The past few days have been quite challenging for the entire cryptocurrency, market, and Bitcoin is no exception, standing above $18K. The next few days can be deciding for the mid-term future of the entire market as a break below this level could extend the bear market considerably.

Technical Analysis

By: Edris

The Daily Chart

On the Daily chart, the price failed to break the significant bearish trendline last week. The 50-day and 100-day moving average lines located near the $22K level also played their part in pushing the price to the downside.

Currently, the market is testing the $18K support area for the third time. However, considering the overwhelming bearish momentum, a break below this significant level is likely.

In this case, Bitcoin would record a new lower low in the current bear market, and the price could drop towards the $15K area and potentially further downward in the short-term. The crash would also further prolong the duration of the bear market and bring it close to a full year.

The 4-Hour Chart

Looking at the 4-hour timeframe, the price has rapidly dropped from the $22,500 resistance and has descended below the $20K support level. After a few days of consolidation, the price dropped once more towards the $18K support, after failing to break above that vital $20K mark.

The bulls are currently making their last stand at $18K, as a breakdown of this level would cause another round of capitulation and a deeper crash.

However, it’s important to note that turning the market to the upside may not be an easy task, as both the price action and the RSI indicator demonstrate a clear bearish momentum.

Onchain Analysis

By Shayan

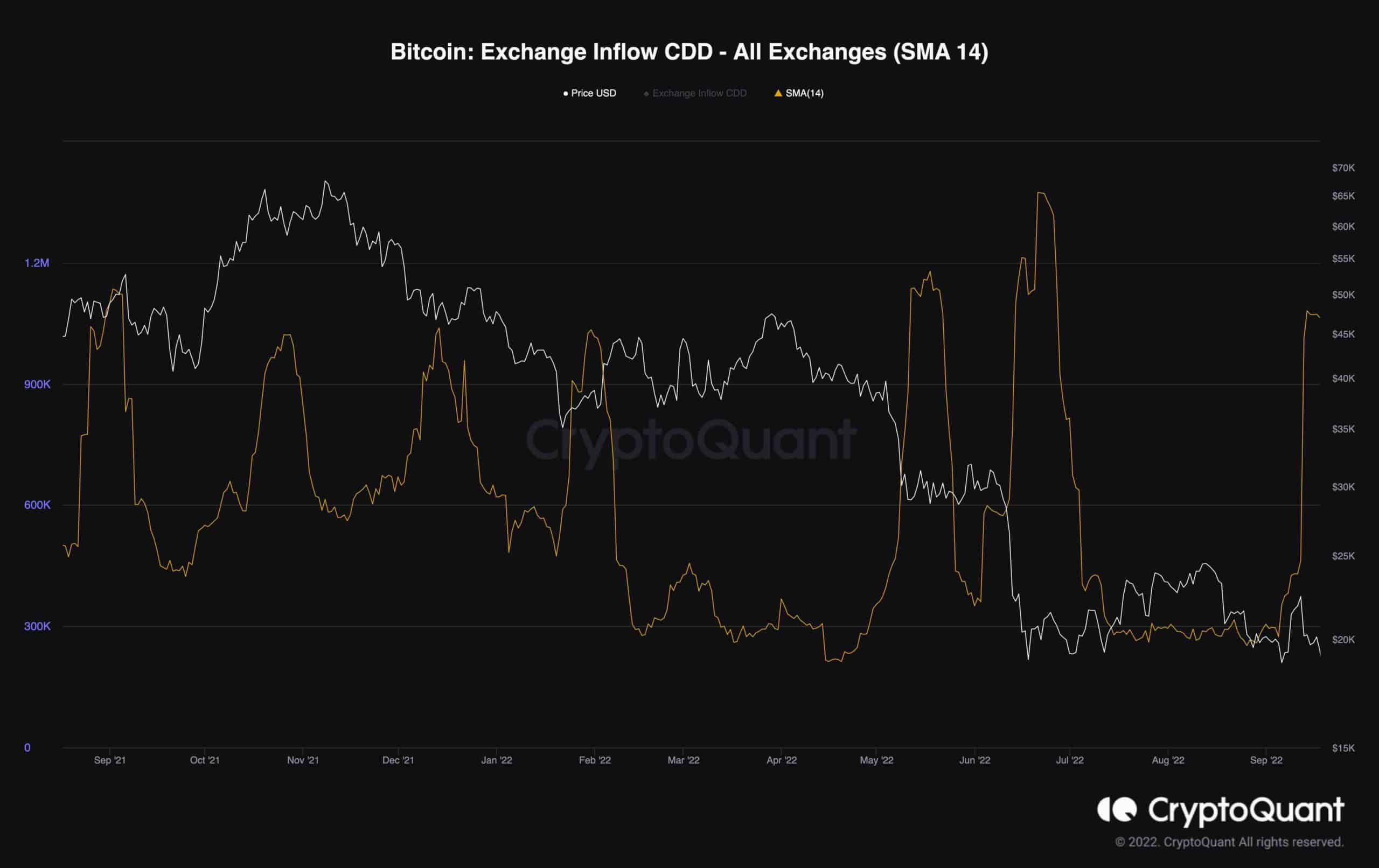

Long-term holders are a crucial cohort among market players, and following their behavior might help determine the market’s direction. Historically, whenever long-term holders sent a considerable amount of Bitcoin to the exchanges, the market experienced a plunge.

The Exchange Inflow CDD is a valuable metric to track their behavior. High values indicate that more long-term holders moved their coins for potential selling.

The metric(14-day moving average) has recently spiked, indicating possible selling pressure coming from the long-term holders. Hence, a downward rally to the $16K level might be the most probable scenario for Bitcoin in the short-term view.

cryptopotato.com

cryptopotato.com