As Bitcoin (BTC) continues to trade in a consolidation phase below $65,000, technical indicators and historical performances suggest that the maiden cryptocurrency might be on the brink of significant capitulation in the coming months.

In particular, crypto trading expert Alan Santana’s analysis in a TradingView post on April 27 suggested that Bitcoin could drop over 50% from its current price to $30,000.

The analyst warned investors to beware of the imminent “capitulation drop,” which he suggested marks a significant event that occurs only once every several years. Santana’s calculations are based on Bitcoin’s average trading range over the past month and a half, which sits around $66,600.

The expert pointed to several indicators, including declining volume and a weakening Relative Strength Index (RSI), as signs of impending bearish momentum. The analysis outlined a potential scenario where Bitcoin experiences a sharp drop, followed by a stabilization.

“This is the final warning and a friendly reminder; what we are about to witness is a “capitulation drop!”. <…> the 50% capitulation drop, we get a number in the range of $33,300. <…> The action should go something like this: The initial drop fast and strong; remember that the initial move is bearish marketwide, period. Then this move stabilizes and the ALTSBTC and smaller Altcoins will recover first. Mid-size second and the biggest one last,” the expert said.

Key levels to watch

Santana added that Bitcoin’s failure to break above key resistance levels, such as the EMA50, further confirms the market’s short-term bearish bias. According to Santana:

“Bitcoin moved back below EMA50 24-April and has been trading below. As long as the trading happens below this level, here set at $64,560; the short-term bearish bias is super strong and confirmed.”

At the same time, Santana pointed out that the potential for correction can be derived from historical Bitcoin performance. For instance, the trading expert noted that May historically tends to be a challenging month for cryptocurrencies, mainly when prices are coming down from multi-year highs.

However, the analyst encouraged investors not to panic, as the capitulation drop represents the beginning of a new bullish phase for Bitcoin, with significant opportunities expected to emerge in late 2024 and throughout 2025.

Despite the anticipated drop to around $30,000, Santana predicted that Bitcoin would eventually rebound by 30-50% before slowly climbing. This gradual ascent could see Bitcoin experience a significant bullish momentum expected to kick in within the first six months of 2025, a year when a new all-time high is expected.

Bitcoin price analysis

As of press time, Bitcoin was trading at $63,519, reflecting gains of approximately 0.6% over the last 24 hours. However, in the weekly timeframe, Bitcoin declined by nearly 3%.

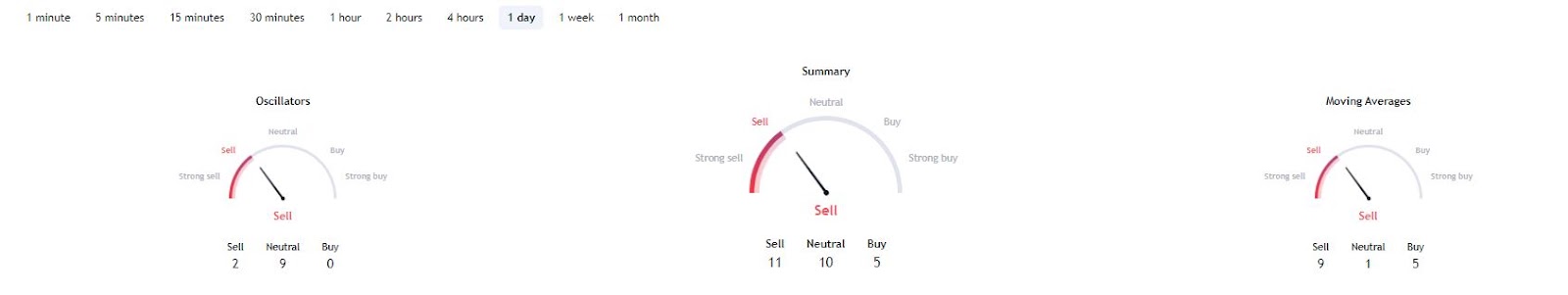

Elsewhere, a review of Bitcoin’s one-day technical analysis sourced from TradingView echoes bearish sentiments. A summary of the indicators indicates a ‘sell’ sentiment at 11, while moving averages also signal ‘sell’ at 9. The same bearish sentiment is mirrored in oscillators, with a gauge reading of 2.

Overall, the analysis appears to align with the historical trend known as the post-halving retrace, where Bitcoin undergoes a correction before resuming its upward rally. Breaching below the $60,000 mark could further validate the prevailing bearish sentiment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com