- ATOM price is resting near its 2022 lows and a major Fibonacci support level.

- Another 30% drop is likely if $18 fails to hold as support.

- In conjunction with time cycles, extreme oversold conditions indicate a bullish reversal may begin.

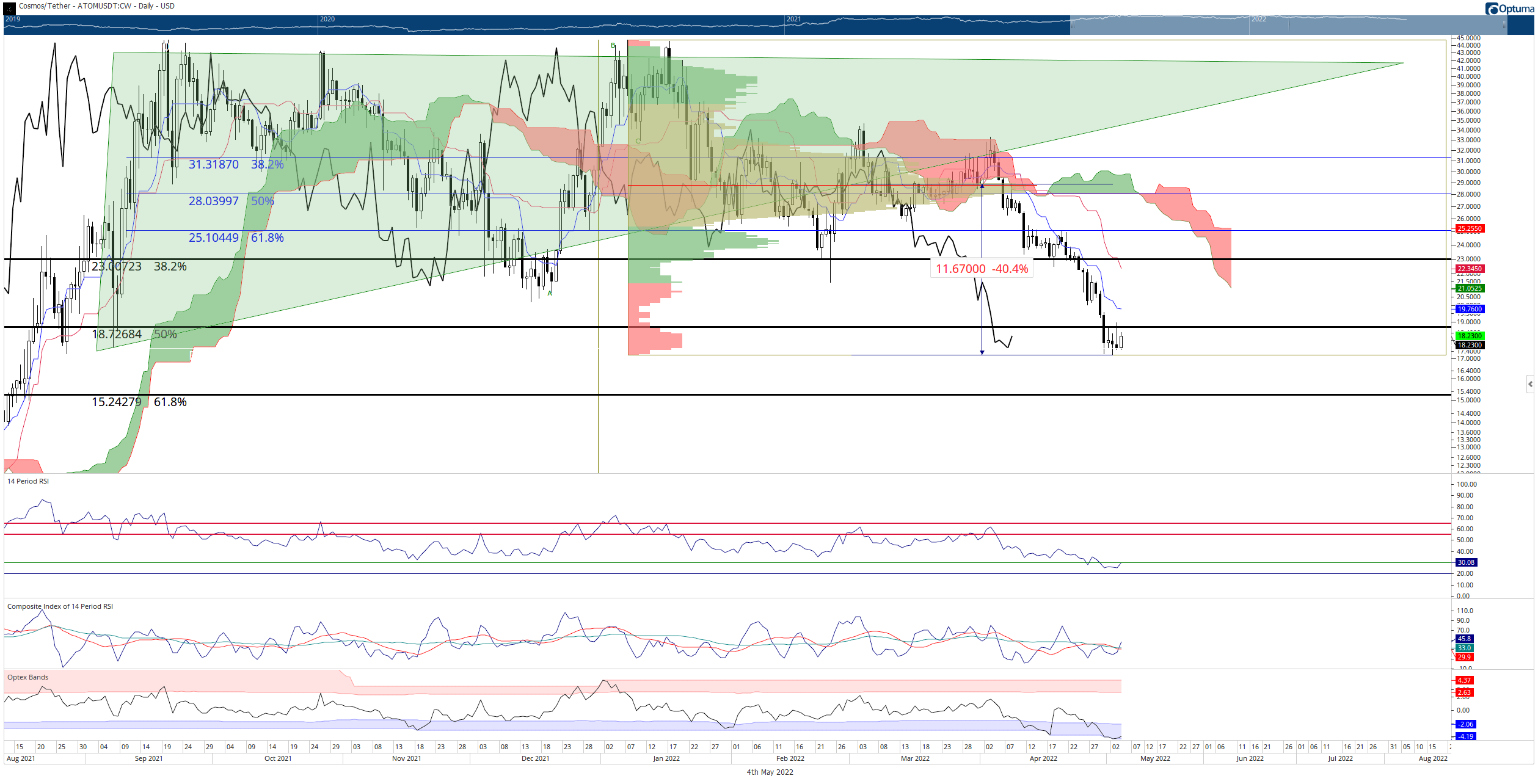

ATOM price action has faced the same selling pressure seen across all risk-on instruments. Cosmos lost nearly 40% of its value from the beginning of April to the close of April, and that trend may continue. But extremes in the oscillators may hint at some reprieve coming soon.

ATOM price may surprise with a major, albeit temporary rally

ATOM price and the broader cryptocurrency market have experienced some relief from the constant selling pressure. The relief rally before the US Federal Reserves meeting is not a surprise, but neither is the bounce itself.

ATOM/USDT Daily Ichimoku Kinkon Hyo Chart

The oscillators on the daily chart show clear signs that a bottom may be in. For example, the Relative Strength Index hit lows not seen since the Covid Crash in March 2020 - indicating extreme oversold conditions. Likewise, the Composite Index shows even more extreme oversold conditions after hitting new all-time lows.

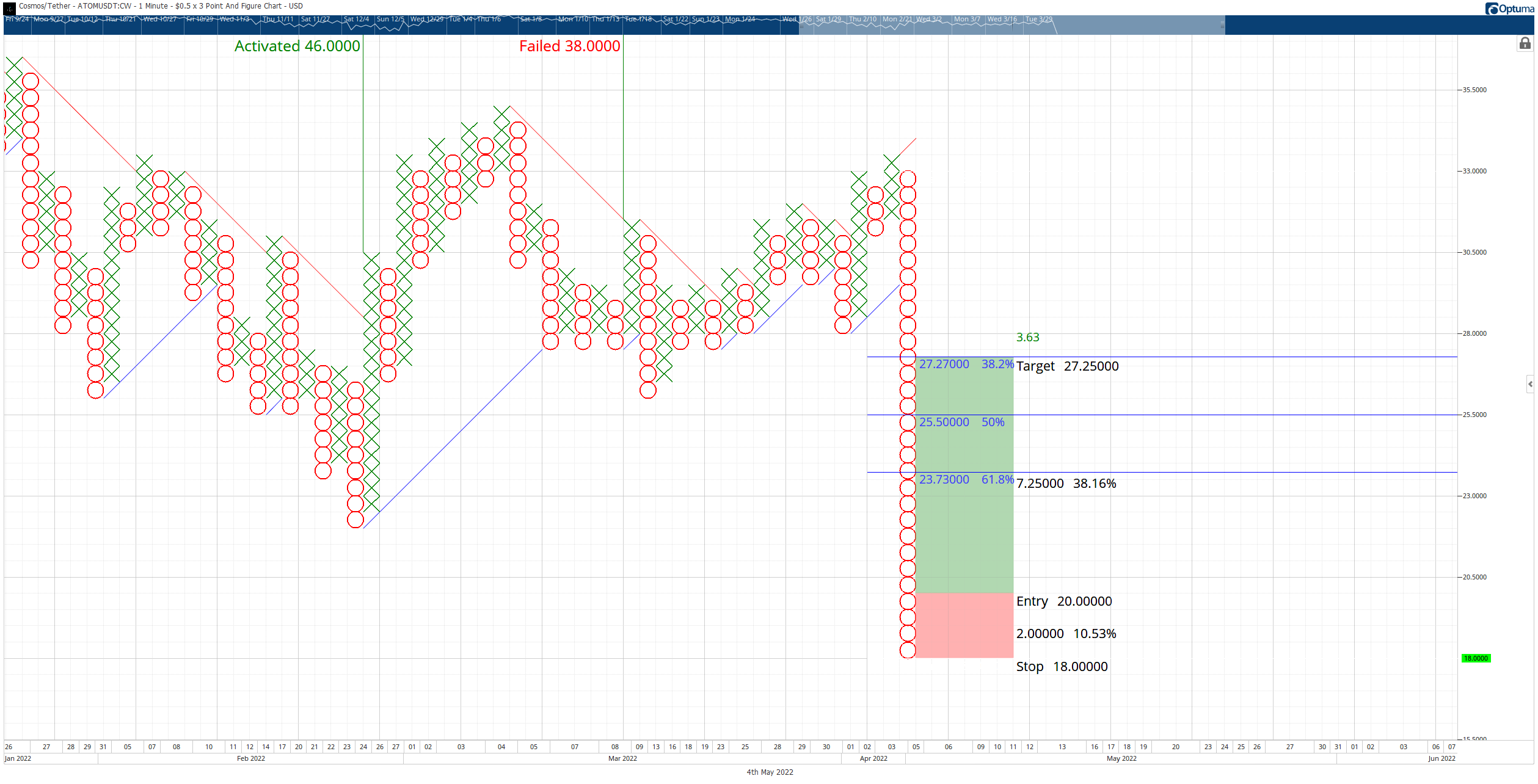

From a bullish perspective, there is a theoretical long opportunity for ATOM price on the $0.50/3-box Reversal Point and Figure chart. The long idea is a buy stop order at $20, a stop loss at $18, and a profit target at $27.25.

ATOM/USDT $0.50/3-box Reversal Point and Figure Chart

The theoretical buy opportunity is based on a pattern in Point and Figure analysis known as a Spike Pattern. The entry from the Spike Pattern is the 3-box reversal and, as such, has no invalidation point. As ATOM price moves lower, the entry moves lower as well.

However, downside risks remain substantial. There is a significant gap in the 2021 Volume Profile between the high volume nodes at $18 and $13. Any sustained period spent below the $18 value area increases the likelihood of a swift sell-off towards $13.

fxstreet.com

fxstreet.com