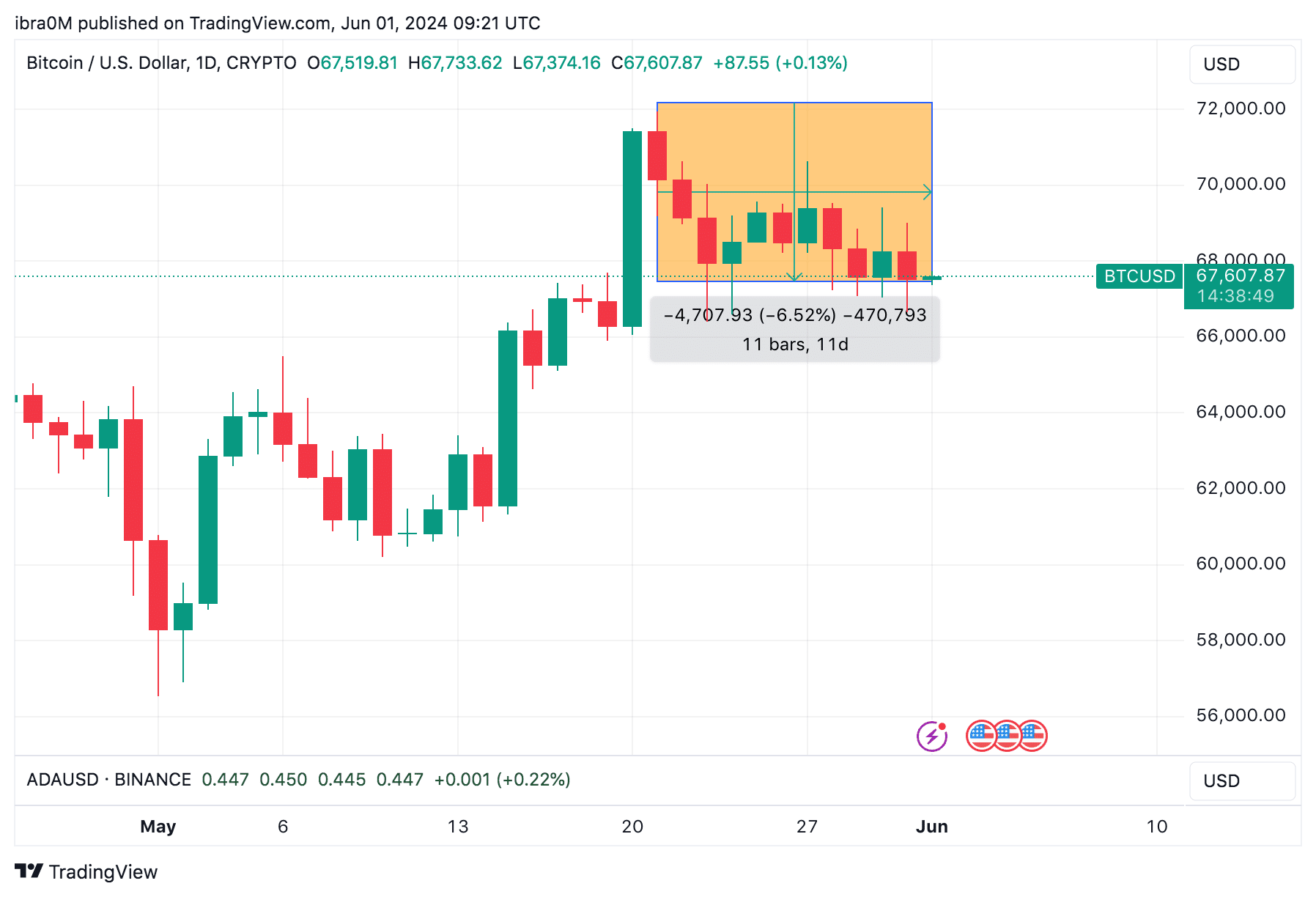

Bitcoin price held firm at the $67,500 support on Saturday June 1 2024, as the crypto market entered consolidation phase amid delays surrounding Ethereum ETFs official launch.

Bitcoin price down 7% since Ethereum ETF approval

The Ethereum ETF approval triggered bullish sentiment and positive media coverage, as it marked a significant milestone for global cryptocurrency industry. However, a week down the line, the ETH spot ETFs are yet to launch, with fund issuers still making final adjustments to their fillings.

With the ETH ETFs in hiatus, the crypto markets have witnessed significant swings in investment patterns and strategy. Notably, ETH and specific Etheruem-hosted projects like memecoins and DeFi protocols have been in high demand, to the detriment of the other rival blockchain networks.

Since reaching its monthly peak of $71,954 on May 21, Bitcoin has now declined 7%, falling as low as $66,657 within the daily timeframe on May 31. A closer look at the daily chart shows how Bitcoin bulls have instantly responded with covering purchases to reclaim the $67,500 support territory.

Whale Investors are Buying the Bitcoin Dip

However, while retail investors appear to be seeking more profitable opportunities within the Ethereum ecosystem, on-chain data shows that whale investors have continued to doubled on BTC.

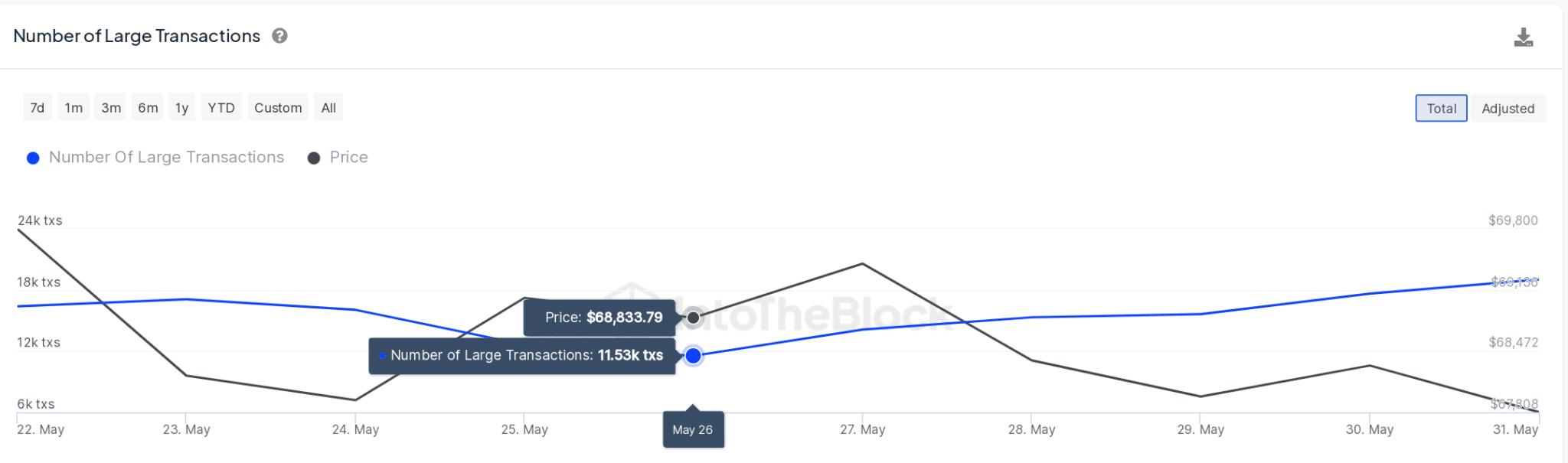

IntoTheBlock’s daily Large Transactions chart below tracks the total number of unique BTC transactions that exceed $100,000 in value on any given day. This provides real-time insights into the level of whale demand accruing to Bitcoin during that given period.

Bitcoin attracted on 11,530 whale transactions on May 26, as depicted in the chart above. But as the price correction phase intensified, rather than exit, Bitcoin whales appear to have increased their demand.

The latest data as on May 31 shows that Bitcoin reached 19,020 whale transactions, reflecting 65% surge in whale demand, during a period of 7% price decline.

This shows that while BTC price dropped over the past week amid weak retail sentiment, whale investors have capitalized on the low prices to buy the dip.

Bitcoin price forecast: $70k Rebound Ahead

Bitcoin is exchanging hand for $67,600 at the time of writing on June 1, down 7% over the last 10-days. But given the steady increase in whale demand, Bitcoin price looks set to enter a major rebound above $70,000 mark once the market sentiment flips bullish in the days ahead.

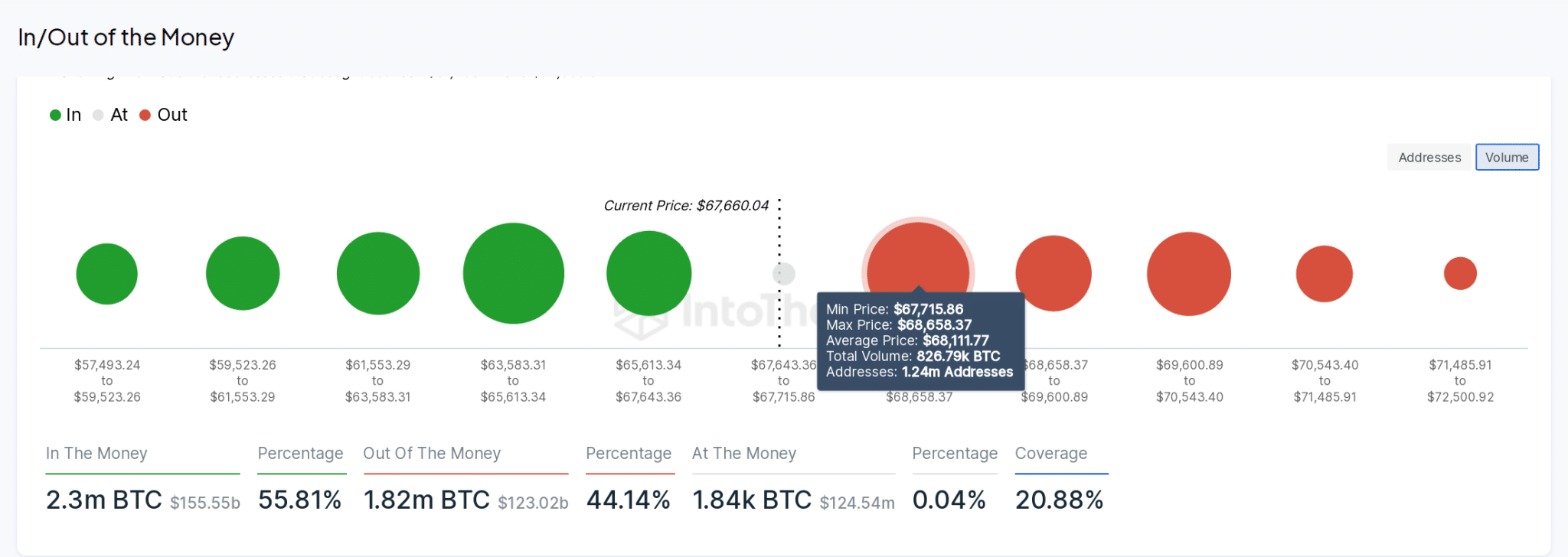

In terms of key resistance levels to watch, IntoTheBlock’s GIOM data shows BTC price could hit an initial roadblock at the $68,500 level.

As seen above, 1.24 million existing BTC holder address had acquired 826,790 BTC at the maximum price of $68,658. If those holder opt to exit early, Bitcoin price could experience downward pressure once it nears their breakeven point.

But if the bullish momentum is strong enough to propel Bitcoin price above the $68,700 level, an instant rebound above $70,000 could be on the cards.

On the downside, if the $67,500 support fails to hold, Bitcoin bears could target a reversal toward the $65,600 area. But with the growing whale demand, this scenario currently looks unlikely.

thecryptobasic.com

thecryptobasic.com