Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

There’s a manic electricity in the air right now. OpenAI is going through it. So is Eric Adams. Diddy is roomies with SBF.

You know what they say — sometimes you just need a spark, and then boom, boom, boom, now the bats come alive. Who knows what’s around the corner, but I’d hold onto your hats.

In the meantime, here’s all you need to know about Bhutan’s crypto and how the big brains are thinking about markets right now.

— David Canellis

Royal Bitcoin

The Kingdom of Bhutan’s bitcoin mining operations are raking it in.

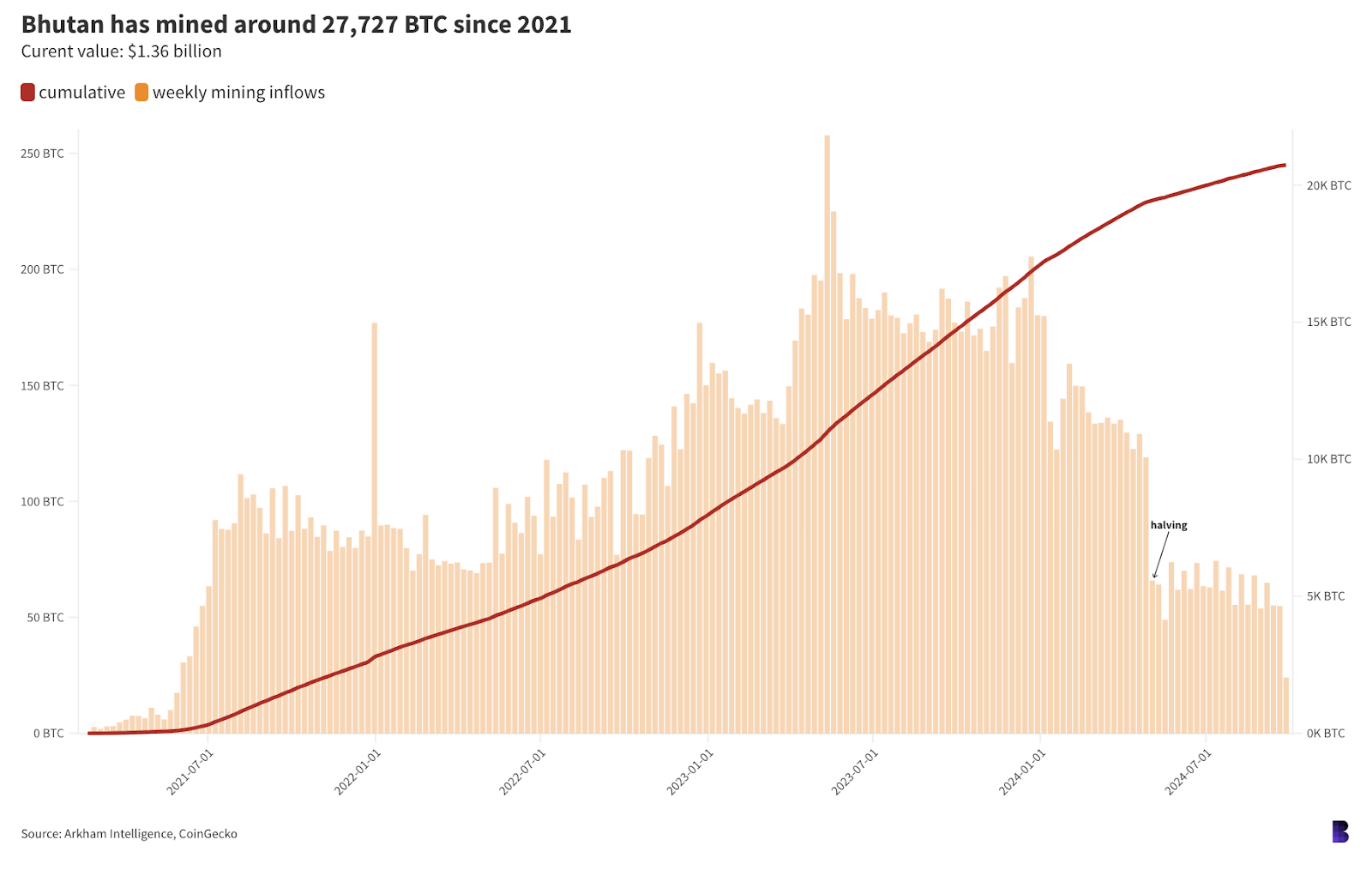

Bhutan is currently generating anywhere from 55 BTC ($3.6 million) to 75 BTC ($4.9 million) every week from its mining operations.

The government utilizes mining pools including AntPool, Braiins and Foundry, according to onchain data via Arkham Intelligence.

Bhutan’s sovereign holding company, Druk Holdings, was formed in 2007 to manage investments for the crown “for the long-term benefit of the people of Bhutan.” Its portfolio includes manufacturing and construction, a bank, an airline — and crypto.

Druk’s onchain data shows that it’s been active in crypto since at least February 2021, when it received its first bitcoin: 0.0267 BTC worth around $1,280 at the time.

Following the provenance of that first deposit ends with AntPool, so it could be that that’s when Druk (or another arm of the Bhutan government) first started dabbling in bitcoin mining.

It appears that Bhutan also mined ether for a time. From December 2021 right up until the network’s switch to proof-of-stake in September 2022, Bhutan received 92.53 ETH ($245,000) in a steady stream from an address tied to AntPool.

Much smaller than the 27,727 BTC ($1.36 billion) overall mined by Bhutan in the past three and a half years or so.

Between 2021 and 2022, Bhutan also sent and received over $817 million in cryptocurrency — including bitcoin, tether, usdc, chainlink and ether — to and from lending platforms BlockFi, Celsius and Hodlnaut, all of which have since filed for bankruptcy.

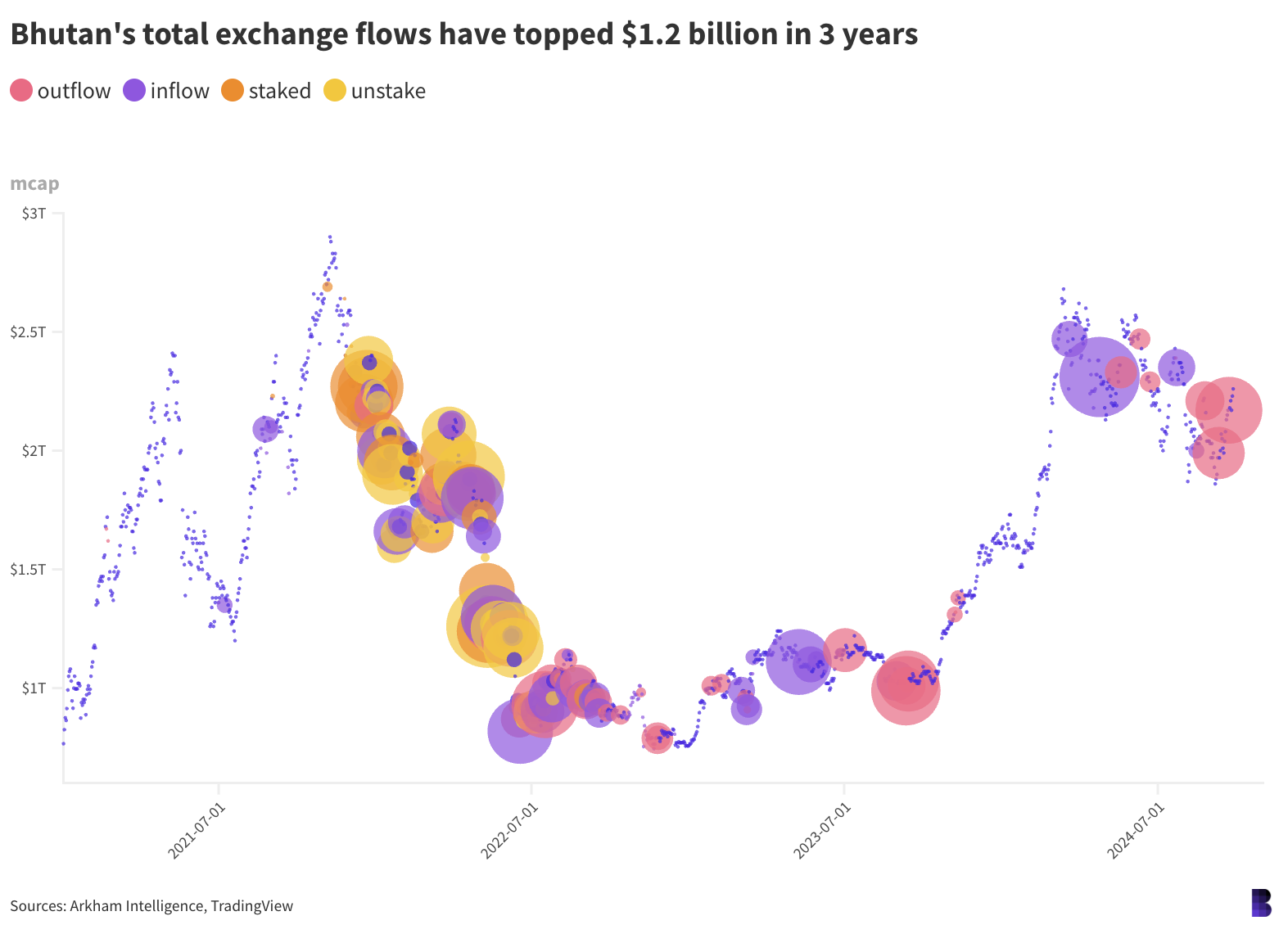

The chart below plots Bhutan’s onchain moves against crypto’s total market cap.

Pink circles represent outflows to crypto exchanges such as Binance and Kraken, purple circles show inflows from those platforms and others back to Bhutan, and the orange and yellow ones indicate where crypto has been staked and unstaked with lending startups.

It’s difficult to properly calculate how much cash Bhutan’s crypto operations have brought in for government coffers.

Bhutan has sent 16,897 BTC to exchanges over the years, worth $1.1 billion now but $578.5 million at the individual time of transfers.

But it has also directed over $237 million in stablecoins and $13.4 million in ETH to trading platforms, and received sums of stablecoins, bitcoin, ether, bnb and chainlink in return.

That could imply that Druk has previously actively traded crypto markets, but it’s not totally clear.

Aside from its bitcoin, Druk is still holding 656 ETH ($1.74 million) — specifically wrapped beacon ETH — with those coins flowing into its addresses from Binance in March around bitcoin’s all time high.

And out of the bitcoin that Bhutan has mined to date, it has retained 13,119 BTC ($860.4 million) in its own addresses, the equivalent of a touch under half its total identified haul. Not bad at all.

— David Canellis

IYKYK

It’s not easy being a bull in a sideways market, Empire hosts Jason Yanowitz and Santiago Santos noted in the Friday round up.

“I’m uncomfortably bullish at this point,” Yanowitz clarified.

“I think people are so uncomfortably offside right now because they’ve gotten so caught in this, like, consolidated period of six months of choppiness that they forget what could be coming.”

With the rate-cutting cycle and now the election — “where I [Yano] don’t think it necessarily even matters who’s going to be elected” — we’re getting closer to eliminating a lot of the uncertainty that caused the market to go sideways in the first place.

The chart is still “noisy,” Santi noted. But he’s also feeling good about the traction.

“I continue to believe we’re entering a concern application phase of this industry. You’re seeing it in different pockets … And a lot of times it’s … very important to re-underwrite your thesis and I appreciate some of these things might have been tried in 2014, 2016, 2018, 2020, 2022. The space is moving fast and you need to be constantly on top of it,” Santi said.

And now you know.

Only last week I wrote about the September seasonality — which could turn it into a down month — and how it was starting to look like bitcoin might buck the trend.

Now, a week later, and there’s a lot of green throughout the broader crypto market. Look at AI tokens and altcoins over the past week (though I don’t disagree with David that some green does not a season make).

We’re also seeing bitcoin break through levels where it was previously stuck. This morning, it’s up to $65,500, its highest since early August, with ETH getting a bump to $2,650 as well.

To Jason’s above point, there are still unknowns. However, it’s becoming clear that price action might not care about the outcome of certain events (like the election) as much as, perhaps, some folks do.

Looking past November, the fourth quarter has long been tipped as a turning point. Ledn’s John Glover has been steadfast in saying that he thinks we could see bitcoin take off in the final months of the year. His core case, he told Empire readers this summer, is $85,000 to $95,000 by year-end.

And PitchBook’s Robert Le told us that he feels “pretty good” about a full-swing bull market next year.

The seedlings of positive vibes are definitely there, they just seem to need a bit more nurturing before they fully mature.

— Katherine Ross

blockworks.co

blockworks.co