Solana declines with the rest of the crypto market but looks to leverage a surge in on-chain activity for a rally to late July highs.

Solana (SOL) recently experienced a 9% decline over the past two days after reaching a seven-week peak of $161.80 on Sept. 29. This drop came on the back of a broader crypto market downturn, which saw the altcoin market cap fall from $800 billion to $739 billion.

However, with strong on-chain activity data and positive market sentiment, Solana could be poised for a rally toward its next pivotal resistance level of $186.

Rising On-Chain Activity Amid Correction

Despite the price dip, the Solana ecosystem is witnessing a surge in on-chain activity across various decentralized finance (DeFi) protocols.

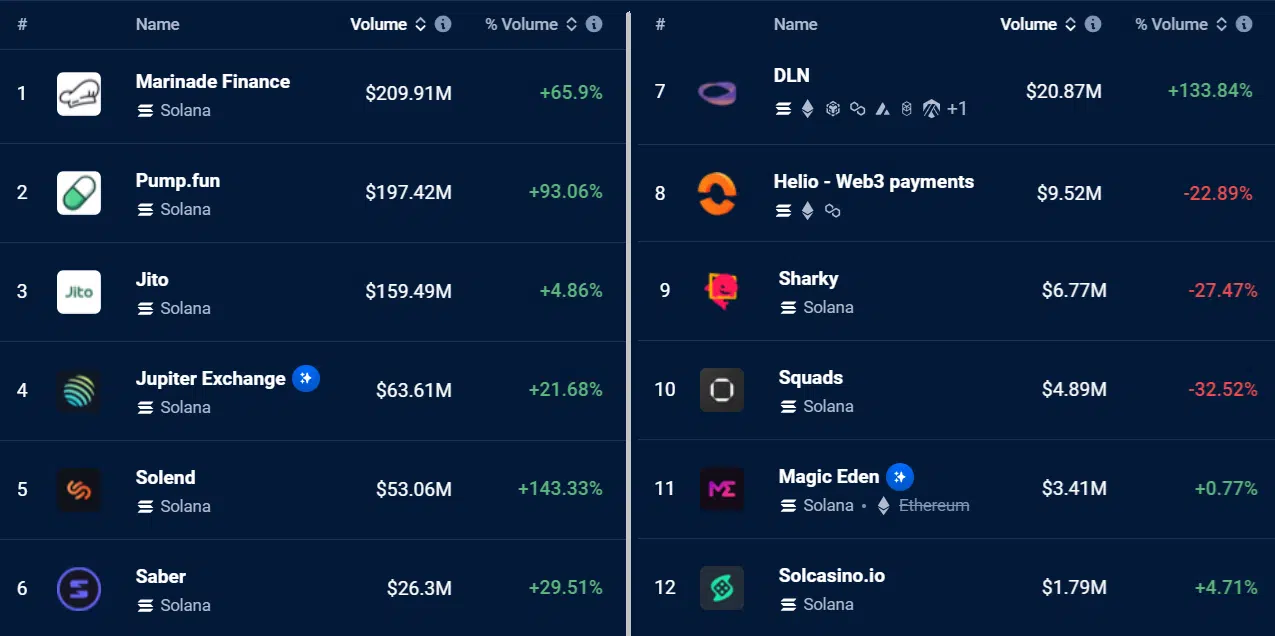

Data from dAppRader shows Solana DeFi staking protocol Marinade Finance recording $209.91 million in volume, up by a substantial 65.9%. Pump.fun is also seeing massive growth with a 93.06% surge in volume, reaching $197.42 million.

Another project seeing steady growth is Jito, with $159.49 million in volume, marking a 4.86% increase. Jupiter Exchange, Solana’s leading decentralized exchange aggregator, witnessed a 21.68% increase in volume to $63.61 million.

On the lending and borrowing side, Solend saw a notable 143.33% increase, bringing its total volume to $53.06 million. Meanwhile, Saber, a stablecoin swapping platform, recorded a 29.51% increase in volume, with total transactions reaching $26.3 million.

However, not all protocols are seeing the same level of success. Helio saw a 22.89% decline in volume to $9.52 million, and Sharky, a lending protocol, experienced a 27.47% drop. Despite these setbacks, overall Solana activity remains strong.

Solana Shows Rebound Potential

Solana’s price movements show a period of consolidation following the recent correction. At the time of writing, SOL is trading around $146.03, with the nearest support level at $144.76, as indicated by the pivot point.

This pivot position indicates that Solana could stabilize in the short term before making another upward move. Further support levels lie at $128.80 (S1) and $118.94 (S2), providing additional safety nets should the price experience further declines.

Meanwhile, the first resistance (R1) is at $160.72, a level it previously failed to hold during the late-September rally. If Solana breaks through this level, it could aim for $170.58 (R2), with a longer-term target at $186.54 (R3), which corresponds to a late July high.

Currently the +DI within the Directional Moving Index is at 19.7, trending downward, while the -DI sits at 18.5, also sloping downward, but at a slower rate. The Average Directional Index (ADX), at 20, shows that the market is in a consolidation phase with no strong trend direction yet.

thecryptobasic.com

thecryptobasic.com