Bitcoin was conceived in 2008 by Satoshi Nakamoto as a P2P payment system that could override traditional payment providers such as Visa and Mastercard.

However, it is still slow and expensive to compete with these intermediaries.

Whereas the Layer 2 Lightning Network could be the right compromise, allowing fast and inexpensive transactions for users.

Will this Bitcoin subnetwork be able to replace Visa over the next few years?

The answer can be found in this article.

What is Bitcoin’s Lightning Network? Is it a threat to Visa?

The Lightning Network is an on-chain protocol that relies on Bitcoin’s core network and enables fast and inexpensive transactions for users, effectively eliminating the problem of expensive fees and slow block validation by BTC miners.

Using a technique called onion routing, the protocol essentially splits data into multiple packets. It then sends them through different nodes in the network using end-to-end encryption.

It was first introduced by developers Thaddeus Dryja and Joseph Poon in 2015 and has become increasingly popular from there on, though it has never achieved the same adoption and popularity as Bitcoin.

In detail, the Lightning Network allows microtransactions (worth a few dollars) to be made off the main chain through multiple payment channels between two or more parties.

Hence, it is not a network capable of transferring large amounts of cryptocurrency money, but rather a payment system to be used in everyday life for micropayments.

The goal of this Layer 2 is to improve the scalability of Bitcoin’s network, providing users with low fees and unparalleled speed of execution.

In the document initially presented to the Bitcoin community, Dryja and Poon, in addition to describing how the protocol works, made explicit their desire to surpass the peak TPS (transaction per second) reached by Visa in 2013.

Bitcoin Lightning Network Concept against Visa

The Lightning Network was thus conceived as a threat to traditional payment providers, which may lose their significant user base in the coming years due to the improved efficiency of the decentralized P2P network.

However, there are still many challenges facing Bitcoin’s Layer 2 supporters.

First and foremost is the concept of security: the Lightning Network needs to be more secure and reliable, capable of neutralizing any Sybil and DDos attacks.

Indeed, Lightning Network nodes can be easily targeted by bad faith users who could jeopardize the sustainability of the off-chain transaction network.

Second, the user experience needs to be improved in every respect so that it is easy to use even for inexperienced individuals.

If Bitcoin’s Lightning Network succeeds in this endeavor, it would probably be able to put a spoke in the wheels of major digital payment providers such as Visa and Mastercard as the years go by.

Even public figures such as Jack Dorsey, former CEO of Twitter, have endorsed the idea of the Lightning Network. In 2018, the latter experimented with the network as a tip payment system on the well-known social network.

Do the costs of Lightning Network of Bitcoin compare with those of Visa and Mastercard?

The lightning network was introduced mainly to solve the cost problem of the Bitcoin network.

It is insane to think that to move a few dollar units one would have to pay almost the same amount in fees.

This has been one of the biggest problems for Bitcoin that has hindered it from achieving mass adoption in recent years.

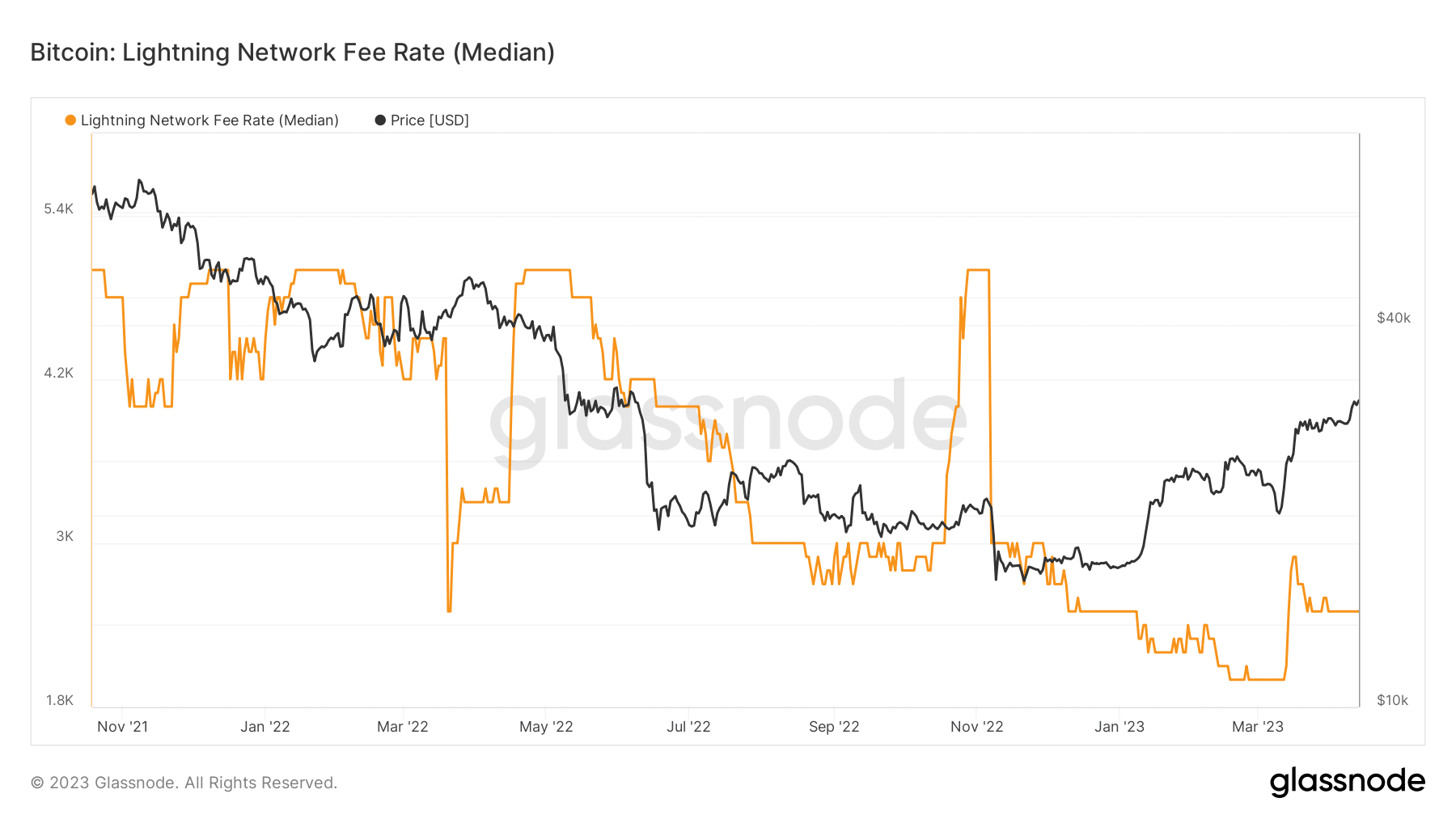

But how much does it cost to make a transaction on a Lightning channel?

Put simply, we can say that there are two types of fees when using this network:

- the first concerns a base fee, charged by each operator node in an arbitrary manner. It is generally very few fractions of a cent (or rather a few units of satoshi), precisely to incentivize traffic on its node.

- The second involves a fee based on the liquidity used within the node. In this case, the channel owner may decide to set a fee, calculated as a percentage of the total satoshi sent. (e.g., 0.01 sat per satoshi sent).

There are special cases where the total fees for using a Lightning channel are zero and cases where the fees are excessively high.

Fee comparison Bitcoin vs Visa

Currently, considering that the base fee is insignificant, for each BTC traded on the lightning network 2500 sats are paid, equivalent to about $0.077.

If we compare these costs with those of major payment service providers such as Visa, we see that the latter are extremely more expensive.

Credit card companies charge a range of fees based on the type of merchant, the amount of the transaction, and where the transaction takes place.

Generally Visa charges an interchange fee ranging from 1.15% + $0.05 to 2.40% + $0.10. They also charge an assessment fee of 0.14%.

Mastercard, on the other hand, charges an interchange fee ranging from 1.15% + $0.05 to 2.50% + $0.10. Their additional assessment fee is 0.1375% for transactions of less than $1,000 and 0.01% for transactions of $1,000 or more.

An interesting on-chain data on Lightning Network

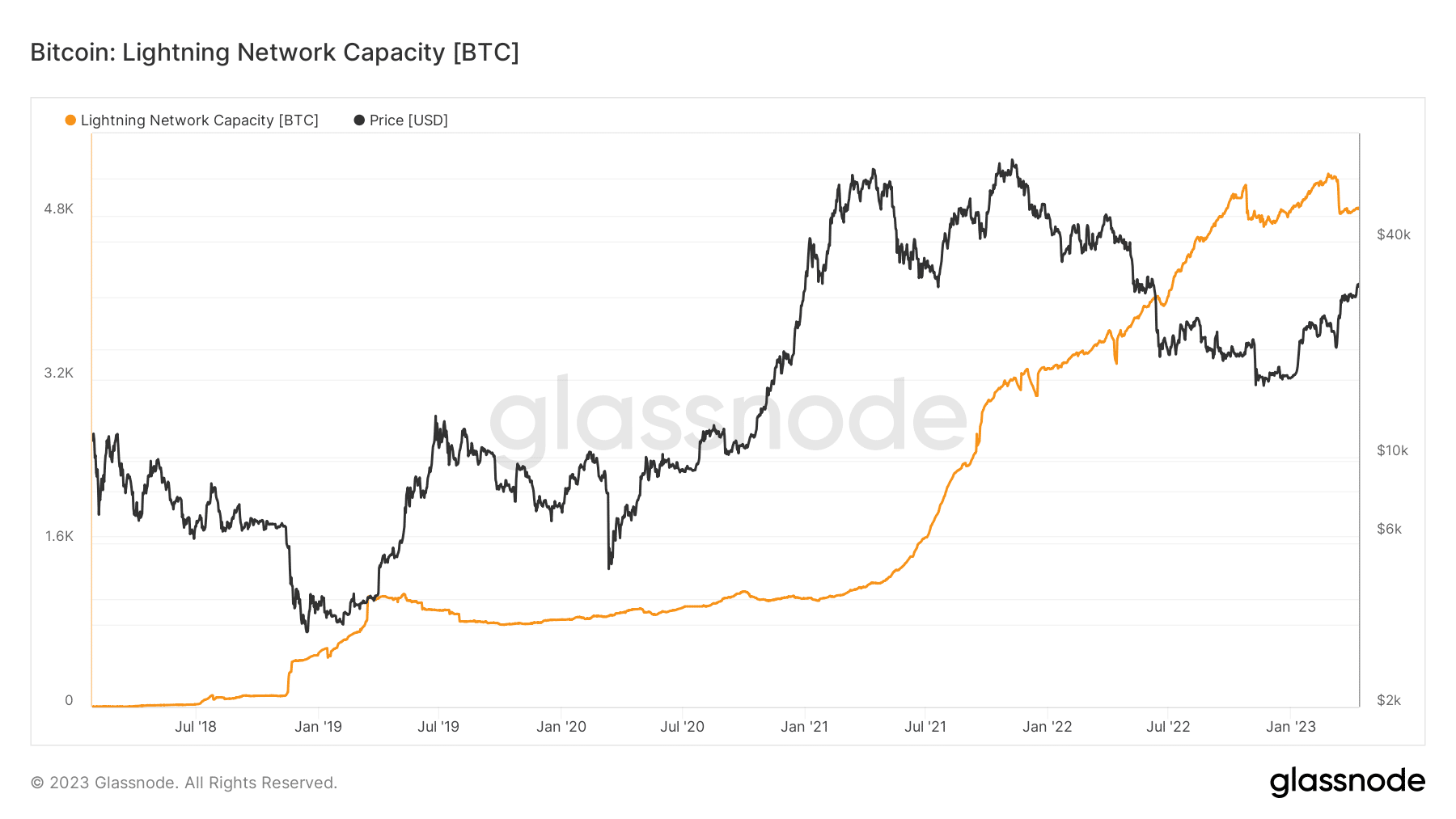

To date, it seems to us unfeasible that traditional payment providers will be threatened by a technology that is still being developed, yet the challenge has been taken seriously by the various Bitcoin developers, who over the years have increased the capacity and simplicity of the network moving closer and closer to the ultimate goal.

Indeed, it is not enough to have a cheaper payment channel to compete with these companies that have now planted their roots in any area of daily life.

The challenge, as mentioned before, is played out on several factors as well as that of network capacity.

To become mainstream, the Lightning Network must upgrade its capacity to a level far beyond what it is today.

To date, the network can support transactions of up to 4,828 BTC, equivalent to about $148 million.

This is still an insignificant amount compared to the huge amount of money moved through traditional providers.

However, the path seems to be the right one, as the value of the lightning network capacity grows more and more over time.

en.cryptonomist.ch

en.cryptonomist.ch