Worldcoin (WLD) price has defied the bearish trend and surged over 20% this week. Notably, WLD crypto is now trying to push the price above the $2 mark for a significant breakthrough.

However, the WLD price stayed capped in range for over two months. It was still attempting to close convincingly above the $2 mark.

Last week, bulls failed to volatile the 100-day EMA mark and a 10% rejection was noted. Meanwhile, the WLD token has bottomed out and is poised for a recovery.

A daily close above the $2.20 mark would permit the bulls to outperform in the upcoming sessions. As the WLD token climbed above the 20-day EMA mark, its buying pressure began to gain momentum.

WLD Bulls Fight For Dominance: Price Action Analysis

At press time, WLD price was trading at $1.88. It marked a 1.20% surge over the past 24 hours and a 20% surge over the last seven days.

The daily chart showed that Worldcoin’s price movement aligned with a potential breakthrough in its 20-day EMA. In contrast, it also appears set to test its 100-day EMA level.

WLD Price by TheCoinRepublic on TradingView.com

This indicated a shift in the short-term bullish momentum. Additionally, a recovery could be seen in the subsequent sessions.

Crypto Analyst @CryptoTony, in his post, said that the $1.85 mark crossover would fuel further gains ahead.

$WLD / $USD – Update

— Crypto Tony (@CryptoTony__) October 5, 2024

$1.85 reclaim and we are good for a reclaim pic.twitter.com/m9Tj6azzRo

Likewise, @CryptoJack, in his post, said that WLD crypto bounced from the support zone and could retest the $3 resistance level soon.

The price of $WLD is bouncing from support!#Worldcoin should retest the $3 resistance very soon. pic.twitter.com/qwqs7JVo1v

— CryptoJack (@cryptojack) October 5, 2024

Per the Fib levels, the WLD price recently surpassed its 38.2% zone above the $1.60 mark. The 50% hurdle was around the $2.20 level; a significant bullish trend can be seen above it.

WLD Price Prediction: Bearish Divergence Emerges

Despite the bullish recovery of WLD crypto this week, the MACD indicator plotted red histogram readings. This conveyed a negative outlook.

However, the RSI line rests above the midline region, 56 at press time, representing neutral cues. In addition, the Chaikin Money Flow (CMF) reading was above zero, 0.08, at press time. It reflected significant liquidity entering the market.

What Do On-Chain Metrics Data Say?

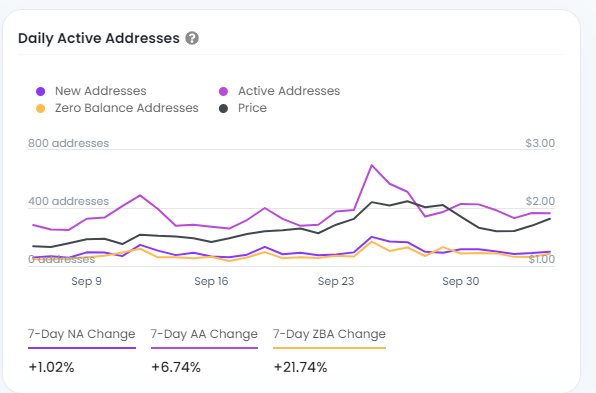

Over the last seven days, WLD token’s new addresses noted a +1.02% change. At the same time, the active addresses rose over 6.74%. Amidst this, the buyers anticipated a short-term price rise and began accumulating.

Source: IntoTheBlock

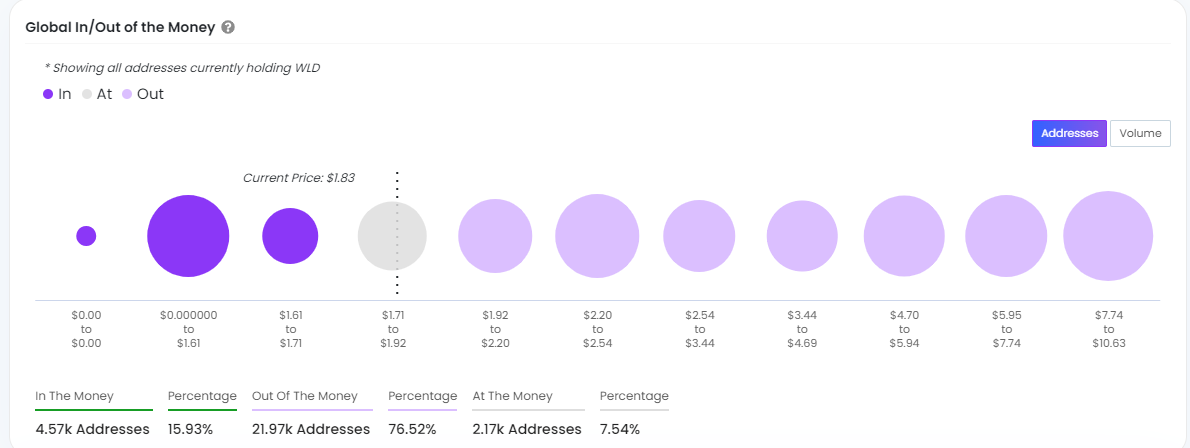

Data from IntoTheBlock indicated that 15.93% of in-the-money holders are making money at the current price levels. On the other hand, more than 80% of holders were looking into trouble and trying to secure their gains.

Source: IntoTheBlock

Furthermore, the Open Interest (OI) surged over 5.89% to $197.17 Million, signifying prolonged buildup activity over the past 24 hours. This holder’s data indicated that WLD could trigger a short-term bounce to cover the gains near the $2 breakeven price.

If the WLD price faces rejection from the $2 mark, its value could drop to $1.50. On the other hand, if liquidity inflows and demand surges, its price might rise above $2. The $2.40 mark would follow this in the coming sessions.

thecoinrepublic.com

thecoinrepublic.com