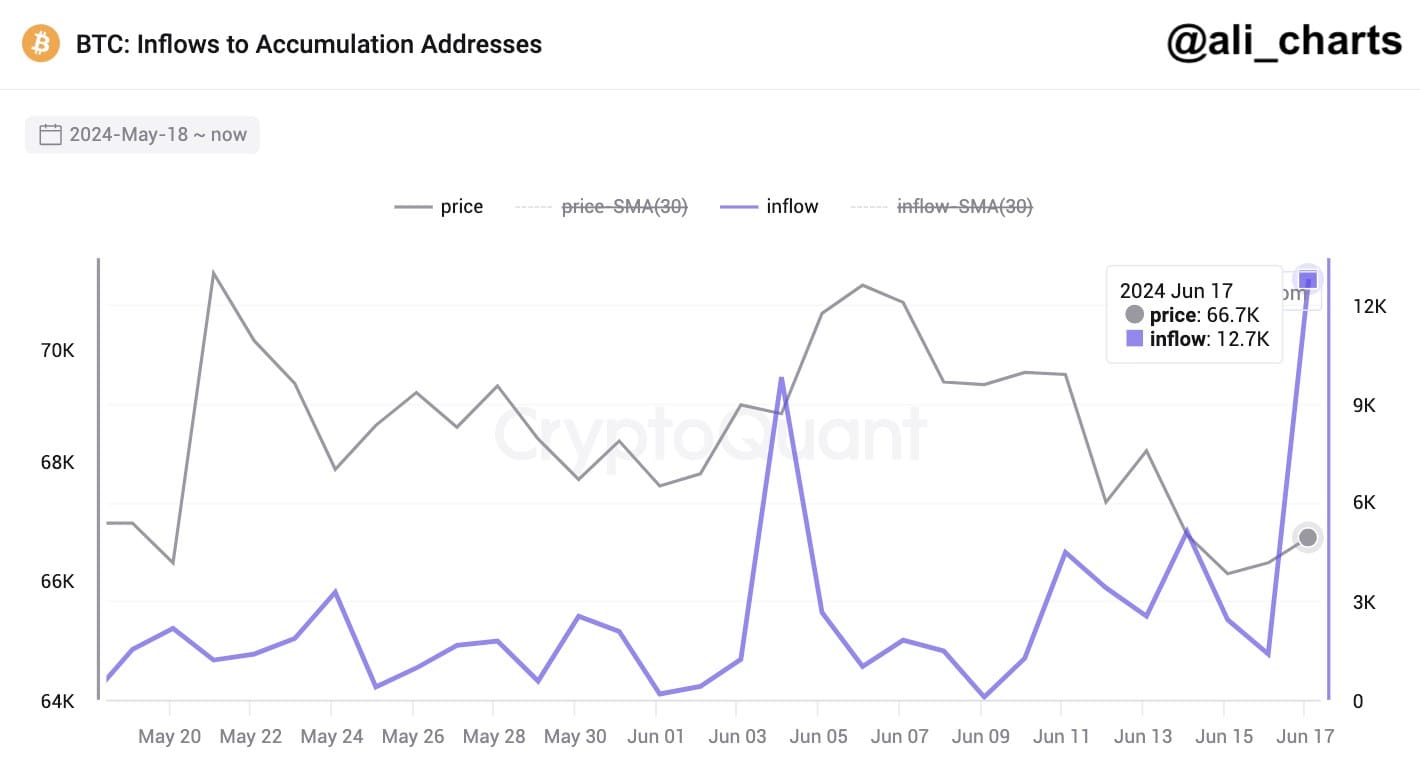

With the recent price crash, Bitcoin (BTC) long-term investors have been on an accumulation rampage, registering a record inflow average. According to two sources, the so-called “Accumulation Addresses” have acquired over 12,700 BTC and 20,000 BTC.

First, Ali Martinez reported the labeled “accumulation addresses” receiving 12,700 BTC in the last 24 hours, worth $840 million. In the meantime, long-position traders have lost nearly $400 million as over $136 billion left the cryptocurrency market.

Later on, Luke Mikic shared the same metric, showing an all-time high of 20,000 BTC inflow to “accumulation addresses.” In this second chart, we can see the historical data from 2014, evidencing the record inflow to long-term holders.

In a comment, Mikic explained the label monitors addresses that are not selling a majority of their coins. However, the analyst says he is not sure whether it includes cryptocurrency exchanges. Including exchanges could distort the result of this metric, considering an increase in deposits usually means intention to sell instead of long-term investment and accumulation.

🐳20,000 Bitcoin have been accumulated by whales on this recent correction.

— Luke Mikic⚡️🇸🇻🇦🇺 9-5 Escape Artist (@LukeMikic21) June 18, 2024

This is the highest inflow into accumulation addresses EVER! pic.twitter.com/s5alE1X32N

Bitcoin bearish bias

Despite the positive outlook of a record-high accumulation in long-term holding addresses, Bitcoin has displayed bearish signals recently.

On that note, Bitcoin miners have sold at a higher pace in the last few months, reaching levels of the previous bear market. According to metrics, these entities have been operating underwater for years, mining Bitcoin at a price below its average cost.

These sell-offs are evidence of early investors realizing their profit, using retail for an exit liquidity strategy, as Finbold warned.

Moreover, Martinez warns of a double-top pattern forming in Bitcoin’s monthly chart, pairing with 2021’s highs. The analyst also mentioned the “TD Sequential,” a technical indicator, presents a bearish sell signal.

#Bitcoin looks like it is forming a double top on the 2-month chart, with the TD Sequential presenting a sell signal! pic.twitter.com/o1DAnUg2Pj

— Ali (@ali_charts) June 18, 2024

The conflicting data and indicators highlight how difficult it is to forecast and predict Bitcoin’s price action accurately. Investors must always hedge themselves with proper risk management and be cautious while speculating in such a volatile asset, easily moved by whales.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com