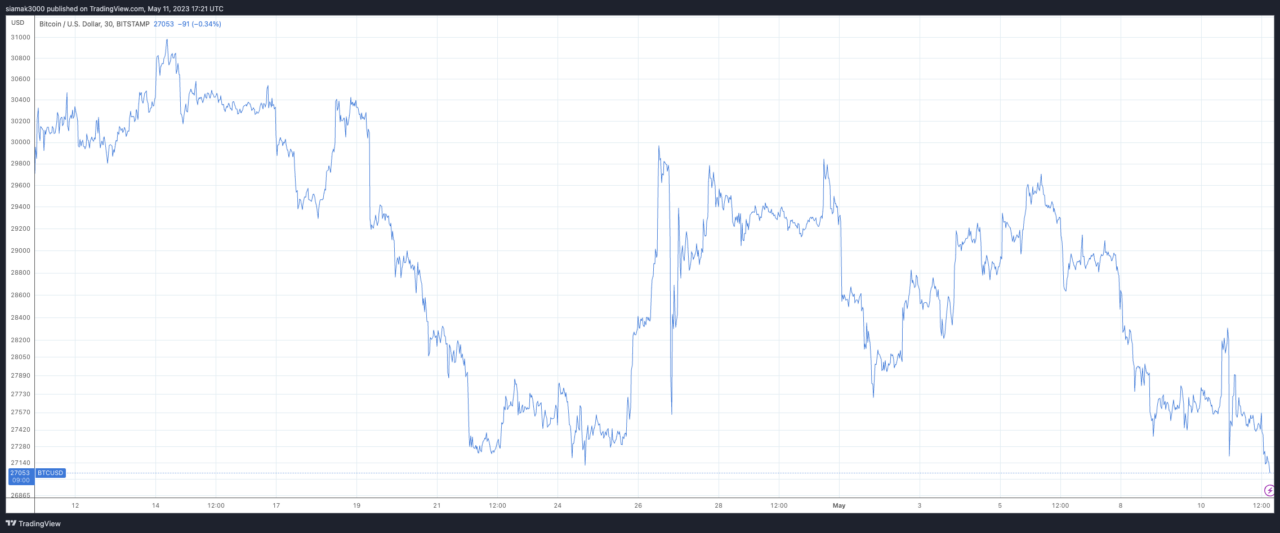

Bitcoin’s recent slip below $28,000 has investors on their toes, with many questioning where the world’s leading digital asset will land as we approach the end of May.

According to a recent article published by Finbold on Wednesday (10 May 2023), after opening May over the $29,000 mark, Bitcoin’s price slid, struggling to maintain around $27,500. This downward trend has left investors uncertain about the cryptocurrency’s future as it grapples with vital resistance levels.

Finbold refers to a CoinMarketCap survey in which 9,765 members, boasting an 82% historical accuracy rate, predict a significant drop in Bitcoin’s price by the end of May. If this forecast holds, Bitcoin’s price could average $24,753 by May 31, representing a decline of -10.35% or -$2,857 from the price at the time of writing.

Bitcoin currently trades at $27,192, with a 5.94% decline over the past week. Despite the dip, Bitcoin’s market capitalization remains substantial at $527 billion, underlining its dominance in the cryptocurrency market.

Finbold also highlights IntoTheBlock’s visual representation of Bitcoin purchases at specific price levels, revealing increased buying activity near the $30,000 mark. However, the analysis also points out a lack of robust buying support below the current price level until approximately $24,000.

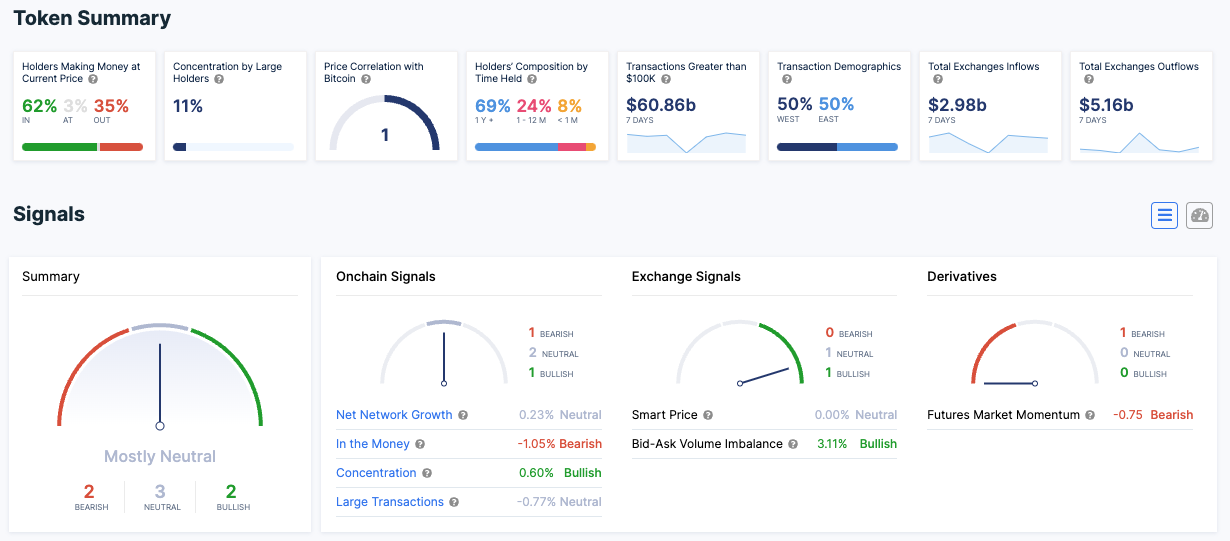

You may have noticed some weakness in the market lately, with altcoins in particular taking a hit (excluding memecoins). However, as Bitcoin remains the determining factor for most assets, let's take a closer look at the on-chain situation for #BTC .

— IntoTheBlock (@intotheblock) May 10, 2023

In the image below, you can… pic.twitter.com/hAatBo6XXf

Moreover, Finbold reports a decrease in the percentage of Bitcoin holders currently in profit, now at 62%. Finbold also points out that despite the dip, similar drops have occurred earlier this year and have proven short-lived due to increased buying pressure, suggesting that Bitcoin’s current state may yet see a turnaround.

cryptoglobe.com

cryptoglobe.com