Morgan Stanley, one of the leading financial giants on Wall Street, is set to empower its 15,000 brokers with the ability to actively recommend Bitcoin exchange-traded funds (ETFs) to their clients, according to a report by AdvisorHub, cited by an article in CoinDesk. This decision marks a significant shift from the bank’s previous policy, which allowed the purchase of spot Bitcoin ETFs only on an unsolicited basis—meaning brokers could execute transactions only if clients requested them first.

The change comes in response to the rising demand for spot Bitcoin ETFs, which Morgan Stanley executives believe could usher additional capital into these funds. These ETFs provide an attractive proposition for investors looking to gain exposure to Bitcoin without the complexities and risks associated with direct cryptocurrency ownership.

An executive from Morgan Stanley emphasized the cautious approach the bank intends to maintain, stating, “We’re going to make sure that we’re very careful about it…we are going to make sure everybody has access to it. We just want to do it in a controlled way.” This statement highlights the bank’s strategy to integrate more cryptocurrency options into its offerings while ensuring that both the financial advisors and their clients are well informed and prepared for this type of investment.

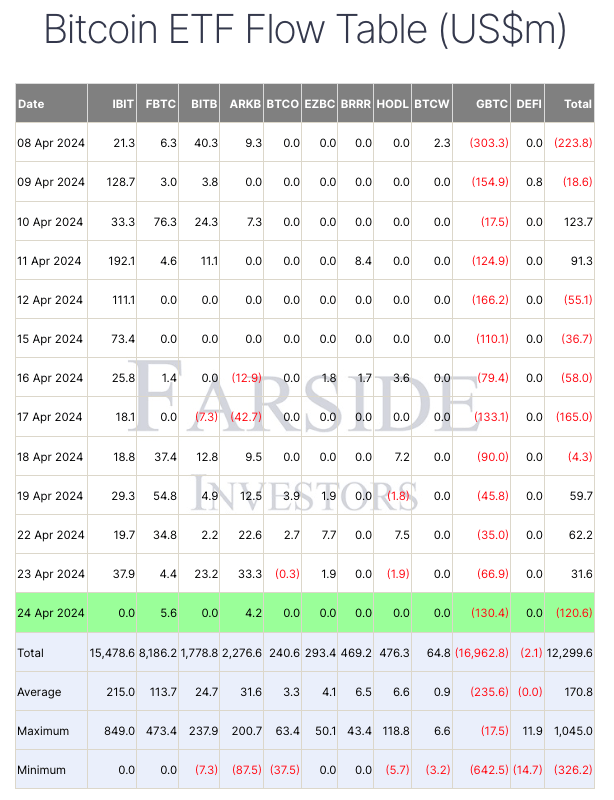

The backdrop to this strategic shift is the Securities and Exchange Commission’s (SEC) approval of 11 spot Bitcoin ETFs in January. Notable investment giants like BlackRock, Fidelity, and Invesco received the green light, leading to a surge in fund inflows, which significantly bolstered Bitcoin’s market position. However, despite the initial enthusiasm, these inflows have shown signs of tapering off recently. For instance, BlackRock iShares Bitcoin Trust (IBIT) reported its first day of zero inflows since the launch of tn spot Bitcoin ETFs in the United States on January 11, despite having attracted consistent investments previously, accumulating nearly $15.5 billion in just 71 days.

To date, the spot Bitcoin ETF market in the U.S. has amassed a considerable $12.3 billion in Bitcoin, reflecting the growing investor interest and confidence in cryptocurrency as a viable investment asset.

Morgan Stanley’s move to enable direct recommendations by its brokers could potentially revive the inflow momentum and further integrate cryptocurrency into mainstream investment portfolios.

Featured Image via YouTube

cryptoglobe.com

cryptoglobe.com