Bitcoin experienced a significant surge in November 2021, reaching a peak of $69,000. However, despite a strong rally in the first quarter of this year, its price remains substantially lower, having dropped by about two-thirds from its record high.

The positive aspect of this price decline is that it has made it more accessible for individuals to enter the Bitcoin market or continue accumulating smaller units of the cryptocurrency, known as satoshis.

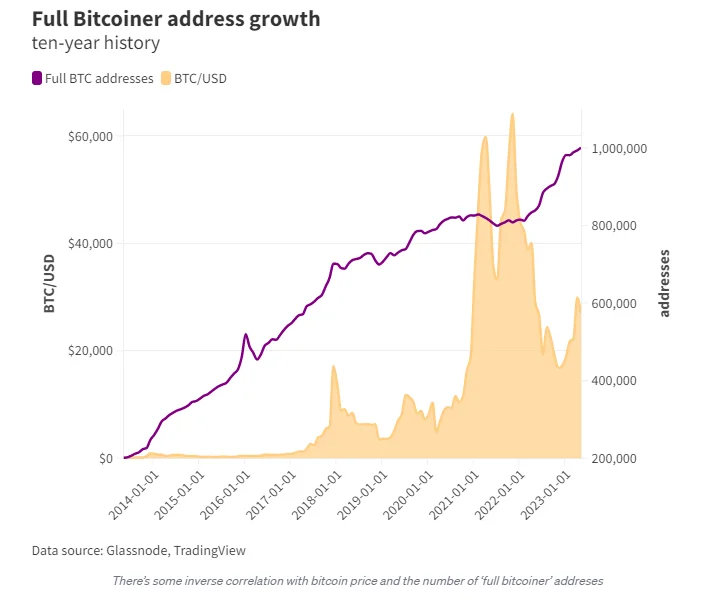

According to data from Glassnode, over one million addresses currently hold more than 1 BTC (approximately $26,800).

Notably, the number of addresses holding a full bitcoin increased notably in February of the previous year, when bitcoin underwent a correction following its record high.

Dan Ashmore, head of research at Investoo Group, explained that owning a full bitcoin is equivalent to roughly half of the median salary in the United States. While it has become relatively easier to acquire one bitcoin compared to late 2021, it may once again become unattainable for many if prices surge again.

Ashmore emphasized that during the pandemic’s bullish market, there was a significant slowdown in the growth of addresses holding 1 Bitcoin or more. However, as bitcoin’s price decreased, the upward trajectory resumed, and he expects this pattern to persist in the future.

It is important to note that one Bitcoin address does not necessarily represent a single individual, as some people control multiple addresses. At the same time, institutions or groups may also own certain addresses.

Ashmore believes that reaching the milestone of one million addresses with more than 1 BTC demonstrates Bitcoin’s establishment in the mainstream domain in recent years.

Despite the inherent decentralization of the Bitcoin network, wealth distribution is more concentrated than commonly assumed. BitInfoCharts indicates that only 7% of the bitcoin supply (1.356 million BTC, valued at $36.4 billion) is spread among nearly 46.5 million addresses holding some BTC but less than one. On the other hand, the remaining 93% (18 million BTC, worth $482.7 billion) is contained within one million addresses that possess a full Bitcoin.

READ MORE: Tether’s Hidden Reserves Exposed – How Much Gold do They Own?

Hence, addresses holding more than 1 BTC represent approximately 2.1% of all non-zero Bitcoin addresses. However, these statistics are somewhat skewed due to the significant amount of BTC held in crypto exchange addresses, primarily representing aggregated user holdings. CoinGlass data indicates that around 1.89 million BTC ($50.7 billion), equivalent to one in ten circulating BTC, is held by crypto exchanges like Binance, Coinbase, and Bitfinex.

Additionally, Glassnode estimates that 1.46 million BTC ($39.2 billion) is “probably lost” forever, accounting for 7.5% of the current total Bitcoin supply.

Nevertheless, Erik Saberski, vice president of data science at The Tie, suggests that even distribution across financial systems contributes to stability within associated asset classes. Conversely, fewer holders’ imbalanced buying and selling pressure can cause significant price fluctuations. Therefore, an increased number of people holding a full Bitcoin could indicate enhanced price stability, reflecting the maturation of BTC.

Saberski further notes that as Bitcoin is the leading asset in the crypto economy, this adoption signal could signify broader growth for the overall digital asset ecosystem. However, it’s important to recognize that adoption occurs over a much slower timescale and doesn’t necessarily provide immediate insights into short-term market conditions.