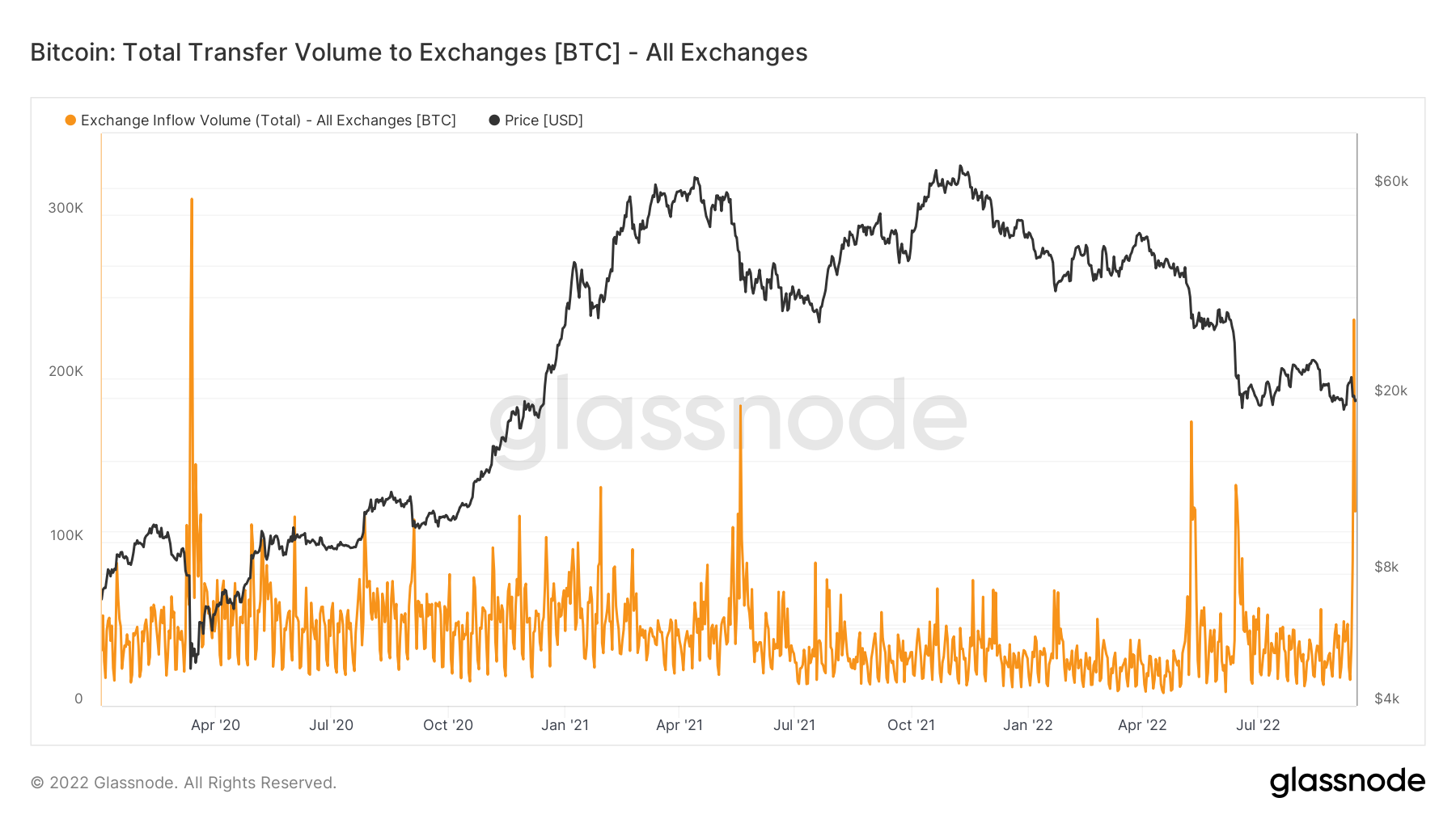

236,000 BTC entered trading platforms in one day amid what one of the market commentators called ‘unusual’ exchange flows. Bitcoin (BTC) exchanges have recorded massive volumes in September as price drops result in renewed interest in trading.

Data acquired from sources including on-chain analytics company Glassnode indicates that exchange inflows hit their highest since March 2021.

Volatility Seems To Be Imminent

On September 14, more than 236,000 BTC made their way to the major exchanges tracked by Glassnode. That was the biggest one-day spike since the chaos seen during Bitcoin’s drop to around $3,600 in March 2021.

The sell-offs in May 2021 and May and June this year failed to match the tally, indicating that more of the Bitcoin investor base is now aiming to reduce exposure. Separate data from analytics company Santiment covering both centralized and decentralized exchanges pushed the total inflow figure for the week through September 13 to 1.69 million Bitcoin.

The company added in Twitter comments:

“This was the highest amount of $BTC moved since October 2021.”

As Bitcoin plunged to reach around $19,600 this week, in the meantime, some ‘unusual’ signals were arising from interactions with exchanges from larger and smaller hodlers, based on commentator David P. Ellis.

Orcas vomited 11.8K coins but Minnows returned by the tens of thousands, presumably because alts are beginning to crumble. Exchange flows were tame today for the first day in three, but volume was still well above average. The scent of volatility is in the air.

Go #BTC 🚀. pic.twitter.com/ltSWkrb2QK

— David P. Ellis (@DavidPBitcoin) September 16, 2022

The action follows the curious movement of long-dormant coins at the beginning of September, an event initially attributed to the already defunct exchange Mt. Gox.

Miners Slow Bitcoin Sales

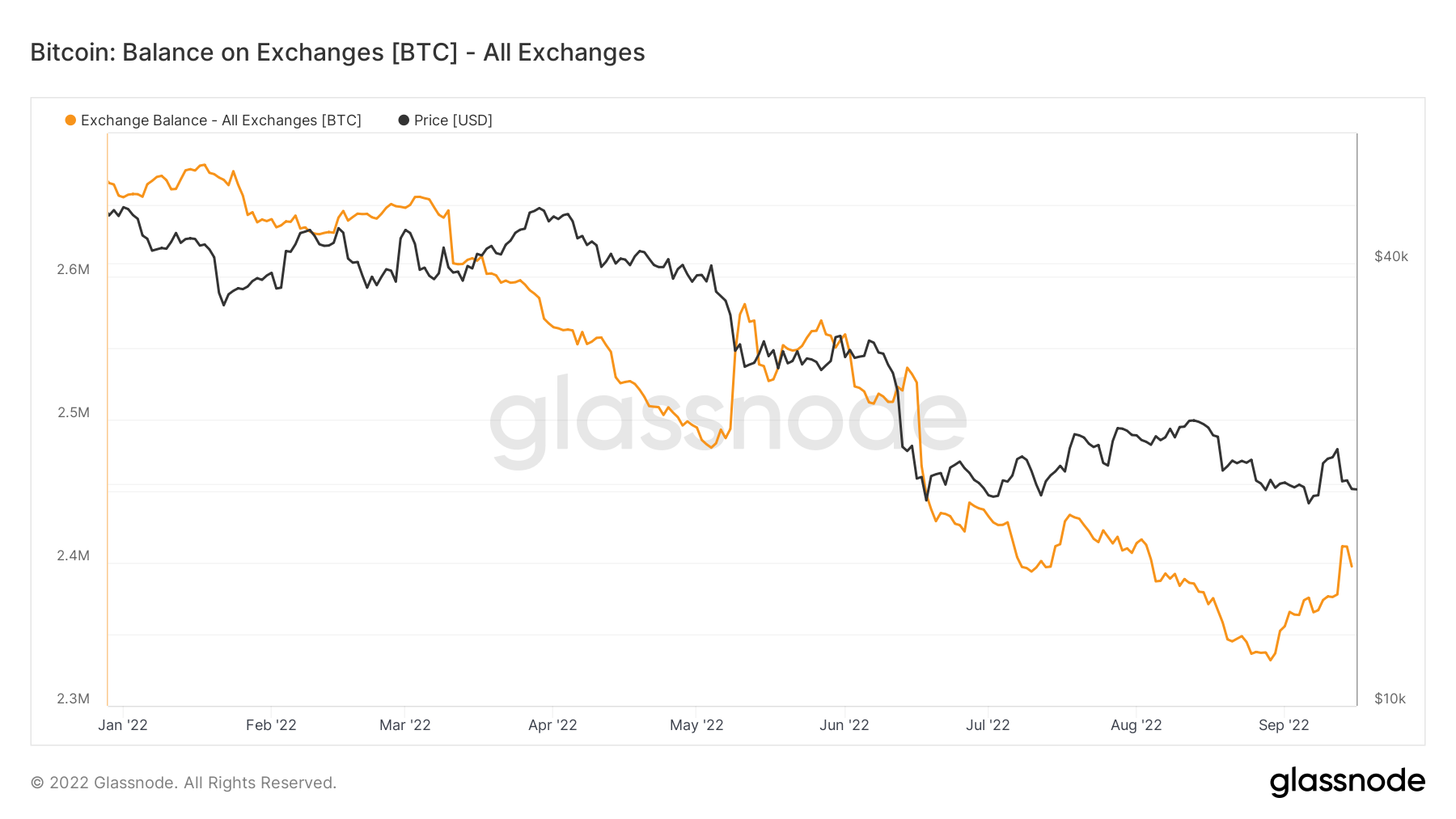

Returning to trading platforms themselves, Glassnode indicates that exchange balances have increased by about 80,000 BTC since the end of August.

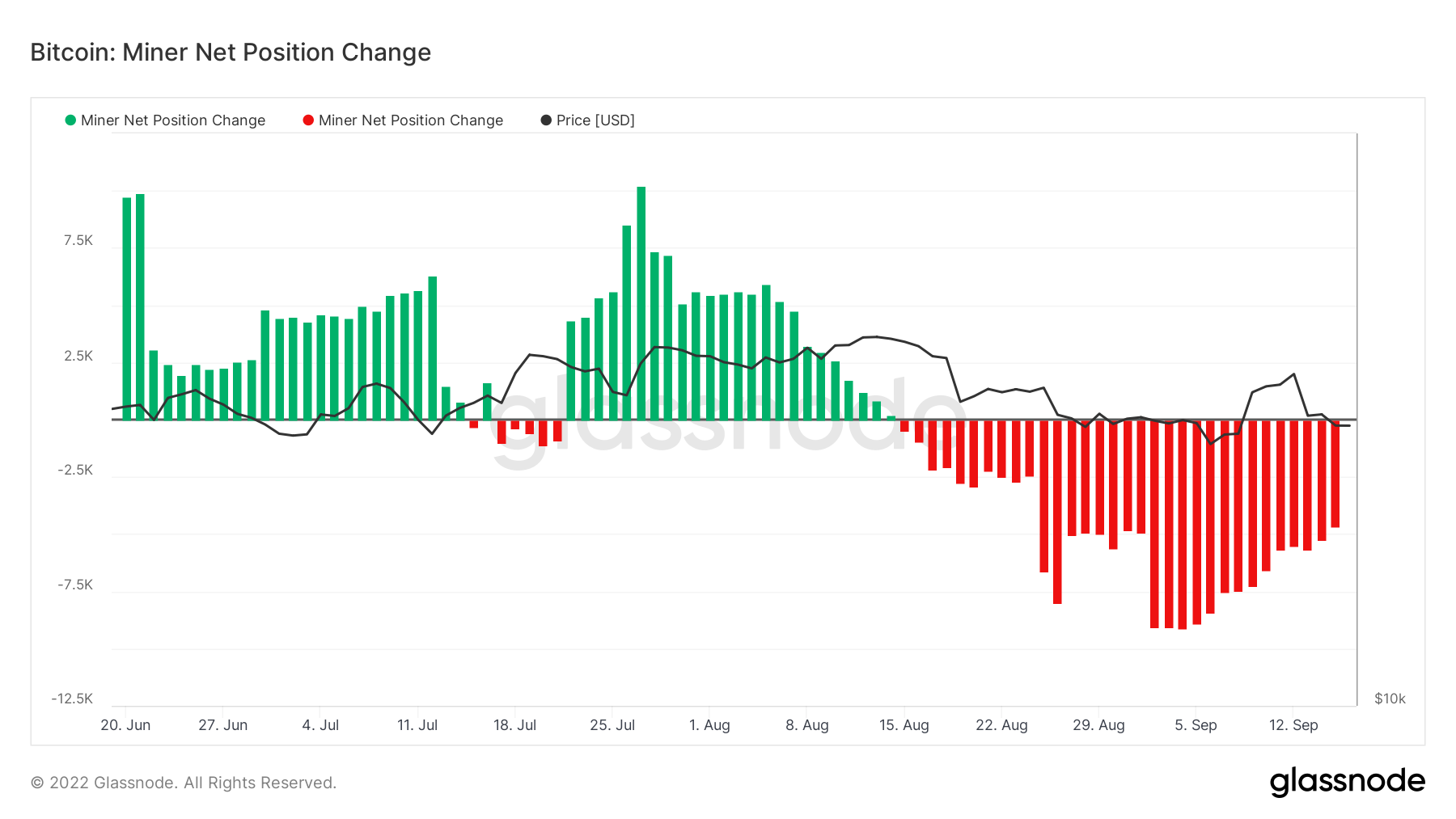

Miners, which in August completed a ‘capitulation’ period in a normally bullish sign for the market, have also continued to sell holdings mostly in recent weeks.

However, this trend is toward miners returning to net holding Bitcoin that they earn.

cryptovibes.com

cryptovibes.com