The Goatseus Maximus (GOAT) price has increased 53.56% in the last 24 hours and 153.74% over the last seven days. The strong trend momentum, indicated by both ADX and RSI readings, suggests that GOAT could soon challenge its previous all-time high if buying interest continues.

However, a potential trend reversal could lead to significant downside risks, with key support levels much lower than current prices. This setup highlights both the opportunities and risks that traders should consider in the coming days.

GOAT Current Trend Is Still Strong

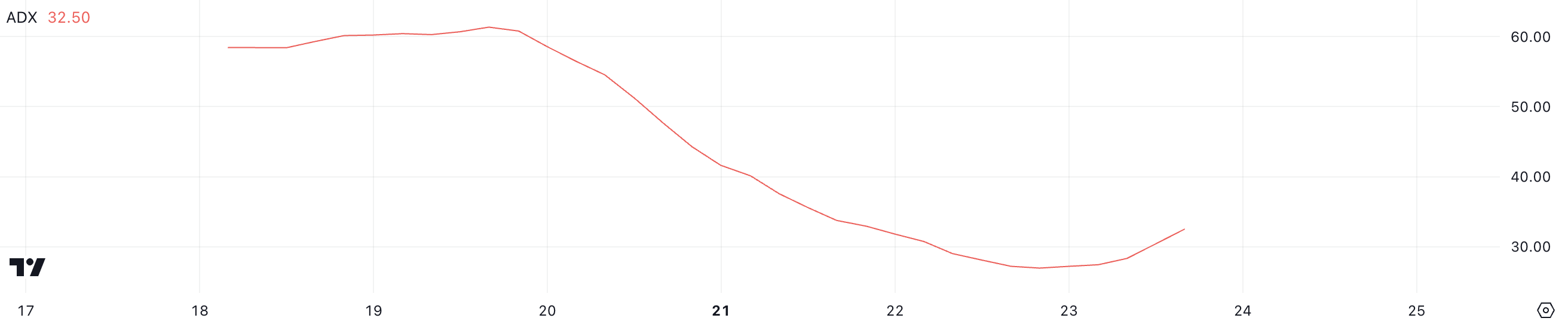

The GOAT ADX (Average Directional Index) is currently at 32.50, indicating that the ongoing trend remains strong. ADX is a technical indicator used to measure the strength of a trend, whether bullish or bearish, and it ranges from 0 to 100.

An ADX value below 20 suggests a weak or nonexistent trend, while values above 25 indicate a strong trend. With GOAT’s ADX at 32.50, the trend still has notable strength, showing that market participants are pushing in one direction with considerable momentum.

Although the ADX has dropped from over 60 just three days ago, it remains at a solid level above 30, which means that the current trend is still strong. This suggests that despite the recent decrease in trend strength, the market could continue moving in the direction of the trend.

That would potentially lead GOAT price to achieve new all-time highs in the coming days. With the trend strength still significant, a continuation of the bullish momentum could see GOAT price make another push upwards.

Read More: 11 Top Solana Meme Coins to Watch in October 2024

GOAT RSI Is not Overbought Anymore

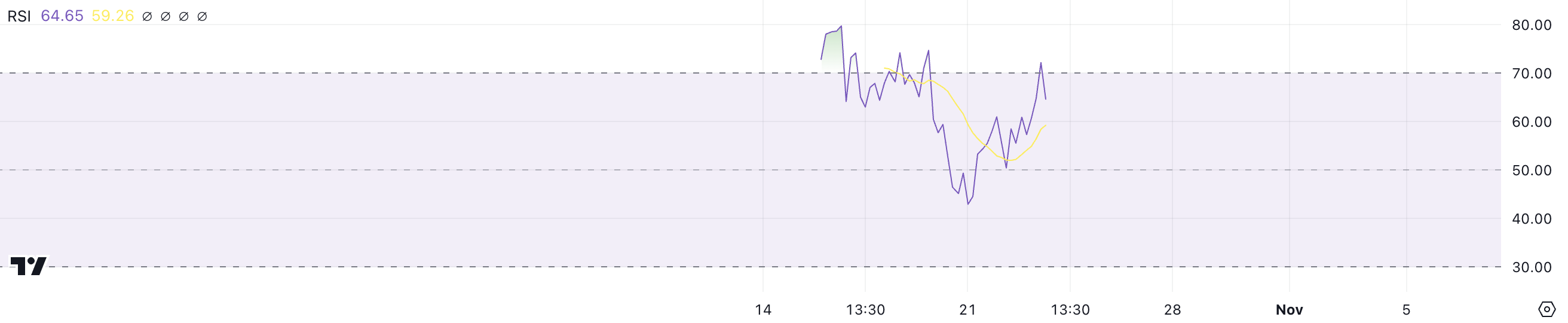

The GOAT RSI (Relative Strength Index) is currently at 64.65, having declined from above 70 on the last day. This means that while GOAT recently experienced strong buying pressure, the momentum has slightly eased, bringing it out of the overbought territory.

RSI is a momentum indicator used to evaluate whether an asset is overbought or oversold. It ranges from 0 to 100. Typically, an RSI above 70 signals overbought conditions, suggesting a possible correction. On the other hand, an RSI below 30 indicates an oversold condition, pointing towards a potential buying opportunity.

With the current RSI at 64.65, GOAT is no longer overbought, which implies that there is still room for further upward movement. The decrease in RSI without dipping into oversold territory indicates that the market is cooling down without a complete loss of bullish sentiment.

This suggests that the recent gains have not entirely exhausted buyer interest, and GOAT could still have the potential for growth if renewed buying pressure emerges.

GOAT Price Prediction: A New All-Time High Soon?

Given the current levels of ADX and RSI, GOAT could soon retest its previous all-time high of $0.779, indicating a potential growth of 23.8%. The strong ADX reading suggests that the current trend still has momentum. Also, according to the RSI, which is no longer overbought, implies there is room for further gains.

Together, these factors create a favorable setup for GOAT to challenge its previous peak as long as market sentiment remains supportive. This could lead GOAT on its path to becoming one of the most relevant meme coins in the Solana ecosystem.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

However, if the trend reverses, there is a significant downside risk, with the next major support level sitting at $0.17. This represents a potential price correction of 73%, which could occur if bearish momentum takes hold.

The wide gap between the current price and support highlights the importance of sustaining the ongoing bullish trend. If that doesn’t happen, GOAT could face a steep decline if selling pressure increases.

beincrypto.com

beincrypto.com