ENA, the native token of Ethena— an Ethereum-based synthetic dollar protocol — has experienced an impressive 45% surge over the past week. Currently trading at $0.38, ENA has reached its highest price level since July.

With increasing bullish momentum, the altcoin is positioned for a potential 150% increase. However, the pressing question remains: when will this occur?

Ethena’s Uptrend is Strong

At its current price, Ethena is above its 20-day exponential moving average (EMA) and its 50-day simple moving average (SMA). The token’s 20-day EMA measures its average closing price over the past 20 days, while its 50-day SMA tracks its average price over the past 50 trading days. Trading above these key moving averages suggests that ENA is in a bullish trend.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

When an asset’s price is above the 20-day EMA, it indicates short-term strength and suggests significant recent buying activity. Being above the 50-day SMA confirms a longer-term bullish trend. This indicates that the asset has maintained upward momentum over a more extended period, which can attract more investors and traders.

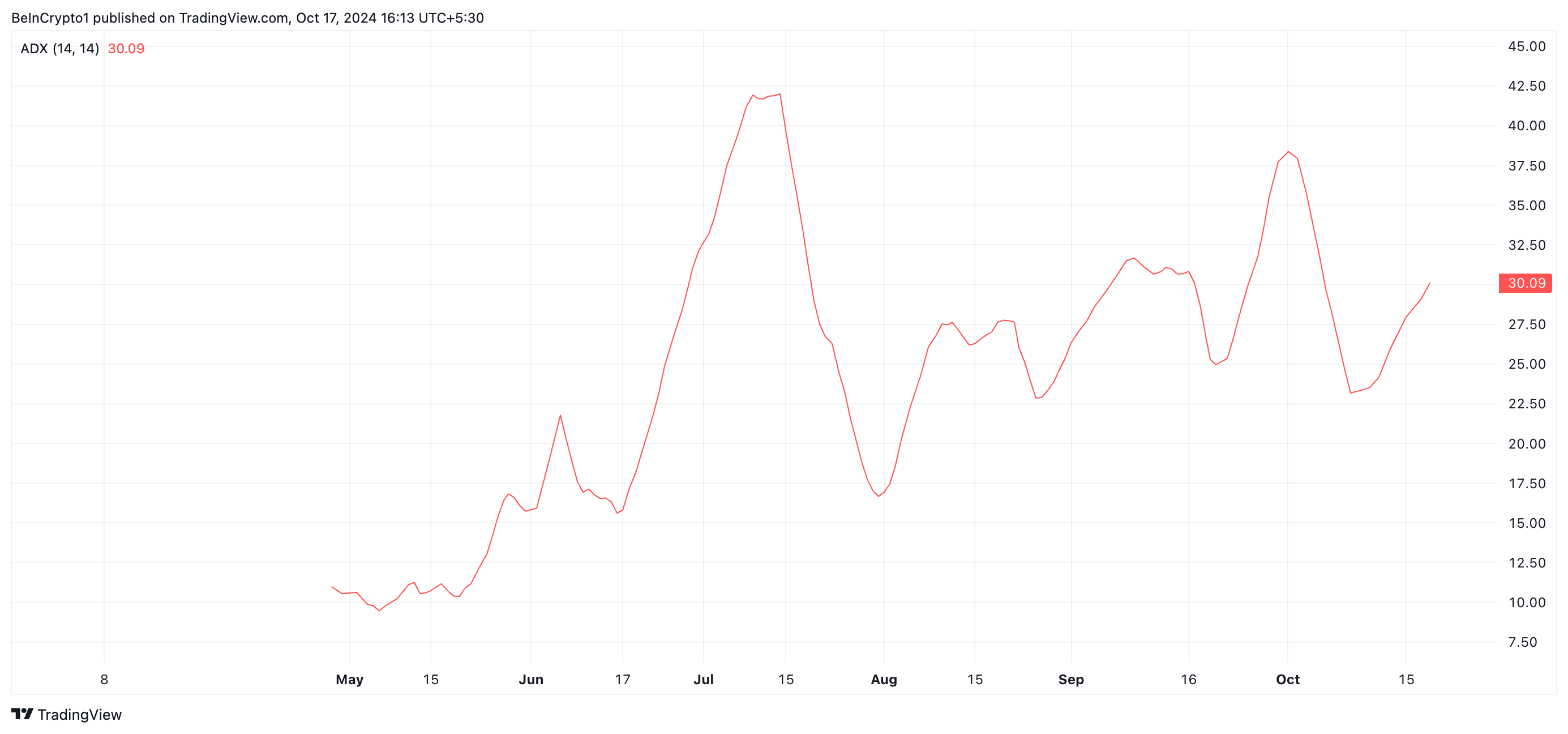

Moreover, ENA’s current Average Directional Index (ADX) is 30.09, confirming the strength of the market uptrend. This indicator measures the strength of a trend.

It ranges between 0 and 100, with values above 25 indicating a strong trend, while values under 20 suggest a weak trend. With an ADX reading of 30.09 and rising, ENA’s price rally is strong and could be sustained as long as demand remains.

ENA Price Prediction: Profit-Taking Could Lead to All-Time Low

ENA is currently trading at $0.38, which is shy of the resistance level of $0.48. A successful breach of this level could propel the altcoin toward $1.01, representing a potential surge of 152% from its current price.

Read more: How To Use Ethena Finance To Stake USDe

However, if profit-taking begins, ENA’s price may struggle to hold above its 20-day EMA and 50-day SMA, potentially flipping these levels into resistance levels. Should the bulls fail to defend these key levels, ENA could tumble toward its all-time low of $0.19, last seen on September 6.

beincrypto.com

beincrypto.com