Bitcoin whales on the cryptocurrency exchange Bitfinex have consistently added to their Bitcoin position in May. The large wallet investors on Bitfinex predicted the crash in Bitcoin in April and started accumulating BTC in May, “buying the dip.”

Bitfinex whales bet over $3 billion on Bitcoin rally

Bitcoin has witnessed large drawdowns, up to 40% in previous cycles, post the halving event. BTC quickly recovered from its recent correction, making a comeback above $65,500 on Monday, May 6.

Bitcoin whales on the crypto exchange Bitfinex timed Bitcoin’s correction. The large wallet investors trimmed their BTC holdings from 76,000 prior to March’s all-time high to 42,000, taking profits during Bitcoin’s all-time high.

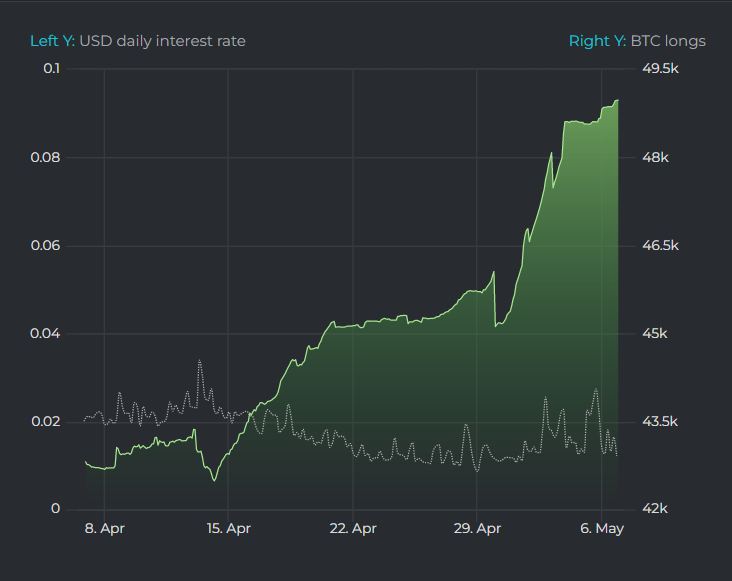

Data from intelligence tracker Datamish shows that throughout April, whales added approximately 6,165 long positions (bullish bets) in Bitcoin. As of Monday, May 6, total Bitcoin long positions stand at 48,978 BTC, worth over $3 billion.

Bitfinex long positions

Whales continue to reinforce their positions and pile Bitcoin longs in May. Typically, Bitfinex whale activity is considered a reliable indicator of Bitcoin price trend. Long positions tend to bottom out by the time BTC price hits a local top and the converse is true.

The recent market dip is marked by consistent accumulation by large wallet investors. The Fear and Greed Index, a tool to measure the overall sentiment among market participants shows that there is “greed” among traders. Typically, “greed” boosts an asset’s value. Bitcoin is likely headed towards further gains in May, as market participants act greedy.

Bitcoin price on track to reach $150,000 this cycle: Bernstein

Following Bitcoin’s recent recovery, analysts at Bernstein Research say that BTC “is far from done.” Analysts have reiterated their prediction on Bitcoin, stating that BTC is poised to reach $150,000 by the end of 2025, in the ongoing cycle.

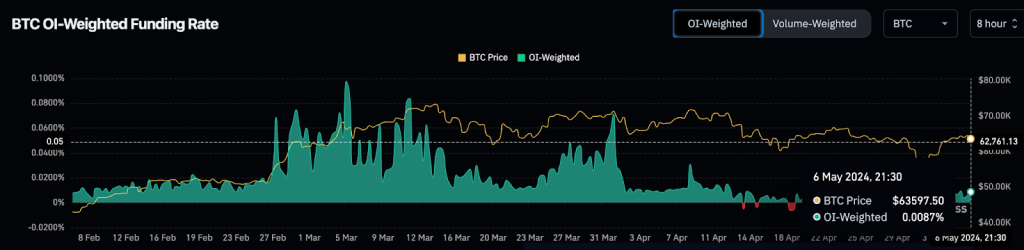

Bitcoin’s funding rate is back in the positive territory, based on Coinglass data, signaling the asset is likely out of negative territory. Typically, negative funding rates are associated with bearish outcomes for an asset.

Bitcoin Open Interest weighted funding rate

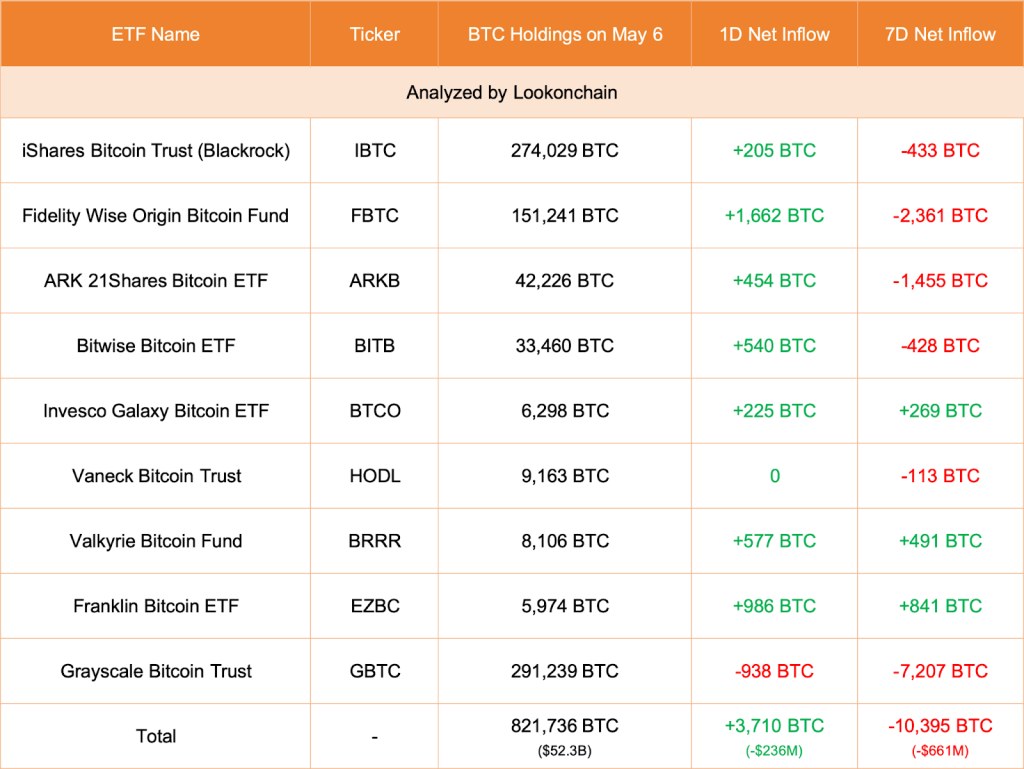

The net inflow of Bitcoin Spot ETFs is another key catalyst that could influence the asset’s price. Data from May 6 flows shows that 3,710 BTC worth $236 million flowed into Bitcoin ETFs, supporting the thesis of recovery in the crypto market.

Bitcoin ETF flows

At the time of writing, Bitcoin price is $63,362 on Binance.

The post Bitcoin traders bet over $3 billion on BTC bull run, what do Bitfinex whales know? appeared first on Invezz

invezz.com

invezz.com