Solana price analysis for today shows the prices have entered a bullish trend for the past 24 hours. The prices have been trading above the $50.21 support level and are currently facing resistance at $53.3. The prices had dipped to lows of $46.0 yesterday before the market corrected its high. The market is currently trading in a bullish trend with prices expected to continue rising to new highs. The prices opened the daily trading session trading low at $49.0 before the market corrected to highs of $52.2.

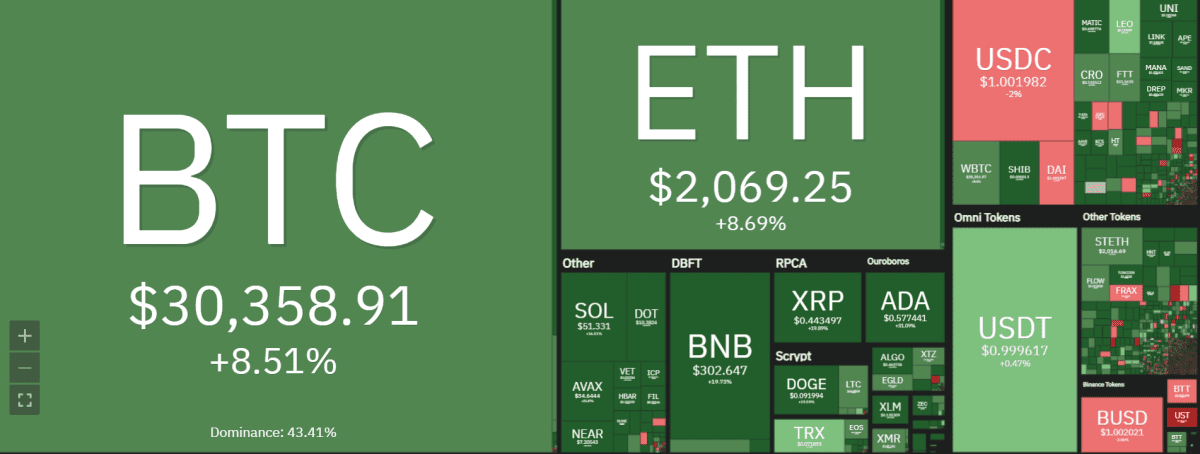

The market is expected to continue its bullish trend in the near term with prices expected to retrace to their previous highs of above $100 level. The digital asset is ranking in position 9 with a 24-hour trading volume of $3,363,532,69. The market cap for SOL is $25.6 billion as it dominates 1.31 percent of the cryptocurrency market.

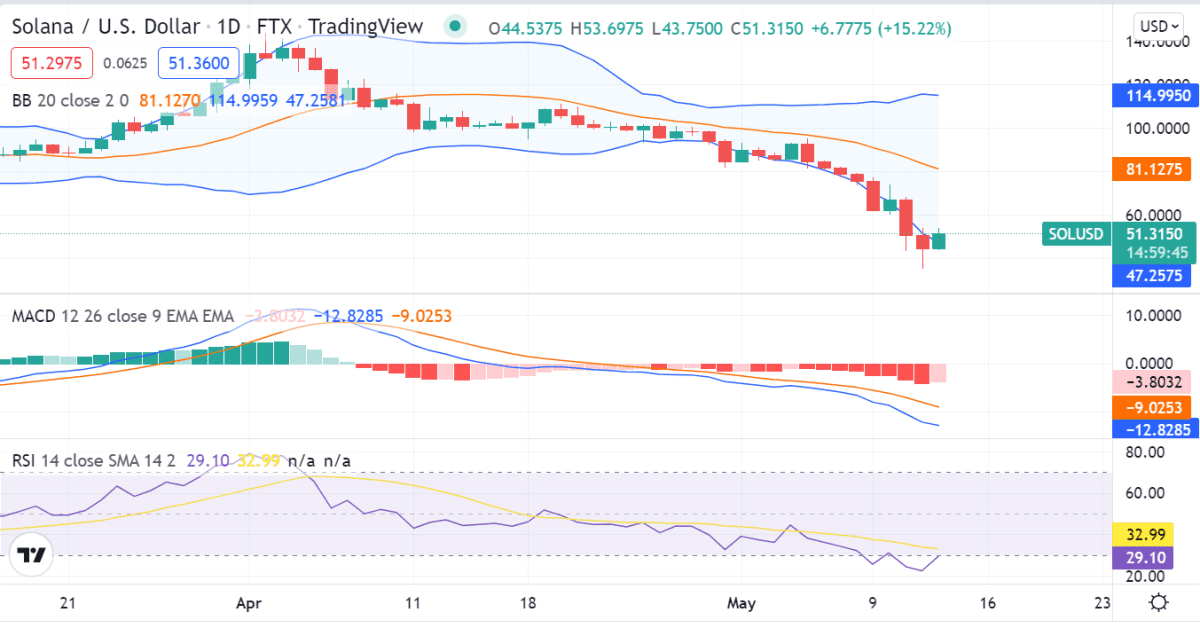

Solana price action on a 1-day price chart: Bulls continue to push prices higher as altcoin hits $50.21

As seen on the 1-day price chart, Solana (SOL) has been on an uptrend in recent hours. The market looks to have found a new level of support at $50.21 as it currently trades around this price point. The next level of resistance is located at $53.3, which if breached, could see prices continue their run towards the $100 price level. The RSI indicator is currently trading in the overbought region, which could see a price pullback in the near term. However, the MACD indicator is still in bullish territory, which suggests that the market still has some upside potential.

Solana price analysis on the daily timeframe indicates the prices are trading in an ascending triangle pattern. On the daily timeframe, Solana prices are trading in an ascending triangle pattern. This is a bullish continuation pattern that typically signals further upside potential in the market. The Parabolic SAR indicator is currently in bullish territory, which also suggests that the market has further upside potential and an increase in the market volatility is indicated by the bulging Bollinger bands.

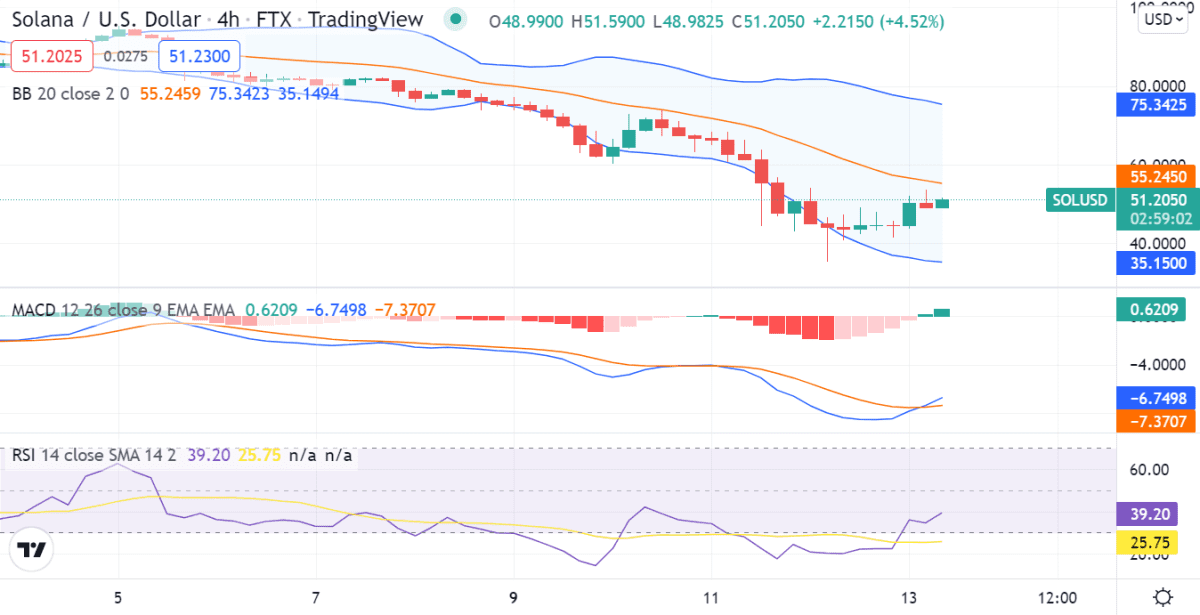

Solana price analysis on a 4-hour price chart: Prices continue to push higher as the market looks to test the $53.3 resistance

Solana price analysis on the 4-hour timeframe shows that the prices are currently trading inside an ascending channel. On the 4-hour timeframe, Solana prices are trading in an ascending channel. This is a bullish continuation pattern that typically signals further upside potential in the market. The Stochastic RSI indicator is currently in overbought territory, which could see a price pullback in the near term. However, the MACD indicator is still in bullish territory, which suggests that the market still has some upside potential.

The market looks to be testing the $53.3 resistance level and a breakout above this level could see prices continue their run towards the $100 price level. The RSI indicator is currently in the overbought region, which could see a price pullback in the near term. Moreover, the MACD line is currently below the signal line, which suggests that the market has further upside potential. The Bollinger bands are currently bulging, which indicates an increase in market volatility.

Solana price analysis conclusion

In conclusion, Solana price analysis indicates the market sentiment has shifted to the bullish zone as the market looks to make a run towards the $100 price level. The market is recovering from the recent market crash seen this week and is expected to continue its upward trend in the near term. The prices will need to stabilize above the $53.3 resistance level to confirm the breakout and continue its run towards the $100 price level.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com