The 2024 Bitcoin (BTC) halving had many investors highly optimistic about how high the world’s premier cryptocurrency could go, but trading since the event brought a decisive shift in sentiment.

Indeed, with BTC consistently remaining closer to $60,000 than $70,000 for prolonged periods, experts turned toward analyzing when and if the coin will collapse.

In this climate, two prominent analysts – most active on X – arrived at much the same conclusion in rapid succession: Bitcoin may yet rise once again but cannot afford to fall below a crucial price.

Bitcoin needs to stay above this price to surge again

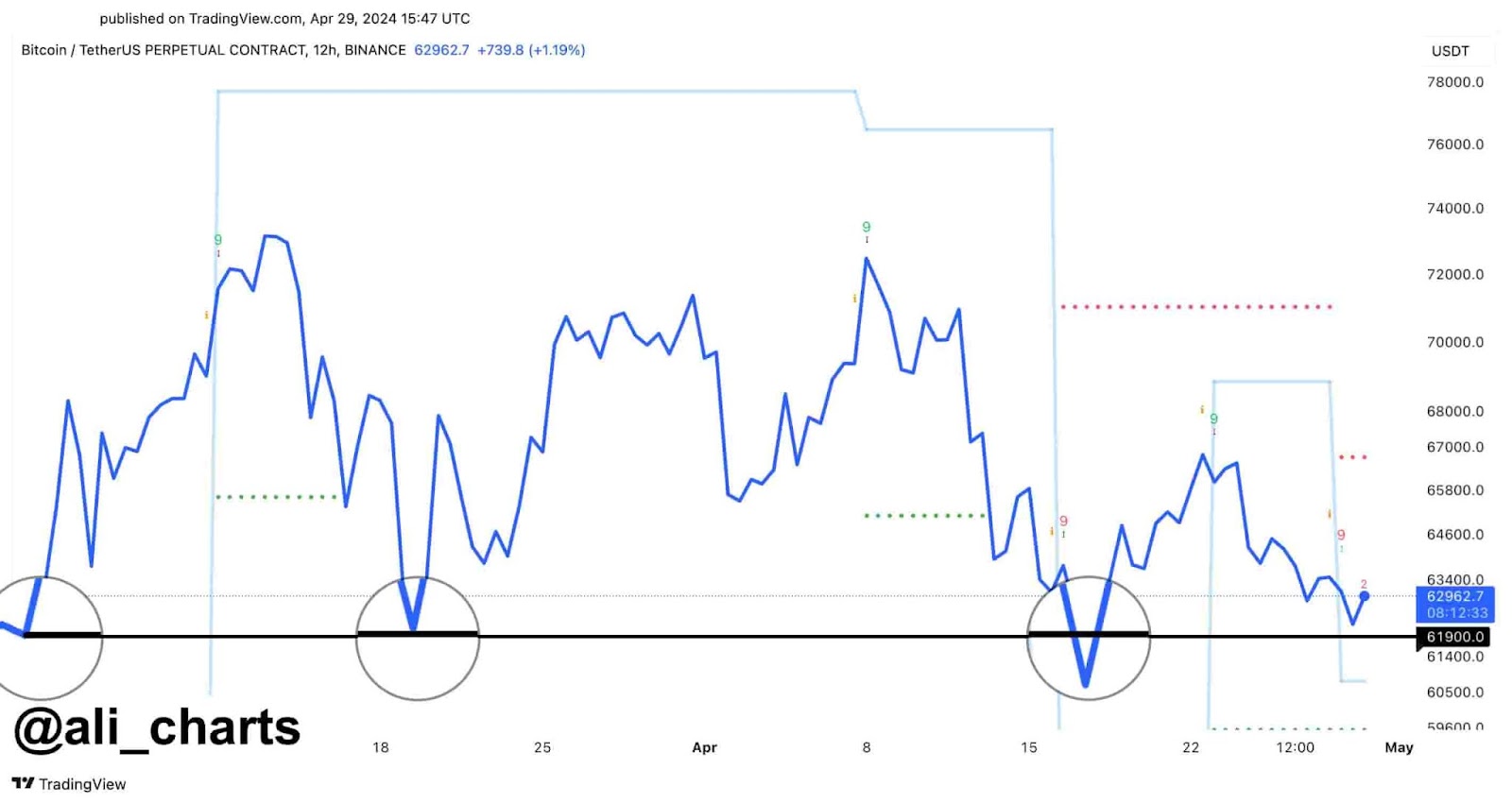

On Monday, April 29, the prominent crypto market expert Ali Martinez identified an important fact about Bitcoin’s recent performance – $61,900 has been serving as a crucial support level for BTC.

In the same post, Martinez added that should the coin withstand the current pressure and remain above the import level, there is a strong possibility that Bitcoin shall again rocket to $71,000.

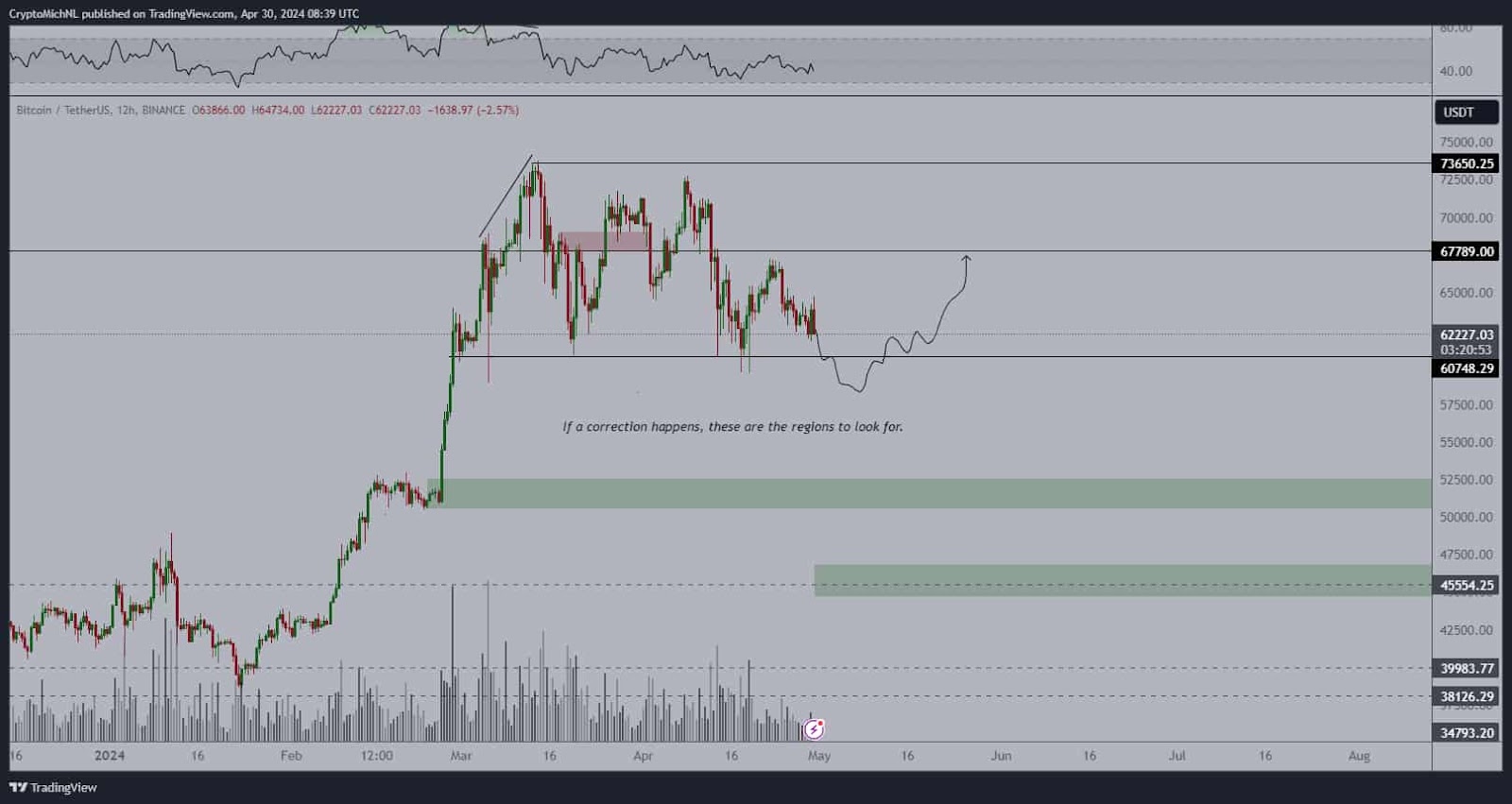

Writing one day later, on Tuesday, April 30, another crypto expert – Michaël van de Poppe – expressed similar optimism about Bitcoin’s prospects. According to Poppe, the current week is highly important and is likely to lead to the discovery of BTC’s current bottom.

While less precise with the price level, the expert also identified $61,000 as offering a critical zone for Bitcoin and stated that after the bottom – somewhere below the price – BTC will reverse course and experience a resurgence.

BTC price chart

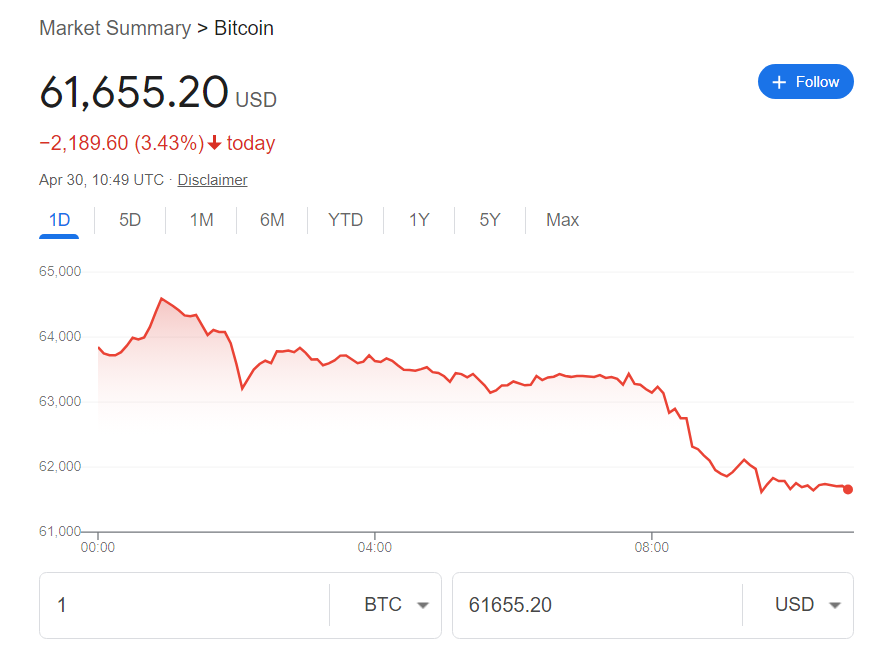

At the time of publication, BTC appears keen to test the expert analysis since, with Bitcoin price today standing at $61,655.20 after a 3.43% 24-hour decline, BTC is below the crucial Martinez-identified support line.

Indeed, the coin’s recent trend has been rather depressing for bulls, given the cryptocurrency is down 4.39% on the weekly chart and 13.47% in the red over the last 30 days.

Still, it would likely be unwise to lose sight of the fact that the flagship digital assets recent decline comes as a correction to an impressive overall 2024 surge, which even saw a new all-time high (ATH) at $73,000 in March.

Indeed, despite the bloodbath, Bitcoin remains 39.58% in the green year-to-date (YTD) in the crypto markets.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com