The cryptocurrency market is showing signs of strength again, as most of its assets recorded advances in recent days, including Bitcoin (BTC), which some crypto experts believe is in for a major breakout.

If Bitcoin’s behavior patterns from the previous years are to be taken into account, these experts just might be proven right, as demonstrated on the side-by-side charts published by the pseudonymous crypto analyst Moustache on November 1.

The expert listed the similarities between Bitcoin’s technicals in 2019 and those in 2022, along with his predictions for its price action after the New Year’s holidays, which Moustache believes will be bullish.

Specifically, these similarities include the successful ABC-correction, analogous relative strength indicator (RSI), similar Stochastic RSI (StochRSI), and the last body-candle close being greater than the previous month.

Patterns keep adding up

Earlier, the same expert presented other patterns that point to Bitcoin moving towards $30,000 in 2023, along with another crypto trading expert and Dutch institutional investor, PlanB, hinting at a ‘Moonvember’ for the maiden decentralized finance (DeFi) token.

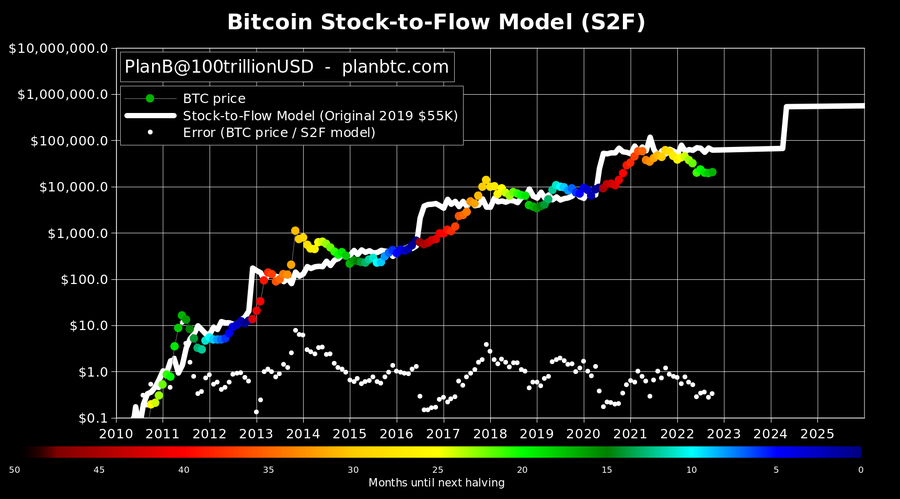

At the same time, PlanB noted that Bitcoin’s closing price was $20,498, and posted his stock-to-flow (S2F) live model, predicting a bullish advance for BTC, in his tweet on November 1.

Elsewhere, prominent crypto analyst Michaël van de Poppe observed that Bitcoin was “consolidating nicely, while yields are ready to tumble down,” as well as identifying that altcoins were breaking out on October 31.

Bitcoin might also expect some push after the famous former NSA computer intelligence analyst and whistleblower Edward Snowden praised its lightning network speed and the founder’s dedication to remaining anonymous for 14 years.

Bitcoin price analysis

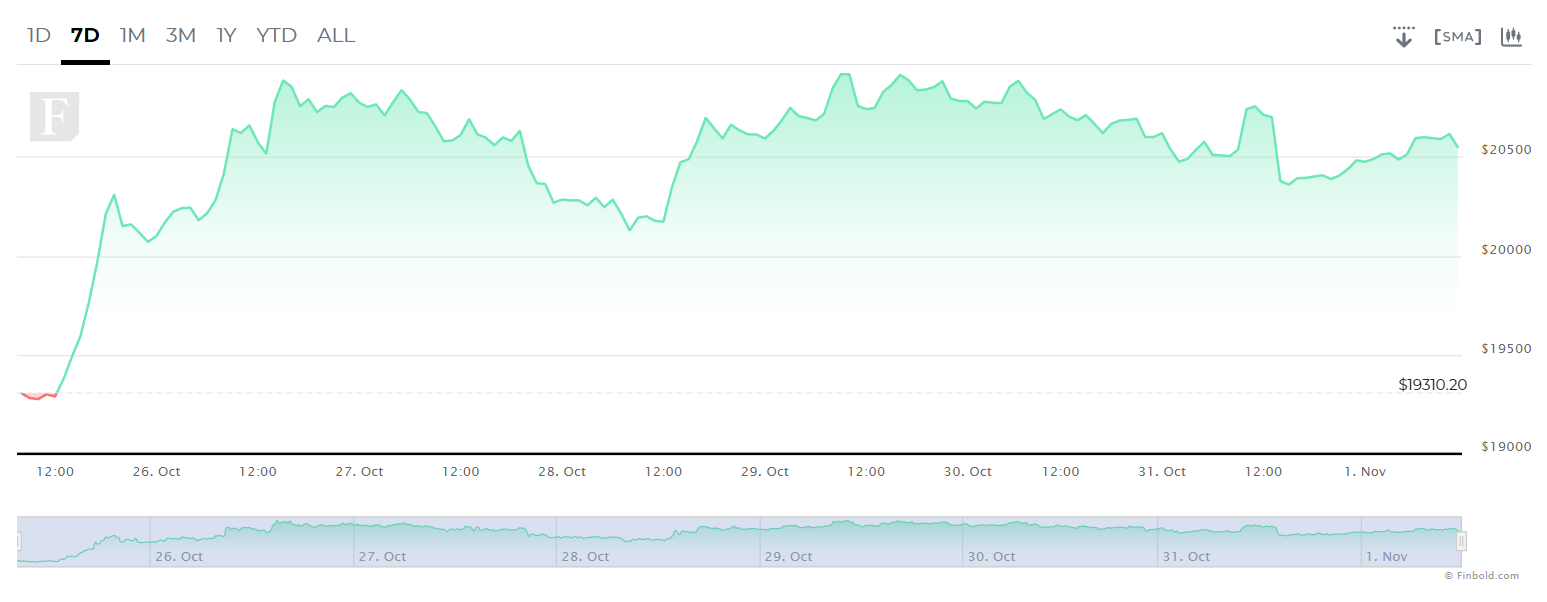

As things stand, the flagship digital asset is changing hands at the price of $20,523, recording a 0.83% drop on the day, but still a 6.34% increase across the week, adding up to the monthly growth of 6.72%.

Presently, Bitcoin’s market capitalization stands at $394.13 billion, retaining its position as the largest cryptocurrency by this indicator, according to data retrieved by Finbold on November 1.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com