Bitcoin ($BTC) has witnessed a strong bearish momentum after three days of consolidation, leading to its price fall below the $66,000 mark.

Bitcoin is down by 0.9% in the past 24 hours and is trading at $65,600 at the time of writing. The asset’s market cap also dropped below the $1.3 trillion mark for the second time this month. Bitcoin’s daily trading volume, however, increased by 125%, reaching $36.3 billion.

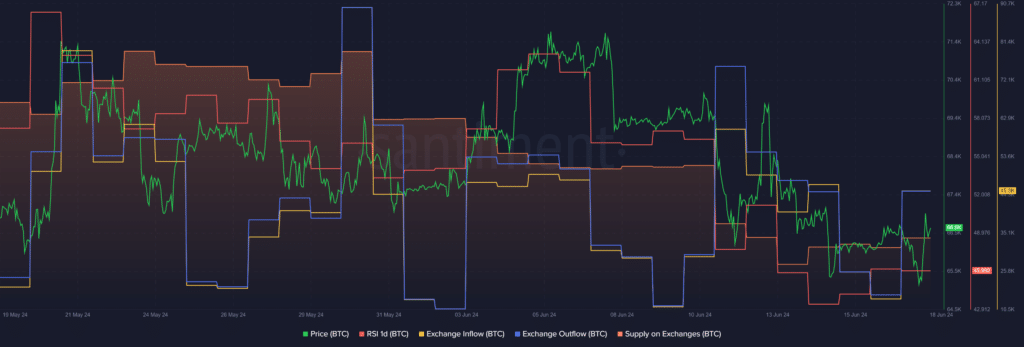

According to data provided by Santiment, the $BTC exchange inflow surged by 137% over the past day — rising from 19,172 $BTC to 45,356 $BTC.

Data from the market intelligence platform shows that the amount of Bitcoin leaving exchanges has also significantly increased. Per Santiment, the $BTC exchange outflow surged by 119% in the past 24 hours — rising from 19,871 $BTC to 43,493 $BTC.

Per Santiment, the Bitcoin supply on exchanges also increased from 937,240 $BTC to 939,230 $BTC over the past day. This shows an exchange net inflow of 1,863 $BTC over the past day. The heightened inflows come as the broader cryptocurrency market weathers bearish momentum.

Moreover, the global crypto market capitalization declined by 2.6% in the past 24 hours and is currently hovering at $2.485 trillion, according to data from CoinGecko. Per data provided by the price aggregator, 96% of the leading 300 cryptocurrencies, including meme coins, are wandering in the red zone.

According to Santiment data, the $BTC relative strength index (RSI) is sitting at 46 at the reporting time. The indicator shows that the leading cryptocurrency is slightly undervalued.