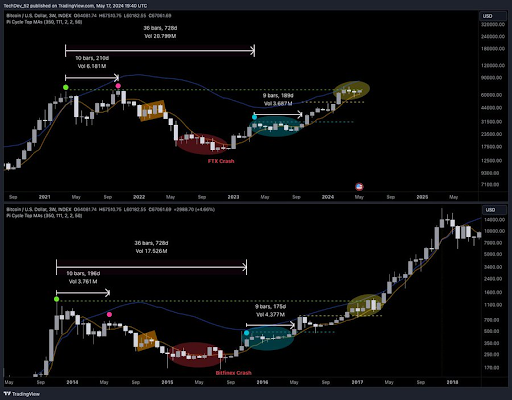

Interestingly, just like in 2017, when Bitcoin’s price bottomed following the Bitfinex crash, the crypto token also looked to have bottomed in this market cycle when FTX, another crypto exchange, collapsed. Back then, Bitcoin consolidated for some time before enjoying a parabolic rally, which made it reach $20,000 in 2018.

As TechDev suggested, history could repeat itself with Bitcoin consolidating ahead of a move that could send it to as high as $100,000. From the chart the crypto analyst shared, one could see that Bitcoin has consolidated longer in this market cycle than it did in 2017. However, crypto analyst Rekt Capital hinted that this longer period of consolidation was necessary.

He mentioned that Bitcoin was accelerating by almost 200 days in this market cycle and added that consolidating for longer will help it resynchronize with previous bull cycles. This strategic consolidation is a reassuring sign of Bitcoin’s stability and potential for growth. Meanwhile, in a recent X post, he revealed that Bitcoin was already attempting to perform the “post Bull Flag breakout retest,” which could secure a trend continuation to the upside.

In a subsequent X post, Rekt Capital shared a chart showing that a breakout from the $66,000 range could kickstart the continuation of Bitcoin’s bull run, which could well send its price above $100,000.

“Optimal Targets” For Bitcoin In This Market Cycle

Crypto analyst Mikybull Crypto mentioned in an X post that the optimal targets for Bitcoin in this bull run should be between $138,000 and $150,000. Interestingly, he made this statement while revealing that the crypto’s current price action is mirroring that of 2017. The crypto analyst’s prediction suggests that Bitcoin enjoying a 1,200% price gain (like in 2017) is unlikely.

newsbtc.com

newsbtc.com