Bitcoin (BTC), the world’s most popular cryptocurrency, experienced a surge in value, crossing the $28,000 mark after the release of a positive US jobs data report. The report, which exceeded expectations, provided a boost to investor sentiment, resulting in a sharp rise in the price of BTC.

At the start of trading on Wall Street on April 7, BTC showed little interest in advancing as recent macroeconomic data from the United States bolstered bets on future interest rate hikes.

US adds 236k jobs – missing out on the 239K jobs forecast

The Bureau of Labor Statistics (BLS) reported the addition of 236,000 jobs in March, exceeding economists’ predictions of 239,000 jobs. In addition, the BLS reported that the unemployment rate fell to 3.5% from 3.6% in February, which was below the consensus estimate of 3.6%.

The U.S. unemployment rate came in at 3.5% in March, below expectations for 3.6% and the previous reading of 3.6%. The non-agricultural employment population recorded a seasonally adjusted increase of 236,000 in March. The continued decline in the unemployment rate and the…

— Wu Blockchain (@WuBlockchain) April 7, 2023

The gain of 311,000 jobs in February was revised up to 326,000. This morning’s payrolls report is the last one the U.S. Federal Reserve will see before its May 2-3 meeting. The central bank will decide whether to continue tightening monetary policy or pause its now over-a-year-long series of rate hikes.

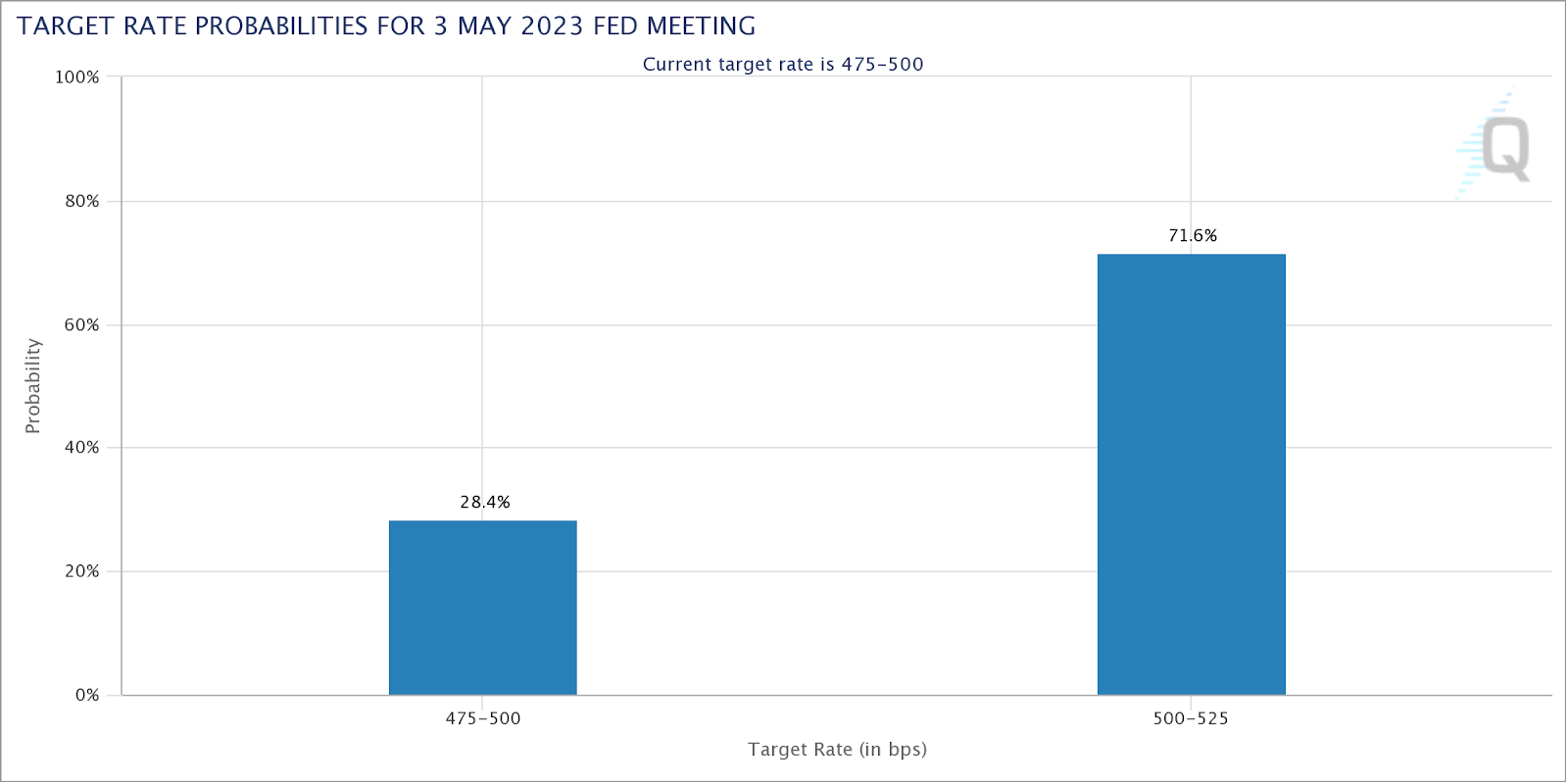

Prior to the release of the report, futures markets had priced in a two-in-three chance that the Fed would pause in May. The ADP reported on Wednesday that only 145,000 private sector jobs were added in March, compared to the anticipated 210,000. These figures suggest that the labor market may be experiencing some weakness.

Then, on Thursday, the Department of Labor reported initial weekly jobless claims of 228,000, which was significantly higher than the forecast of 200,000. In addition, the 192,000 initial claims from the previous week were revised up to 246,000.

BTC begins to stabilize above $28,000

TradingView data tracked BTC/USD as it fluctuated around $27,900 on Bitstamp. The U.S. nonfarm payrolls data, the most important macroeconomic indicator of the week, came in slightly below expectations, indicating a slower than anticipated increase in unemployment.

In turn, this increased market expectations that the Federal Reserve would continue to raise interest rates to combat inflation, to the detriment of BTC and the performance of risky digital assets.

According to CME Group’s FedWatch Tool, the odds of another 25-basis-point rate hike in May surpassed 70% on the day, having previously hovered around 50%.

The S&P 500 and the Nasdaq Composite Index gained 0.4% and 0.8%, respectively, at the opening of trading today. In the meantime, the U.S. dollar managed an uncharacteristic copycat rally, rising back above 102 to reach its highest levels in several days.

Crypto markets rebound, signaling the end of the bear market

Despite a banking crisis, rising interest rates, and a slew of new legal and regulatory headaches for the fledgling industry, cryptocurrencies are rising in 2023.

Ether, the second-largest cryptocurrency, increased by 51% during the three-month period ending on March 31. BTC is currently trading near $28,000 while ETH surpassed $1,900 per coin on Wednesday. This is the highest level ETH has reached since September of last year. Both are relatively unchanged over the past twenty-four hours.

#Bitcoin History Repeats. pic.twitter.com/3wBSFJaRYh

— Crypto Rover (@rovercrc) April 7, 2023

Even Dogecoin (DOGE), a cryptocurrency that began as a joke, rose 30% Monday after Elon Musk replaced Twitter’s bird icon with the Shiba Inu logo of Dogecoin. When Twitter’s logo was changed back on Thursday, Doge lost some of his gains.

The rapid rise of digital currencies has been one of the year’s biggest market surprises, following a crash in 2022 that cost investors billions as higher interest rates and inflation reduced the value and appeal of risky assets. The re-establishment of BTC’s market dominance has restored faith in crypto investors.

This year’s crypto comeback is taking place even as Washington regulators step up their efforts to rein in the market. Moreover, since the beginning of February, BTC’s 50-day moving average has risen above the 200-day moving average, indicating to chart users that market sentiment has shifted from bearish to bullish.

cryptopolitan.com

cryptopolitan.com