ALLINVAIN’s journey in the early Bitcoin era highlights the potential and inherent risks of the cryptocurrency market.

As an early adopter and significant contributor to Bitcoin’s growth, his experiences reflect the crucial need for security measures. His story remains a reminder of the vulnerabilities that early Bitcoin users faced.

Bitcoin Developer Lost 25,000 BTC

In the early days of Bitcoin, when the cryptocurrency traded for less than $0.05, a developer known as ALLINVAIN mined and traded Bitcoin. By 2010, he launched one of the first Bitcoin exchanges, Bitcoin Express, which allowed users to buy Bitcoin with PayPal.

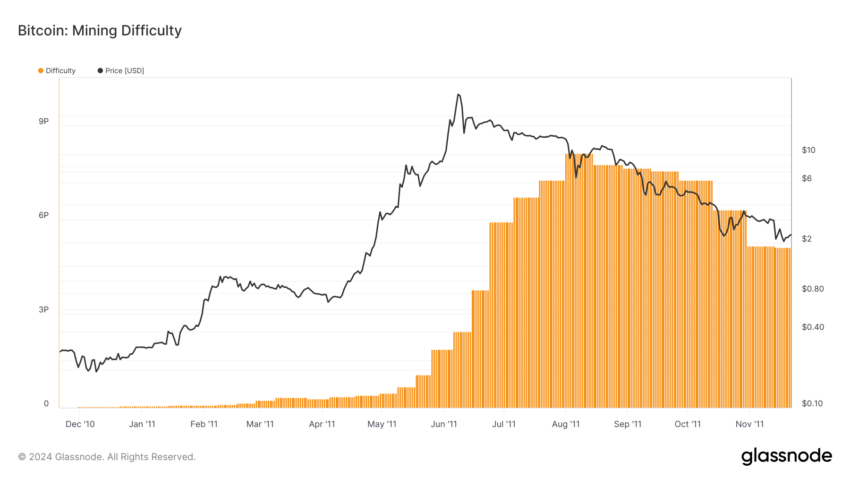

Early transactions sold 1,000 BTC for just $5. At that time, he was mining around 1,200 BTC daily with a laptop. However, the simplicity of mining Bitcoin changed in 2011 as more people joined the network, drastically increasing the mining difficulty.

“It’s as if everyone, their mother, father, cousin, and their dog started mining,” ALLINVAIN remarked.

To support the Bitcoin economy, he began buying and selling real goods for Bitcoin, such as acting as a purchasing agent for Canadian users wanting to buy coffee cards. His dedication to the Bitcoin economy earned him the status of a “Bitcoin whale,” as he accumulated over 25,000 BTC.

In early 2011, Bitcoin’s value surged to $30, marking the first significant bubble. ALLINVAIN’s holdings then amounted to about $500,000. However, on June 13, 2011, his fortune took a dire turn when he discovered a 25,000 BTC transaction had been made from his crypto wallet without his consent.

“I am totally devastated today. I just woke up to see a very large chunk of my bitcoin balance gone. If only the wallet file was encrypted on the HD. I do feel like this is my fault for not moving that money to a separate non-windows computer,” he wrote.

The theft is worth approximately $1.6 billion today. He acknowledged his lapse in security, noting that his unencrypted wallet file had been compromised, possibly by a trojan virus disguised as mining software.

The news of the theft quickly spread globally, with coverage by Forbes, branding it the first major Bitcoin theft. Conspiracy theories abounded, with some speculating that ALLINVAIN had staged the theft. However, he admitted it was his fault, blaming poor security practices.

Despite the loss, ALLINVAIN remained active in the Bitcoin community, eventually starting a hosted mining business to rebuild his holdings. His experience serves as a stark reminder to Bitcoin users of the necessity of securing private keys offline and maintaining personal security protocols.

beincrypto.com

beincrypto.com