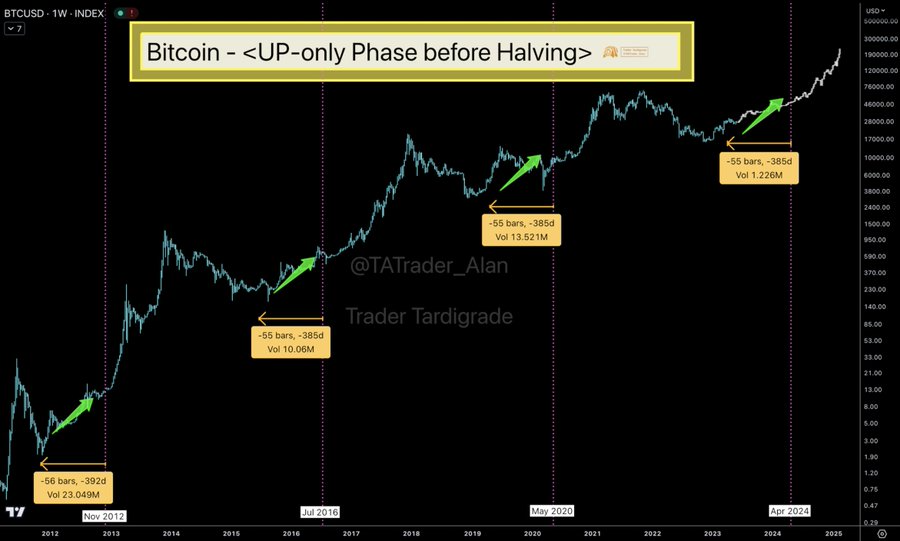

With less than one year left before the next Bitcoin (BTC) halving, when the current reward for mining the flagship decentralized finance (DeFi) asset further cuts in half, historical chart patterns indicate optimism could be in order for Bitcoin investors.

Notably, Bitcoin has gone through a halving event three times in its history – in November 2012, July 2016, and May 2020, and price increases have accompanied each of them, according to the data shared by cryptocurrency expert Trader Tardigrade on May 31.

“Bitcoin has entered the final phase before the next halving. This phase is ‘UP-ONLY’ phase, which was test 3 times in $BTC history.”

Halving patterns

Indeed, steady price climbs have both preceded and followed previous Bitcoin halvings, with the exception of a brief decline in 2020 caused by the Covid-19 pandemic but a recovery later on. If history repeats itself this time around, the analyst expects a price of about $50,000 around the halving event itself.

After the halving, the maiden crypto asset should proceed with a further upward continuation in the following years, potentially even reaching the price of $200,000 in 2025, as the expert’s chart analysis indicates.

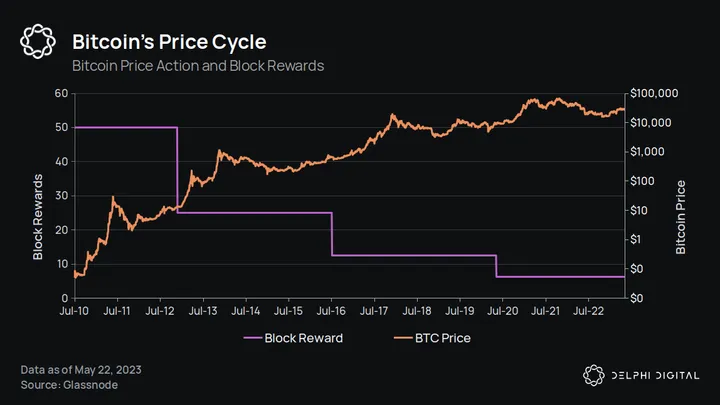

At the same time, crypto market research platform Delphi Digital also posted a chart demonstrating the digital asset’s historical price action and block rewards side by side since July 2010, stating that “Bitcoin halvening events have historically signaled a substantial increase in the price of Bitcoin.”

Bitcoin price analysis

As things stand, Bitcoin is currently changing hands at the price of $26,967, recording a decline of 2.67% in the last 24 hours and 5.48% over the previous 30 days but still demonstrating a 2.05% increase on its weekly chart, as the recent data shows.

Earlier, the coin had achieved its first-ever golden cross between the moving average (MA) on 20 observed time periods and that of the 200 periods, a bullish sign that should have led to a significant price gain, according to the crypto analyst Moustache, but the rally has not yet occurred.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com