The Bitcoin bulls appear to be getting a rain check on gains with the BTC price action appearing to retrace its weekend progress. Bitcoin (BTC) struggled to maintain its bullish momentum on January 30 as the countdown to the monthly close kept the market extremely nervous.

Bitcoin Dropped Below $23,000

Data acquired from TradingView showed BTC/USD dropping from its latest highs at nearly $24,000 on the day.

These, while Bitcoin’s best performance for almost six months, encountered issues with staying power as the week started, with pre-Wall Street trading seeing a small trip below $23,000.

At the time of writing, Bitcoin is still trading below $23,000 as the United States equities struggled into the final few days of January.

Among the topics of interest for analysts was the CME Bitcoin futures gap from the weekend getting quickly “filled” by spot.

“Gaps” in the futures chart mostly act as a short-term price magnet for spot once futures markets reopen after weekends. Another remained open between roughly $19,970 and $20,530.

One popular trader John Wick wrote in his latest Twitter update:

“CME gaps filled and overshooting now bc of Equity futures being negative, We’re in for a wild week!”

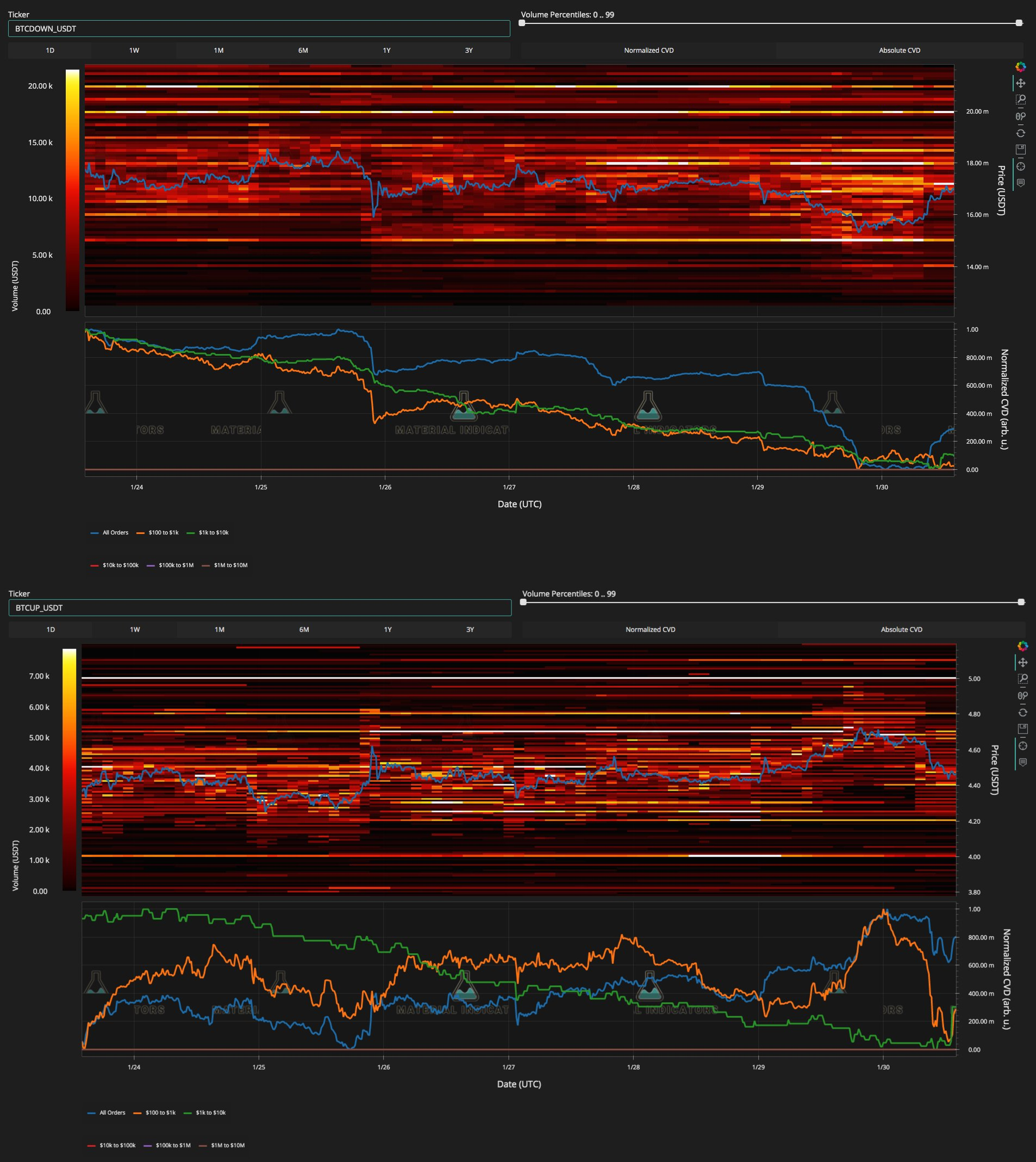

Analytics resource Material Indicators, in the meantime, focused on order book activity on Binance with longs and shorts possibly signaling some upward continuation.

Commentary on a chart of longs and shorts stated:

“Sometimes looking at leveraged assets on Binance can give clues to what is happening with the underlying. BTCDOWN is at resistance and BTCUP is approaching support.”

“Things don’t have to play out as these charts indicate, but so far they correlate with current BTC PA.”

Bitcoin Analyst ‘Not Convinced’

On whether Bitcoin would make good on weeks of upside before the monthly close, others were far from confident.

Among them was Crypto Ed, who, in a note to followers, stated that he was “not convinced yet” over Bitcoin’s overall strength.

An accompanying chart presented a possible retest of $22,000 as a downside target.

Based on previous reports, the area around $25,000 had constituted a considerable cloud of resistance for Bitcoin, being an area of considerable potential short liquidations.

That price nevertheless remained a popular target should the bulls manage to regain their firepower.

cryptovibes.com

cryptovibes.com