Dylan LeClair said Bitcoin’s recent solid performance boils down to the understanding that trustlessness is the only way forward.

The Research Analyst pointed out that, amid tough geopolitical and macroeconomic conditions, Bitcoin has managed to buck the broader market trend – thanks to the growing realization it has no counterparty risk.

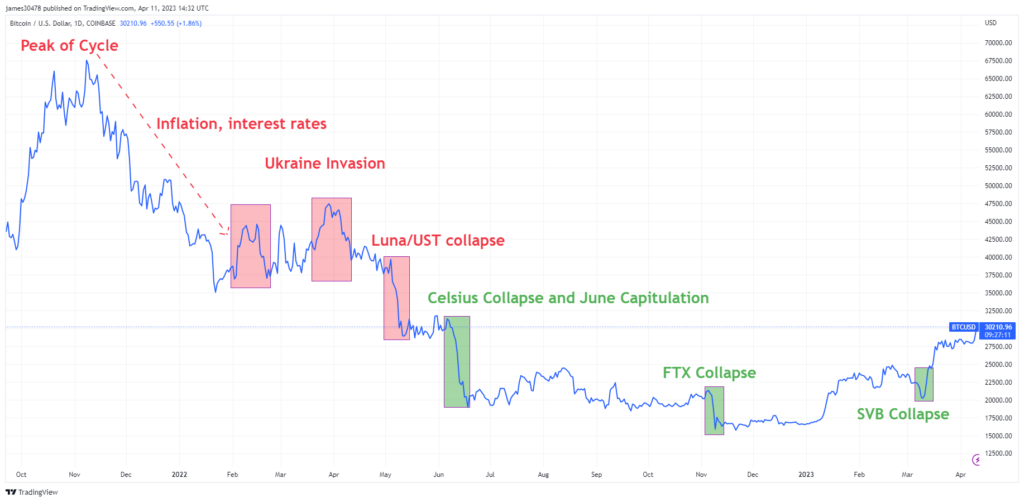

BTC has suffered a steep price decline since the November 2021 top. Recent events, including a spate of CeFi bankruptcies, have contributed significantly to suppressing recovery.

However, despite the doom and gloom, Bitcoin rose above $30,000 on April 11 – marking a 10-month high.

Tough run for Bitcoin

Since the November 2021 top, Bitcoin posted a peak-to-trough loss of 78% – bottoming at $15,500 in November 2022.

Over the last 18 months, the leading cryptocurrency has faced significant headwinds – beginning with the onset of inflation and the associated flip to quantitative tightening. Further uncertainty took hold as the conflict in Eastern Europe broke out in February 2022.

By May 2022, the UST scandal piled on the sell pressure as it emerged the entire LUNA ecosystem was a fraud from the start. The event triggered a downward spiral, affecting other CeFi platforms and further exposing parts of the industry as an interconnected house of cards.

However, it wasn’t until the collapse of FTX that the market bottom came in. Since then, Bitcoin has grown 94%, with the period from March 11, as banking collapses occurred, demonstrating a strong rally.

Worst behind us?

In explaining Bitcoin’s run, LeClair said, “Every four years, the fraud, the leverage, it gets completely wiped out” – leaving the market with majority believers, holding for the long term.

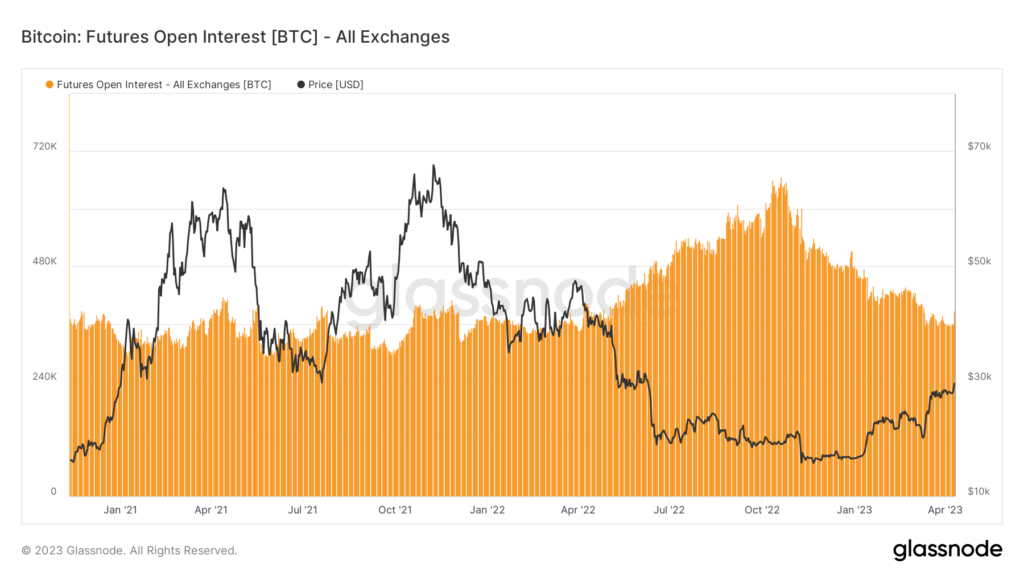

The Glassnode Open Interest chart below supports LeClair’s statement. It shows the number of open futures derivatives contracts sliding from a November 2022 peak of about 600,000 to approximately 400,000 at present – which is roughly in line with historical levels.

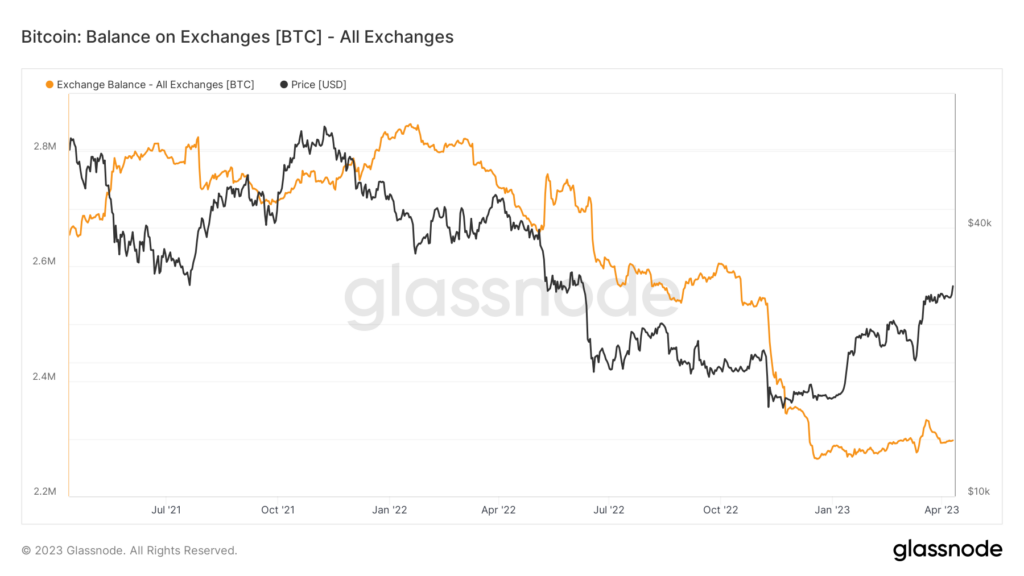

Similarly, the amount of Bitcoin held on exchanges has sunk considerably over the last two years – signifying a trend toward long-term hodling.

LeClair said what’s happening here is that people have realized they want to hold a decentralized asset that doesn’t require trust.

“They don’t want to trust a stablecoin. They don’t want to trust a crypto protocol or a developer. They want to hold a decentralized monetary asset with no counterparty risk.”

CryptoSlate Analyst James Van Straten echoed LeClair’s analysis, adding that the on-chain metrics suggest we are over the worst. However, stagflation will continue to be a factor.

Nonetheless, we are approaching the end of the rate cycle with the likelihood of a final 25 basis point hike left. The pause period will prove interesting, with expectations of rising unemployment and falling equities – if that plays out, Bitcoin’s resilience, as a hedge, will be retested.

cryptoslate.com

cryptoslate.com