In January of this year, Bitcoin broke above its 200-day MA for the first time since the end of 2021. This was a significant milestone for the cryptocurrency, as it had not seen such a signal in over a year. This breakout was a clear indication of Bitcoin’s bullish momentum and its potential for further growth in the future.

Additionally, Bitcoin retested the 200-day moving average in March and remained well above it, demonstrating its robust behavior. However, the leading cryptocurrency is approaching a lower-level retest at $28,000. Whether Bitcoin will withstand further price decline and continue its bullish trend or if a final shakeout is imminent.

Bitcoin’s Halving Cycle And Potential Dip Below The 200-Day MA

Recently, there has been speculation that Bitcoin’s price might be poised for a significant rally as spring arrives. However, the situation is not quite simple as with many things in the crypto world.

According to the expert in the cryptocurrency industry, Mr. Ben Lily, the current halving cycle is an important factor to consider when evaluating Bitcoin’s price movements. When BTC comes off halving cycle lows, it commonly does not immediately clear the 200-day moving average (MA) and stays above it.

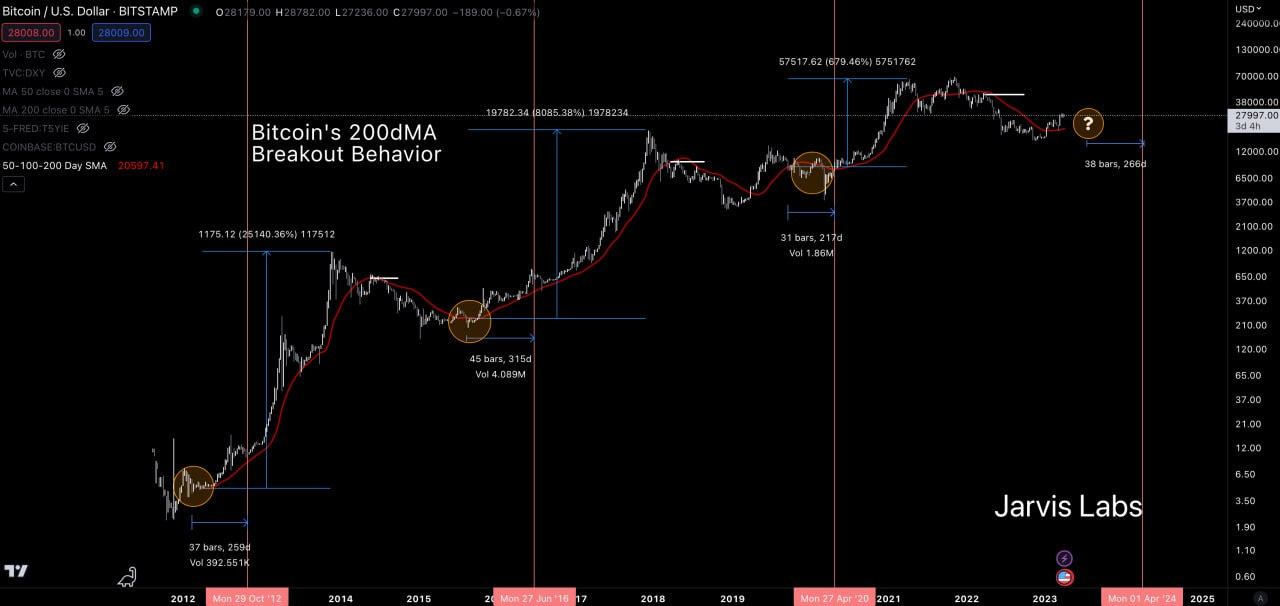

Instead, it tends to return below the 200-day MA before ultimately moving on to form all-time highs. This pattern can be observed in the chart below, which shows the 200-day MA (represented by the dark red line) and the orange circles, which indicate when the price dipped below the 200-day MA.

Furthermore, Lily argues that nothing suggests that the market should expect anything different this time. He believes a catalyst coming this summer will coincide with Bitcoin’s price dipping below the 200-day MA.

FedNow Rollout And Bitcoin: A Tale Of Two Timing

Additionally, Ben Lily has provided further analysis on the potential impact of the upcoming rollout of the Federal Reserve’s CBDC, FedNow, on Bitcoin’s price movements. According to Lily, if the rollout occurs as scheduled in July, it could benefit BTC’s price trajectory.

However, Lily notes that in each of the last three halving cycles, Bitcoin’s price dipped below the 200-day moving average (MA) between 217 and 315 days before the halving itself. If this pattern holds for the current halving cycle, we can expect BTC’s price to dip below the 200-day MA sometime between June and August.

With FedNow set to roll out in the middle of that period, Lily suggests we can expect regulator “war drumming” to be at a fever pitch. This could lead to a final shakeout moment as Bitcoin drops below the 200-day MA, creating a higher low in the market.

At the moment of writing, Bitcoin, the largest cryptocurrency by market capitalization, is being traded at $28,000, indicating a decrease of over 2.5% in the last 24 hours. And, as reported yesterday by NewsBTC, the $27,700 line is key for Bitcoin, as a breakout below this level could signal a shift in the market sentiment and potentially lead to a further decline in price.

Featured image from Unsplash, chart from TradingView.com

newsbtc.com

newsbtc.com