On April 19th, in roughly two days, Bitcoin’s mainnet will undergo its fourth halving at the event block height of 840,000. Each block containing BTC transactions is ordered in a sequential chain of mining, hence the name “blockchain.”

Depending on the BTC price move, when the fourth halving cuts miner block subsidies from 6.25 to 3.125 BTC, miners could be more or less incentivized to stay connected to the network. Given that Bitcoin’s market dominance is 55.6%, this could have severe implications for the entire crypto market.

Which factors will determine the behavior of digital assets and related crypto stocks?

Implications of Miners’ Lowered Incentives

To offset reduced BTC rewards for securing the network and processing transactions, Bitcoin miners will have two primary compensating mechanisms: either the BTC price goes up or more miners unplug from the network.

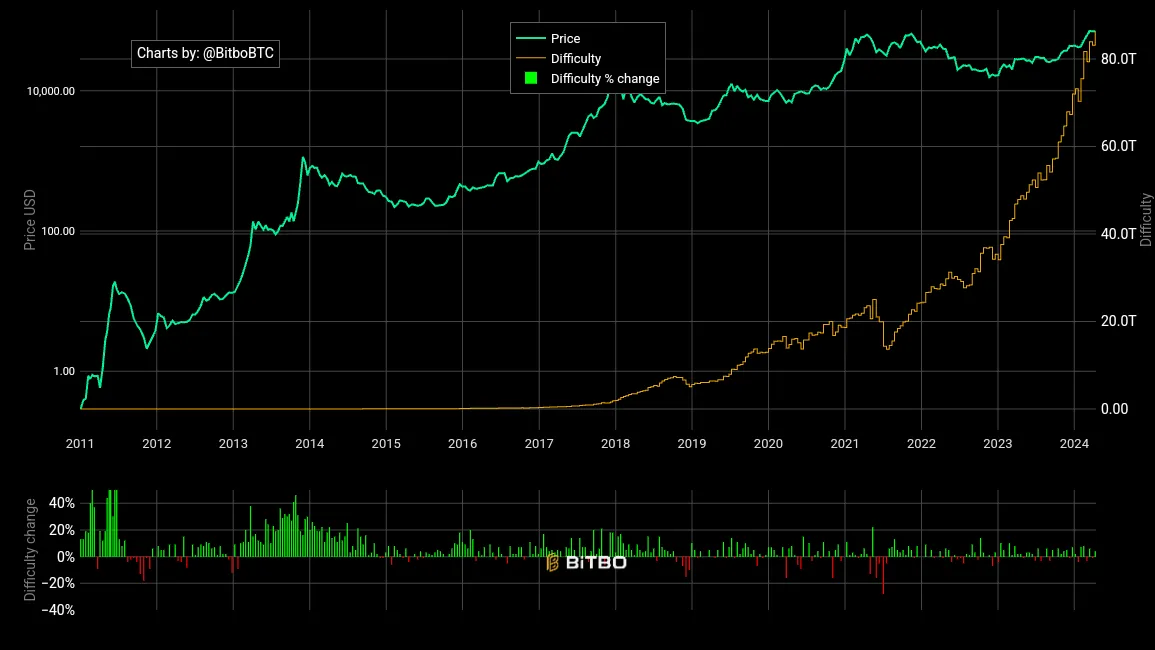

In the latter case, Bitcoin mining difficulty is realigned (auto-adjusted every two weeks or every 2,016 blocks). This means miners who stay plugged in will be more cost-effective in their operations because less computing power (hashrate) will be needed to secure the network. In turn, this would offset the reduction of BTC block subsidies.

Conversely, when the BTC price goes down, Bitcoin mining difficulty also goes down because miners can no longer justify the cost of maintenance and electricity. Bitcoin mining difficulty serves the critical purpose of maintaining network stability so that the average block time is at a consistent 10-minute rate.

The implication of these two mechanisms—halving as an inflationary control and mining difficulty—is that Bitcoin miners themselves can erect selling pressure. Typically, when BTC’s price reaches monthly or quarterly tops, miners sell a portion of their Bitcoin reserves to recoup losses and invest in upgrades.

During the last major bull run, in November 2021, BTC price hit $69k, while miners’ hashprice yielded 38 cents per terahash (TH). As of April 16th, Bitcoin miner revenue is 11 cents per TH. According to Blockware Solutions projection, miners would then receive 6 cents after the halving.

Balancing the Selling Pressures

The approval of eleven Bitcoin ETFs created a new landscape previously absent from halving cycles. It has been attributed to Bitcoin’s ATH of $73.7k in mid-March. With Bitcoin inflows cut in half from the present ~900 BTC mined per day, ETF capital inflows should further ward against selling pressures.

However, the uncertain geopolitical and macroeconomic situation related to inflation has reversed the trend over the last week. Owing to Grayscale’s continued outflows, the overall Bitcoin ETF flows are now in the negative selling pressure zone.

Concurrent with this trend, there could be more selling pressure from long-term (over one year) holders, now aligning with the August 2022 level. Their behavior will be influenced by the Fed’s actions and hedging against geopolitical events.

When placed into historical context, a Bitcoin price retracement following the halving would not be surprising. Within 500 days, however, BTC prices tend to rally significantly, owing to greater scarcity vs. demand pressures.

According to ByBit’s report, crypto exchanges may run out of BTC reserves post-halving if the current rate of withdrawals is sustained.

Bottom Line for Crypto Stocks

Pitting the aforementioned factors against each other, it is likely that the BTC price will rise to new ATH in the second half of the year when the force of the supply shock gathers strength. In the meantime, crypto stocks most heavily exposed to BTC will react accordingly.

As the most diverse ETF, holding stocks from exchanges and mining companies to MicroStrategy and payment processors, Schwab Crypto Thematic ETF (STCE) is down 14.5% over the month but up 24% over the last three months.

Post-halving is likely to see more dips, as it did with prior cycles. However, with the new institutional landscape and greater Bitcoin scarcity, the year’s second half should see renewed crypto stock rallies. This translates to a buying on the weakness interim opportunity for crypto stock investors.

Do you trade BTC regularly, anticipating dips, or just hold it? Let us know in the comments below.

tokenist.com

tokenist.com