-

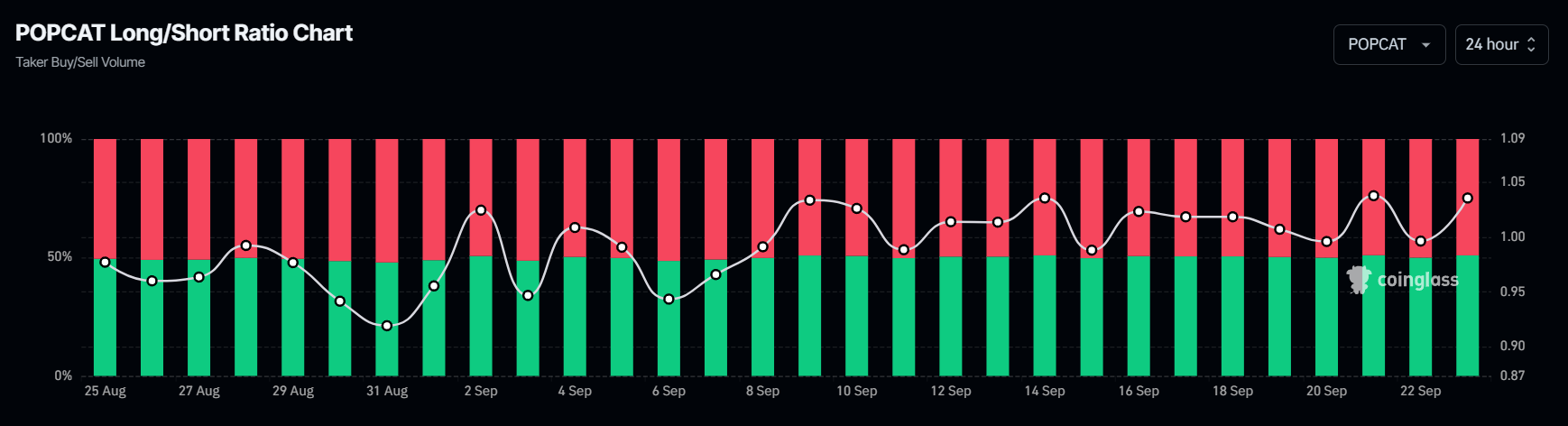

POPCAT’s Long/Short ratio currently stands at 0.1035, indicating bullish market sentiment among traders.

-

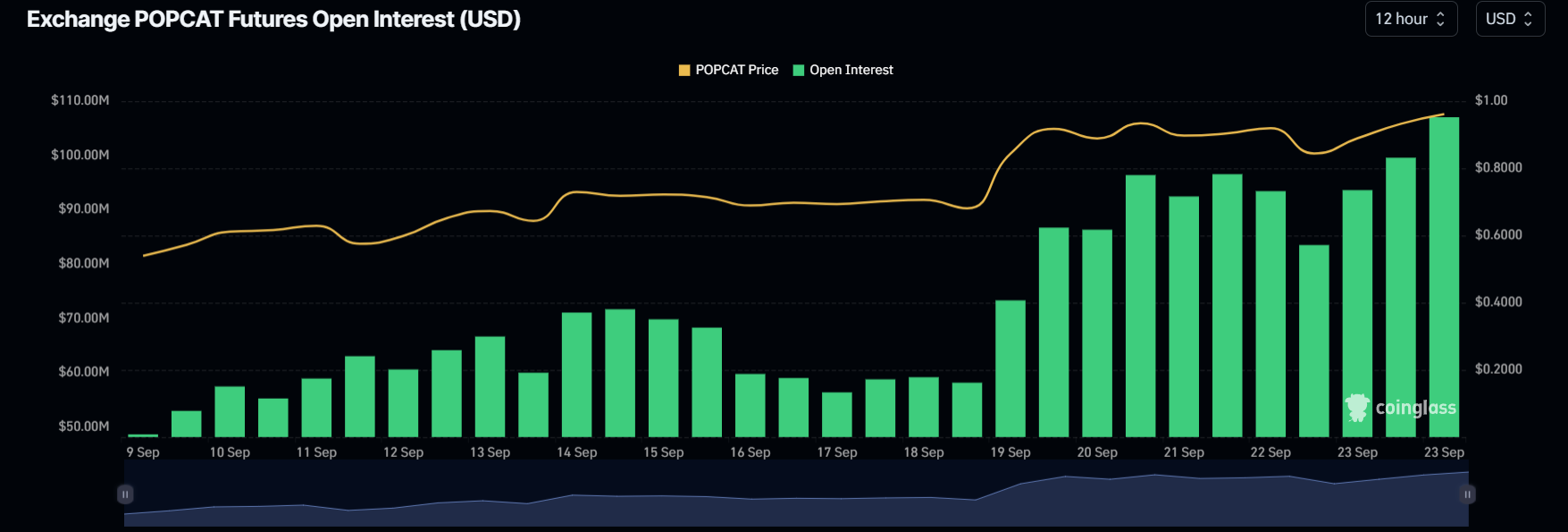

POPCAT future open interest has increased by 30% in the last 24 hours, and 6.8% in the last four hours.

-

There is a high possibility that POPCAT could soar significantly and also make a new high.

Popcat (POPCAT), the popular Solana-based meme coin is poised for a significant upside rally as its on-chain metrics flash bullish signals near the breakout level. Over the past few days, POPCAT has been making a wave in the cryptocurrency landscape following a substantial price surge of over 40%.

POPCAT Price Momentum

At press time, the meme coin is trading near $0.963 and has experienced a price surge of over 16% in the past 24 hours. During the same period, investor and trader participation has skyrocketed. According to CoinMarketCap data, POPCAT’s trading volume has increased by 130% in the last 24 hours.

POPCAT Technical Analysis and Upcoming Levels

According to expert technical analysis, POPCAT appears bullish and is currently facing a strong resistance level of $1. However, this is the third time the meme coin has reached this level. Earlier, when it hit this level, it experienced notable selling pressure, resulting in a 20% price decline.

This time the sentiment has completely changed, and based on the recent performance there is a high possibility that the POPCAT price could soar significantly and also make a new high.

Bullish On-Chain Metrics

This positive outlook for the meme coin is further supported by on-chain metrics. According to the on-chain analytic firm Coinglass, POPCAT’s Long/Short ratio currently stands at 0.1035, indicating bullish market sentiment among traders.

Additionally, its future open interest has increased by 30% in the last 24 hours, and 6.8% in the last four hours. This growing open interest signals a bullish trend for the meme coin.

Traders and investors often use the combination of rising open interest and a long/short ratio above 1, while building long positions. Currently, 51% of top traders hold long positions, while 49% hold short positions.

The current on-chain data suggests that bulls are currently dominating the asset, and there is a strong possibility it could break the resistance level.

coinpedia.org

coinpedia.org