Bitcoin (BTC) has corrected, losing the $21,000 support level as investors look forward to a week filled with numerous macroeconomic activities. Amid the short-term plunge, bulls and bears are still struggling to take control of Bitcoin’s price.

In this line, a crypto analyst at Kitco News, Jim Wyckoff, on November 7 stated that despite Bitcoin falling below $21,000, bulls still have an advantage.

“Bitcoin-U.S. dollar prices are weaker in early U.S. trading Monday. Prices are in an uptrend on the daily bar chart after hitting a nearly two-month high last Friday. The bulls have the near-term technical advantage and are continuing to fight to keep the price uptrend alive,” Wyckoff said.

By press time, Bitcoin was trading at $20,700 after experiencing a relief rally that saw the asset trade at an almost two-months high of above $21,000. The asset primarily benefited from the positive United States jobs data. However, the market is yet to see a strong catalyst likely to give the bulls more strength.

Bitcoin technical analysis

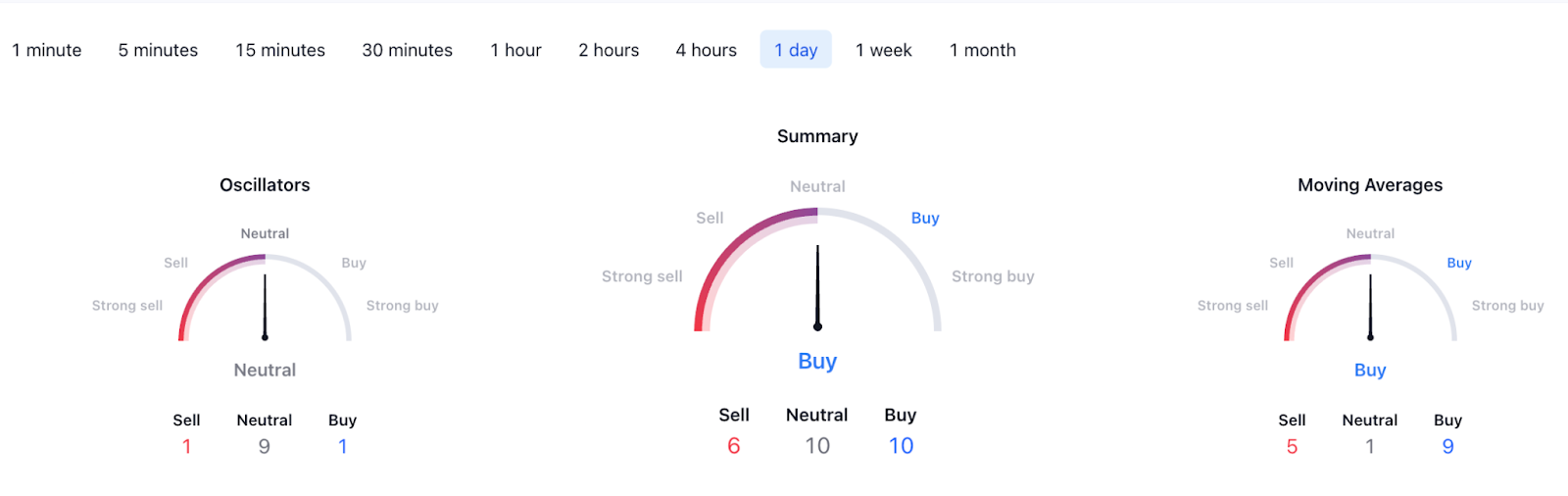

From a technical perspective, the flagship cryptocurrency has a positive outlook. A summary of one-day technicals and moving average are for ‘buy’ at ten and nine, respectively. Elsewhere, oscillators are pushing for neutrality nine.

Macroeconomic activities

Furthermore, investors will be focusing on macroeconomic events that might emerge as possible catalysts for the asset’s rally. The United States midterm elections and the consumer-price index (CPI) inflation data are top in line.

In this case, if the CPI data comes in lower-than-expected, it could benefit the risk assets like Bitcoin since it will likely increase the possibility of the Federal Reserve slowing down on its tightening policies.

Historically, stocks have reacted to the outcome of the midterm elections, and investors should expect the same for crypto, considering that both asset classes have increasingly correlated amid the bear market.

At the same time, the election’s outcome could offer a hint at the regulatory outlook. Notably, cryptocurrency executives have increasingly pumped more money into lobbying.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com