The Bitcoin Ordinals craze is bringing added stress to the mempool. The number of transactions in the waiting room is nearing a two-year high.

The NFT rage appears to be picking up steam again in March after Ordinals swarmed the Bitcoin network in February.

Bitcoin Ordinals Revival

NFT collector Leonidas noted on Twitter that Ordinals had surpassed its prior record high. Data cited by Leonidas shows that on March 23, the inscriptions demanded 9.28 BTC in fees.

Similar to non-fungible tokens, Ordinal Inscriptions are digital commodities. They can be inscribed on a satoshi, the smallest unit of Bitcoin. Before NFT transactions are validated on the Bitcoin blockchain, they are queued in the waiting room of mempool. Nodes often confirm high-fee transactions in the mempool first.

As per the Dune dashboard, Bitcoin Ordinals Inscriptions to date stand at 577,717. Meanwhile, the total fees for the inscriptions surpassed 127 BTC at press time.

Therefore, the mempool is also witnessing a spike as a result. On March 24, mempool in vByte terms is hovering near 226 MvB. The last mempool peak of around 250 MvB occurred in April 2021 when Bitcoin first breached the $63,000 price point.

This was before BTC touched a fresh high of $69,000 in November of the same year. At the time of press, Bitcoin is hovering slightly above the $28,000 level.

In February, the mempool peaked at around 96 MvB in the last ordinals rage before normalizing.

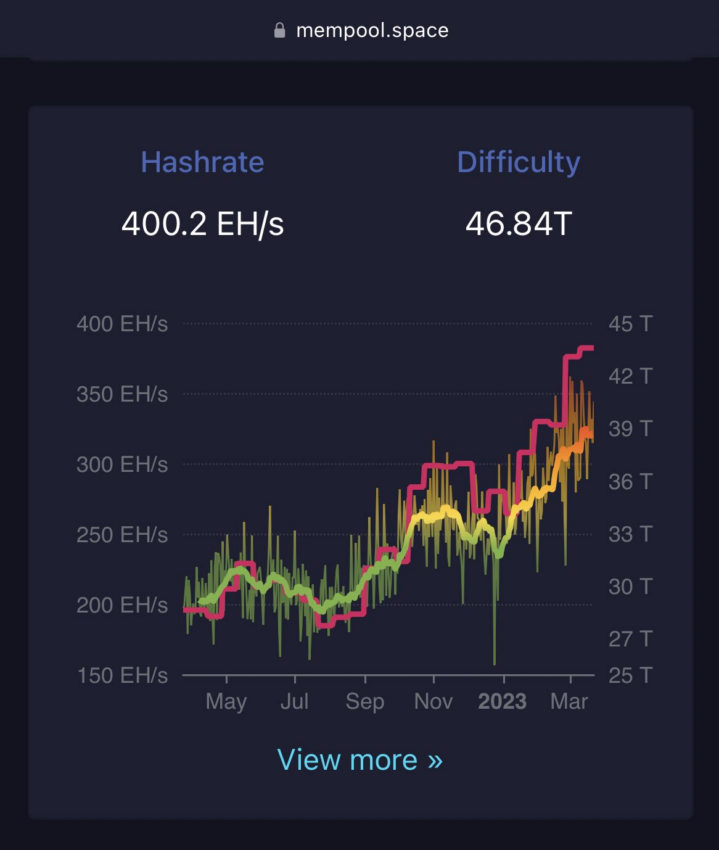

Hash Rate and Difficulty Spiking

Meanwhile, on Friday, Bitcoin mining difficulty increased by 7.5% and inched toward an all-time high. At press time, the BTC network is at an ATH hash rate of 400 EH/s with a record difficulty of 46.84T.

According to data by IntoTheBlock, on-chain signals were bearish at the time of writing. However, 71% of the BTC holders were still making money, and 25% were at a loss at the current price levels.

beincrypto.com

beincrypto.com