The recent 9.3% rise in the price of Bitcoin, which pushed it over $67,000 per BTC by the end of the week, has sparked new discussions among financial experts. This is the first significant weekly increase since early March, following a period of decline after an all-time high of $74,000 per BTC was hit.

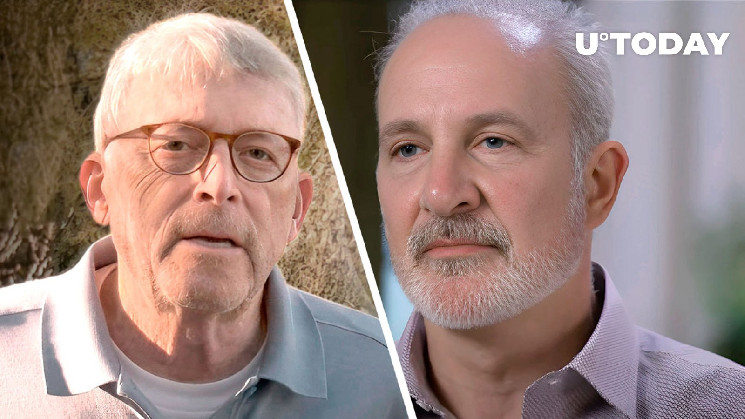

Peter Schiff, a prominent precious metals advocate and cryptocurrency critic, dismissed the significance of Bitcoin's recovery. He noted that silver has gained more than 21% since the beginning of April, compared to cryptocurrency's modest gain of less than 2% over the same period. Schiff argued that silver offers higher returns and declared Bitcoin a failed investment, saying that it is "dead."

Veteran trader Peter Brandt responded to Schiff's comments by advising the public to ignore them. Brandt, who is known for his analysis of Bitcoin and Ethereum, suggested that Schiff's statements were aimed at attracting attention rather than truly understanding the situation.

Who you are betting on?

He suggested that despite his criticism, Schiff understands the value of cryptocurrencies, but prefers to promote silver due to his long-standing preferences. Brandt accused Schiff of exaggerating silver's recent performance in order to undermine BTC.

Why don't you give me the benefit of the doubt and just assume I'm being honest about my view on Bitcoin? If you are betting on Bitcoin you are betting on an imaginary horse. A lot of people will lose a bunch of money betting on Bitcoin. I am just warning them of the high risk.

— Peter Schiff (@PeterSchiff) May 19, 2024

In response, Schiff said that his views on cryptocurrency are sincere. He warned of the high risks associated with investing in Bitcoin, calling it a speculative asset with no intrinsic value. Schiff believes that many investors could suffer significant losses by betting on what he calls an "imaginary horse."

This public disagreement between Schiff and Brandt underscores the ongoing debate in the financial community about the future of cryptocurrency. As Bitcoin continues to rally and show potential for significant gains, opinions remain sharply divided.

Which side will win in the long run? Will Bitcoin prove its skeptics wrong, or will traditional assets like silver offer more reliable returns?

u.today

u.today