It’s no mystery why the Securities and Exchange Commission (SEC) has not approved a spot bitcoin ETF. Since March 2017, the commission has repeatedly explained that it cannot allow non-US exchanges with fake and manipulated trading activity to mislead American investors about the true market for bitcoin.

The SEC has repeatedly yet unsuccessfully asked crypto exchanges to share data in order to verify activity. According to estimates, the amount of fake bitcoin trades far outweigh legitimate ones. Crypto index fund manager Bitwise’s online tool states that 95% of the bitcoin volume reported by crypto exchanges isn’t legitimate.

A different analysis by Forbes puts the figure at 51% ⏤ far lower than Bitwise’s estimate, yet still a shocking projection of manipulation by crypto exchanges. Forbes based its estimate, published in August, on an analysis of trading volume on 157 exchanges.

Making matters worse, even US exchanges seem to falsify trading activity. In June this year, the CFTC filed charges against Tyler and Cameron Winklevoss’ Gemini, accusing the company of lying about market manipulation on its futures platform. The CFTC also alleged that Gemini made misleading statements and omissions in 2017 regarding suspicious trades of bitcoin.

CFTC alleges Gemini cover-up: Execs funded market manipulation

Critics of the SEC’s rejections to a bitcoin spot ETF have accused the agency of being vague and anti-bitcoin. However, communications from the commission tend to be fairly specific about its concerns. By now, there are five exhaustive years’ worth of response letters for ETF applicants to review.

The SEC also hosts office hours and meetings for bitcoin ETF applicants. For example, on March 20, 2019, Lauren Yates from the SEC’s Division of Trading and Markets’ Office of Market Supervision, cited a meeting between the SEC, Bitwise Asset Management, NYSE Arca, and law firm Vedder Price. The meeting included a discussion of NYSE Arca’s proposal to list Bitwise’s Bitcoin ETF Trust.

Yates attached slideshows from a presentation given by Bitwise. According to the presentation, Bitwise planned for its Bitcoin ETF Trust to provide direct exposure to bitcoin through a regulated, insured, third-party custodian. It acknowledged the SEC’s concerns about market manipulation and said it could mitigate them.

95% of exchanges’ self-reported volumes untrustworthy

Bitwise claimed that up to 95% of the trading volume reported to CoinMarketCap regarding bitcoin trades might be fake or non-economic (wash trading is an example of non-economic volume). Crypto exchanges continue to lie today in order to convey liquidity and strength — the actual size of bitcoin and all crypto markets are just a fraction of what exchanges report via their APIs.

Bitwise showed screenshots of trades from what it called a more “real” exchange — Coinbase Pro — while making the point that market manipulation is less likely to occur on US exchanges. Further, that offshore exchanges are likely to have less authentic trading volumes, fewer website visitors, a wider bid/ask spread, and fewer followers on social media.

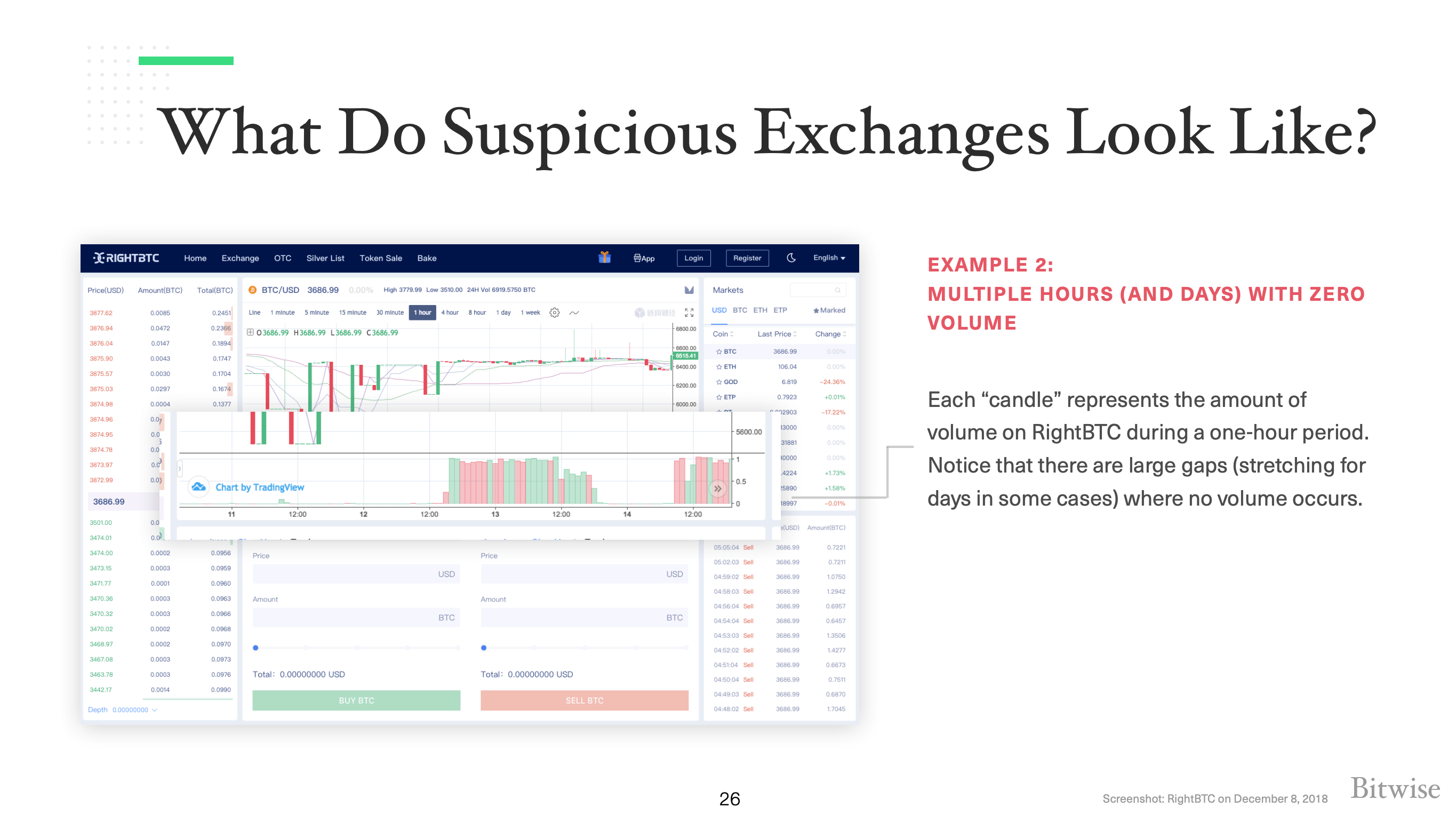

The San Francisco-based index fund manager also stated offshore exchanges are more likely to have long periods with no trading volume and less variation in transactions.

Bitwise accused “fake” exchanges like CoinBene and BitMart of artificially inflating their trading volumes to attract listings for which they could charge high listing fees. At the time, according to Bitwise, they allegedly made considerable money from ICO project teams from listing fees.

For a sense of scale, Bitwise explained that the actual trading volume at the time was likely closer to $273 million than the $6 billion self-reported by exchanges. Only ten of the 81 biggest exchanges reported remotely accurate transaction histories for bitcoin.

- Bitwise presented to the SEC in March 2019.

- Other price index providers for bitcoin follow similar models for calculating a reliable price.

- Indices by Bloomberg, S&P, CF Benchmarks, Brave New Coin, Coindesk, and CryptoCompare exclude all types of self-reported exchange data when calculating bitcoin’s price.

Litany of SEC rejections for spot bitcoin ETFs

Bitwise’s presentation did little to reassure the SEC. In June 2022, the SEC rejected Grayscale’s proposed Bitcoin ETF. It said Grayscale failed to address its concerns about market manipulation. Grayscale quickly filed a lawsuit alleging that the SEC improperly rejected its proposal to transform its GBTC product into an ETF.

In January 2022, the SEC rejected SkyBridge’s Bitcoin ETF for similar reasons. It said SkyBridge failed to establish that it would “prevent fraudulent and manipulative acts and practices.”

The SEC wants even more information about funds’ crypto exposure

Read more: Gary Gensler still backing the SEC to be the best crypto regulator

In November 2021, the commission also denied VanEck’s spot bitcoin ETF application. “The SEC’s decision to deny the application for the VanEck Bitcoin ETF is not a surprise, given comments by SEC Chair Gary Gensler in recent months,” DailyFX senior strategist Christopher Vecchio told TheStreet.

Gensler previously implied that the SEC intends to take its time with spot crypto ETFs until Congress provides more clarity about which regulatory agency is responsible for policing matters related to digital assets.

Other crypto markets awash in wash trading

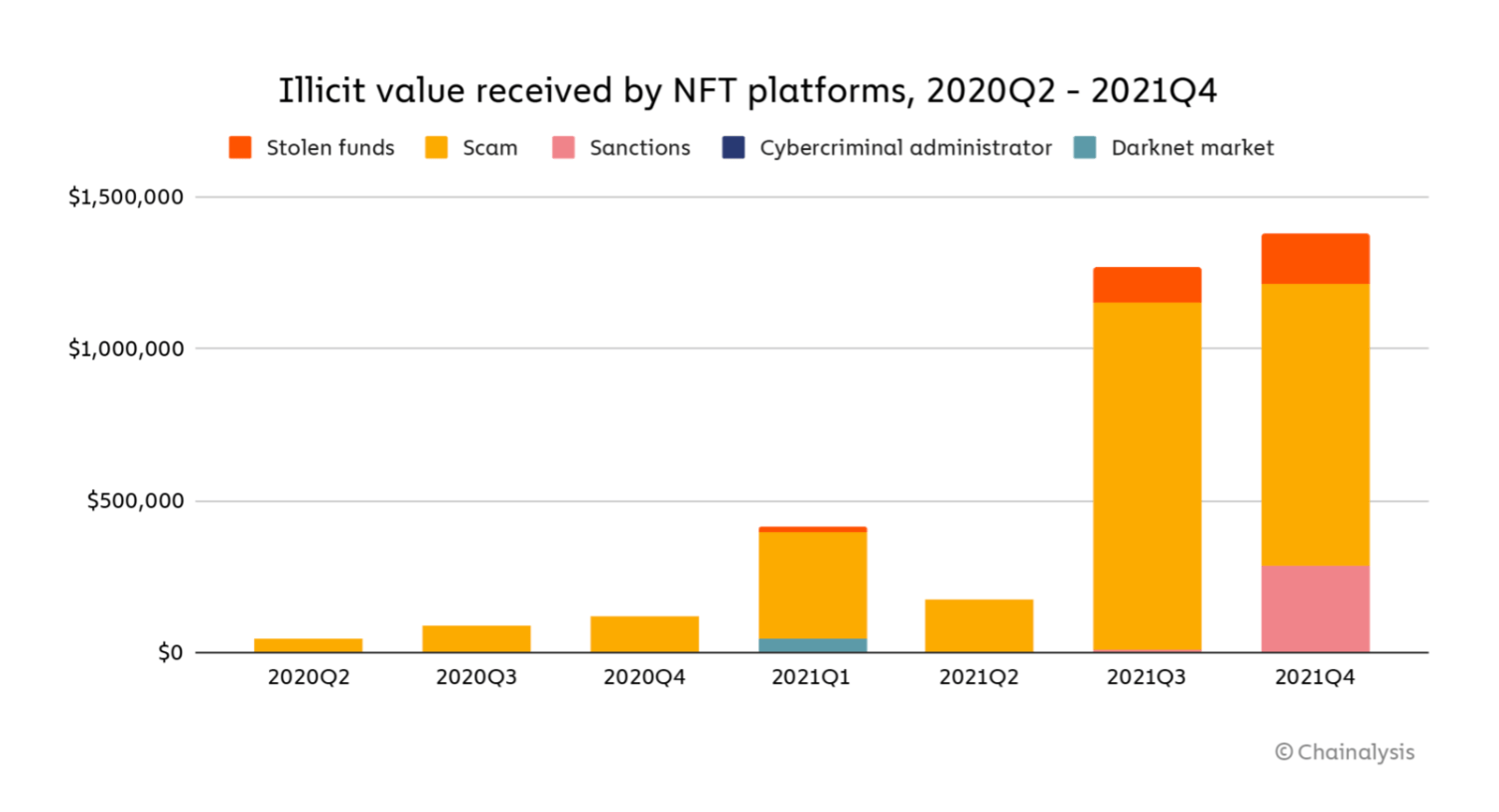

In 2022, wash trading gained attention through analysis of NFT markets. Bloomberg wrote in April that since launch, 95% of traders on popular NFT marketplace LooksRare were selling NFTs to themselves. The outlet noted that the wash trading on LooksRare helped the marketplace to mask an overall decline in demand for NFTs.

Chainalysis backed that up with a report indicating that the NFT market included a lot of wash trading and even a small amount of money laundering. Chainalysis’ February 2022 report on dishonest activity in the NFT space indicates that wash trades generated millions in profits for the self-dealers.

So, with no end in sight to wash trading, fake volume reports, and market manipulation, is there any hope for a spot bitcoin ETF? Eventually, in the distant future, the SEC might approve the ETF. It’s previously given bitcoin investors a glimmer of hope: commissioners approved futures-based ETFs by ProShares and Valkyrie — which started trading on NYSE Arca and NASDAQ, respectively — in October 2021.

However, the commission continues to demonstrate reluctance in approving spot bitcoin ETFs or other, complicated ETFs, such as products that provide leveraged or short exposure to bitcoin’s price.

For more informed news, follow us on Twitter and Google News or listen to our investigative podcast Innovated: Blockchain City.

protos.com

protos.com