Defunct Japanese exchange Mt. Gox will distribute 140,000 Bitcoin (BTC) ($4 billion) in creditor repayments starting on Oct. 31, 2023, which may plunge Bitcoin into bear territory if bulls don’t rally soon.

Initially, the Mt. Gox debtors will pay creditors eligible for the Base, Intermediate, and Lump-Sum Repayment.

Repayments Could Bode Ill for Markets

The notice to creditors says changing global regulations have complicated the precise timing of the repayments, with the Tokyo District Court having the prerogative to push back the deadline. Mt. Gox’s bankruptcy trustee, Nobuaki Kobayashi, has been given oversight of sending 141,686.37 BTC to about 42,000 creditors.

He said in January that some rehabilitation creditors must bring “necessary documents” to the exchange’s head office to register for repayments. As per the January announcement, some creditors could receive their repayments in cash, while others can receive Bitcoin Cash.

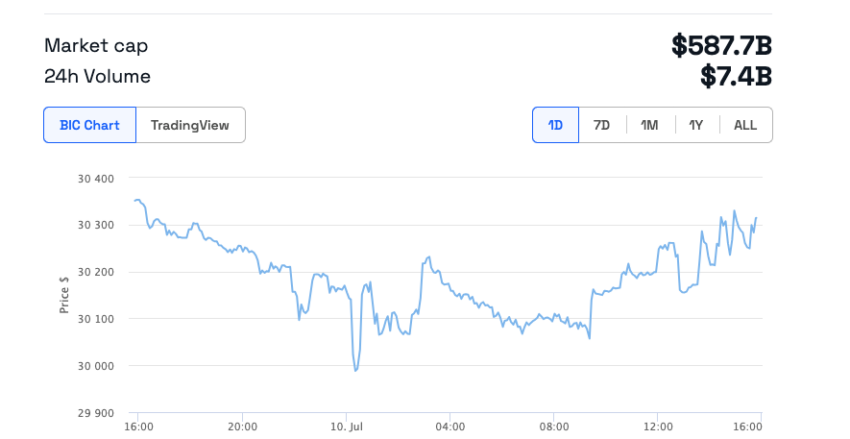

However, the effects of a major sell-off may cause a drop in the price of Bitcoin, depending on the ease with which Mt. Gox creditors can sell their crypto. Influencers and traders from the channel Crypto Banter predict that Bitcoin is at a critical resistance level that could swing bullish or bearish depending on the behavior of bulls.

If the market turns bearish now, a major sell-off from the Mt. Gox creditors could deepen the chasm.

Launched in 2010 by Jed McCaleb, Mt. Gox handled over 70% of global Bitcoin transactions before ceasing operations in February 2014. It initially closed its doors over the alleged disappearance of millions of dollars worth of BTC but later filed for bankruptcy protection. McCaleb went on to co-found Ripple Labs.

Japan Leads Global Crypto Regulations

The collapse of Mt. Gox saw Japan become one of the first countries to establish crypto regulations.

Post Mt. Gox, exchanges must register with the government and keep customer transaction reports. Additionally, the government recently heightened money surveillance in response to concerns from the Financial Action Task Force. Europe’s new Markets in Crypto-Assets bill also enforces the collection of customer information for each transfer.

Additionally, Japan’s revised Payment Services Act recognizes payments with registered stablecoins. A new paper by the Hong Kong University of Technology urged the government to create a stablecoin backed by the Hong Kong dollar to replace the dominance of US dollar reserves in the central bank. Stablecoins form a vital link between the worlds of traditional and crypto finance.

Binance recently launched a compliant local platform that would onboard all Japanese users from Dec. 1, 2023.

beincrypto.com

beincrypto.com