Although Bitcoin (BTC) has continued to consolidate its previous gains, pulling the rest of the cryptocurrency market with it as it sets the current slightly bearish mood, artificial intelligence (AI) platforms have retained their bullish optimism on the price of Bitcoin by the end of this year.

Indeed, not long after it surpassed the massively important psychological price level at $70,000, the largest asset in the crypto sector by market capitalization has returned below it, struggling to return above the $68,000 resistance area from where it could start to recover.

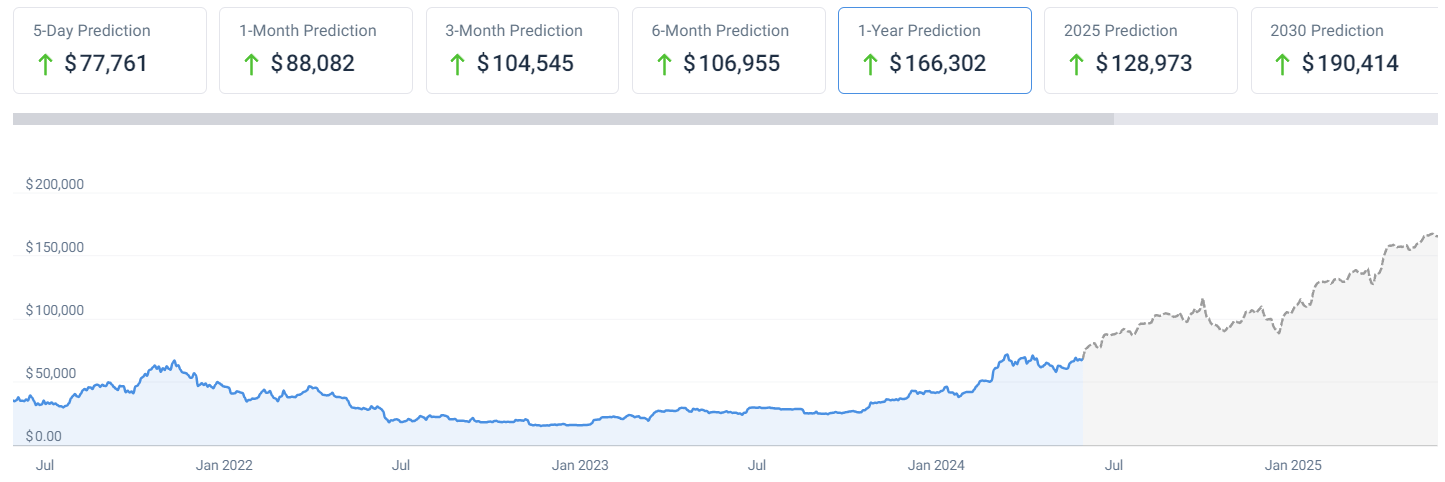

Bitcoin price prediction 2024

Nonetheless, an advanced AI algorithm that relies on Bitcoin’s historical price action, chart patterns, and other relevant developments has set the price of the crypto market’s representative asset at $105,794 on December 30, 2024, which would suggest an increase of 55.77% from its price at press time.

Elsewhere, the new model of OpenAI brainchild ChatGPT, called ChatGPT-4o, has offered a price range of $78,299.17 – $87,000 “based on the available predictions and data,” and taking into account “factors such as the recent halving and its consequent impact on Bitcoin’s issuance and miner rewards.”

At the same time, Claude Opus AI, the recent AI achievement by Anthropic, has provided an even more bullish forecast than its generative AI peer, suggesting $80,000 on the conservative end to potentially over $100,000 on the higher end for Bitcoin, as it explained that:

“This projection takes into account Bitcoin’s historical price patterns, with BTC’s price surging significantly in the 12-18 months following previous halving events.”

Finally, Google Gemini, the AI chatbot developed by Alphabet (NASDAQ: GOOGL), has stated that “given the current information and considering some potential for growth, a possible range could be between $70,000 and $100,000 by the end of 2024” for Bitcoin.

Bitcoin price analysis

For now, the maiden crypto asset is changing hands at the price of $67,915, which represents a decline of 1.20% in the last 24 hours, a 3.18% drop across the previous seven days, but still an increase of 8.90% on its monthly chart, in addition to gaining 61.76% this year, as per data on May 29.

Meanwhile, the game theory phenomenon, which sees rational players, i.e. institutions, pour massive amounts of money into Bitcoin based on observing others profiting from their BTC investments, could help create a ‘fear of missing out’ (FOMO) and drive its price toward a whopping $1 million.

On the other hand, professional crypto trader Wolf has challenged the overly optimistic prognoses, such as that of $500,000 per BTC coming from renowned crypto expert PlanB, arguing instead that $130,000 was the more likely target, upon which he would start selling, using retail traders’ FOMO for exit liquidity.

In conclusion, Bitcoin might follow the path set by any of the above AI platforms or crypto experts, but they all agree on one thing – the flagship decentralized finance (DeFi) asset can only go up. Still, trends in the crypto sector can sometimes change on a whim, so doing one’s own research is critical.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com