At Bitcoin Market Journal, we invest in crypto tokens as if they were stocks. While there are important differences between the two, we analyze crypto “companies” like traditional companies, and diversify our investments with a mix of both.

Key Takeaways:

- Litecoin, created in 2011, has demonstrated resilience and reliability over the years, maintaining its position among the top cryptocurrencies.

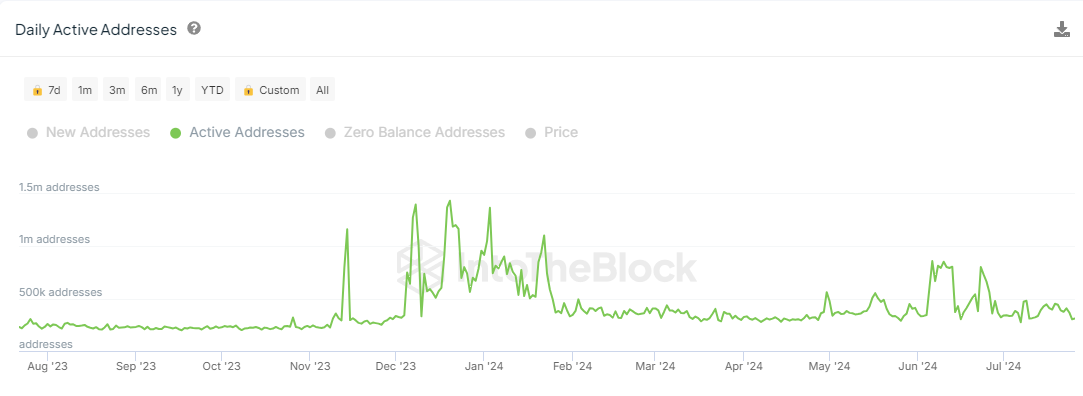

- Litecoin records an impressive number of daily active users, a significant achievement for a blockchain that does not support smart contracts.

- However, Litecoin faces significant competition from other payment cryptocurrencies like Bitcoin Cash – as well as the rise of stablecoins, which are preferred for payments due to their lower volatility.

In 2011, bitcoin was barely two years old. But Charlie Lee, a brilliant mind fresh from the halls of Google, had a vision.

Lee wasn’t just another engineer jumping on the blockchain bandwagon. He envisioned a cryptocurrency that would complement bitcoin, rather than compete with it. He saw Litecoin as a digital asset designed for everyday users, not just the tech-savvy early adopters.

As he built and launched Litecoin, he improved on bitcoin, with faster transaction times and a mining process that wouldn’t require a supercomputer farm in your basement. It was cryptocurrency for the masses, a digital coin that your grandmother could use (well, almost).

The crypto community took notice. By late 2013, Litecoin wasn’t just another altcoin: it boasted a $1 billion market cap, catapulting it to the number two spot in the crypto rankings. For a brief, shining moment, it was the digital silver to bitcoin’s digital gold.

But the crypto world moves fast, and new players entered the game. By 2016, Ripple had nudged Litecoin off its silver medal podium. Not long after, Ethereum swooped in, claiming the second spot and holding onto it tenaciously.

Still, Litecoin has proved its staying power for over a decade. The LTC token has weathered bull runs and bear markets, survived the rise of DeFi and NFTs, and still stands tall among the crypto elite. Litecoin has been a constant presence in the top rankings for over a decade.

So, what’s the secret to Litecoin’s staying power? How has this bitcoin alternative managed to keep its shine in a market that’s constantly chasing the next golden opportunity? Here’s our deep dive on Litecoin for the intelligent crypto investor.

Key Fundamental Data

Daily Active Users (DAU): According to IntoTheBlock, Litecoin records 368,000 daily active users. This marks a significant increase in user engagement compared to the previous year.

Fees and Revenues: Litecoin generates revenue primarily through transaction fees, which are notably low, especially when compared to cryptocurrencies like bitcoin. These fees are supplemented by block rewards that incentivize miners to secure the network. As block rewards decrease over time due to halving events, transaction fees will play an increasingly crucial role in incentivizing miners. The current low fees are sustainable as long as the transaction volume remains high enough to provide sufficient compensation to miners.

Market Cap: LTC has a market cap of $4.3 billion, marking a notable 30% decline from a year ago. This places it behind other Proof of Work (PoW) payment tokens like Bitcoin Cash ($6.3 billion) and DOGE ($14.3 billion).

Market Analysis

Problem that it solves: Litecoin was created to offer a faster and more scalable alternative to Bitcoin. It has a block time of 2.5 minutes (compared to Bitcoin’s 10 minutes), which allows for quicker transaction confirmations.

Customers: Litecoin's customers are individuals and businesses that want to facilitate faster, cheaper blockchain transactions. (Note, however, that the seller has to accept Litecoin, which is where they have a long way to go.)

Value creation: Litecoin's value lies in its speed and lower fees for transactions. It provides a secure, low-cost, and speedy transaction network, making it ideal for small and medium-sized transactions.

Market structure: Initially, Litecoin was one of bitcoin's strongest competitors. However, a decade later, the cryptocurrency landscape has evolved, and newer cryptocurrencies like stablecoins have emerged, offering faster and more efficient transaction methods.

Market size: The global crypto payments market is valued at $1.29 billion and is projected to grow to $4.85 billion by 2033. While this represents a significant growth opportunity, Litecoin faces increasing competition, particularly from stablecoins like USDC and USDT, which offer faster and less volatile payment solutions.

Regulatory risks: Due to its decentralization, Litecoin is probably not the first cryptocurrency that regulators would target. That said, all digital assets come with some degree of regulatory risk.

Competitive Advantage

How big is the company moat? Can they defend against competitors?

Technology/blockchain platform: Litecoin operates on its own Proof-of-Work blockchain which has been up and running for over a decade.

Lead time advantage: Litecoin was among the first few altcoins, and kickstarted the movement of developing alternatives to bitcoin.

Contacts and networks: With backing from notable industry figures, including its founder Charlie Lee, it’s safe to presume that Litecoin has access to key industry players.

Management Team

Does the team have the experience, intelligence, and integrity to make the company great?

Entrepreneurial team: Litecoin has a very strong group of developers and a well-respected board of directors, including Charlie Lee, Xinxi Wang, Alan Austin, and Zing Yang.

Industry/technical experience: As one of the oldest projects in the industry, it’s safe to say that the team has the required industry experience.

Integrity: Litecoin’s team has not been entirely free from controversy: in 2017, Charlie Lee faced backlash from the community after he sold all the LTC that he owned amidst the bull run that year.

Token Mechanics

Is the token design favorable to long-term investors?

Is a token necessary? Like bitcoin, Litecoin requires a token for basic transactions. Far from being a "bolt-on blockchain," the token is the product.

Value added: LTC operates similarly to many other tokens but offers a distinct advantage through its faster confirmation times.

Decentralized: Fully decentralized. Users generate value through the crypto mining process.

Token supply: LTC has a fixed supply of 84 million tokens.

Public exchange: LTC is listed on major crypto exchanges like Binance, Coinbase, and KuCoin.

MVP: Litecoin has been functional for over a decade, and is a well-established name in the crypto world.

User Adoption

How easy will it be for the company to grow users?

Technical Difficulty: LTC suffers from the same complexities that come with blockchain technology. Users must navigate concepts like private keys, wallet management, and transaction fees, which can be daunting for individuals unfamiliar with cryptocurrencies.

Halo Effect: Given Litecoin's close affiliation with bitcoin, the halo effect is strong. However, Litecoin doesn't have many strong associations with other institutions or influential figures, and merchant acceptance is limited.

Buzz: Litecoin has a strong buzz and boasts a strong social media presence with over 1 million followers on Twitter and 359k members on its subreddit.

Potential Risks

What risk factors might cause intelligent investors to stay away?

Team: Litecoin's team is transparent, and its founder Charlie Lee is a well-known figure in the cryptocurrency space. However, past controversies, such as Lee selling all his LTC holdings in 2017, have raised concerns about integrity. While the team has strong technical experience, such controversies could contribute to a perceived risk in trusting the leadership fully.

Financial: The Litecoin Foundation faces financial risk due to its heavy reliance on donations, with a significant portion of its funding coming from Charlie Lee since 2017 (according to Coindesk in 2019). Based on the latest financial statement of the Litecoin Foundation, its total assets amount to approximately $400k, further emphasizing the Foundation’s financial vulnerability and raising concerns about its long-term sustainability

Regulatory: Litecoin carries some regulatory risk, particularly since it is one of the most popular cryptocurrencies in the market. The project does however operate out of Singapore, a relatively crypto-friendly jurisdiction, minimizing the risk of US-based intervention.

Smart Contract: Litecoin has limited smart contract capabilities compared to newer blockchain platforms. In terms of bug reporting, there is no prominent bug bounty program currently in place, but issues can be reported through its Github forum.

Traction: Litecoin faces low traction risk as it has consistently demonstrated an ability to attract and maintain users, both on-chain and off-chain on its socials.

Behavioral: We believe many users invest in LTC now based on its long track record and proven ability to withstand periods of high volatility. Additionally, many others seem to hold out hope the project will get back to its glory days.

Investor Takeaway

BULL CASE: Litecoin boasts proven longevity and reliability as one of the oldest and most valuable cryptocurrencies by market cap. This long-term stability is a testament to its resilience and the trust it has garnered within the crypto community. Additionally, Litecoin records an impressive number of Daily Active Users, a notable achievement for a blockchain that does not support smart contracts.

BEAR CASE: However, Litecoin faces significant competition from other PoW payment cryptocurrencies like Bitcoin Cash and Dogecoin, both of which have larger market caps. The LTC market cap has seen a notable decline over the past year, indicating volatility and market challenges. Additionally, the rise of stablecoins, which are preferred for payments due to their lower volatility, presents a competitive challenge for Litecoin's use case as a payment method.

Overall, our analysts rated LTC a 3.5 out of 5, based on its proven longevity balanced against significant competition from other payment cryptocurrencies. Download the complete scorecard here.

This analysis is to help make you a better-informed investor; it is not financial advice. The future may look different than the past. All investing involves risk; see our investing approach for how we manage risk through diversification. Never invest more than you’re willing to lose, and see losses as learning.

bitcoinmarketjournal.com

bitcoinmarketjournal.com