After what has been an eventful spring of 2024 for the global crypto market, the sentiment has stalled quite a bit since the beginning of the summer. The months of June and July have seen the market trade sideways for the most part — with the occasional spike in activity on individual projects.

When measuring the sentiment on the market, the Crypto Fear and Greed Index has been largely hovering between the values of 45 and 60. However, it is worth noting that the indicators have shifted to firmly bearish, with values between 20 and 25.

This sudden rise of fearful market sentiment can be attributed to fears of a global recession caused by over-leveraged asset prices and cooling consumer demand, which has caused the stock and crypto markets to tumble. The tech sector has been particularly hard hit, which has had ripple effects on major cryptocurrencies as well.

What does this mean for the global crypto market in the long run and should investors be worried that this temporary stagnation may be here to stay in the coming months?

There are several factors that can play into the movements of asset prices on the crypto market and analyzing some of the largest gainers and losers can help us better understand what could be on the horizon for crypto holders.

Some crypto investors have been looking for alternatives on the forex and commodities markets, with top destinations being some of the top-rated FX brokers at ForexBrokersList.org. Energies, such as oil and gas, have been particularly popular over the past year.

Top 5 Gainers for July

Major gainers have been few and far between in July, as the market continued to trade in a see-saw fashion, with losers outnumbering the gainers.

However, there have been some notable exceptions, such as the bounce back of Helium and a positive month from XRP as well.

Contours for a long-term bullish run are yet to be visible, but political factors, such as the outcome of the U.S. presidential elections, could provide a catalyst for every asset market.

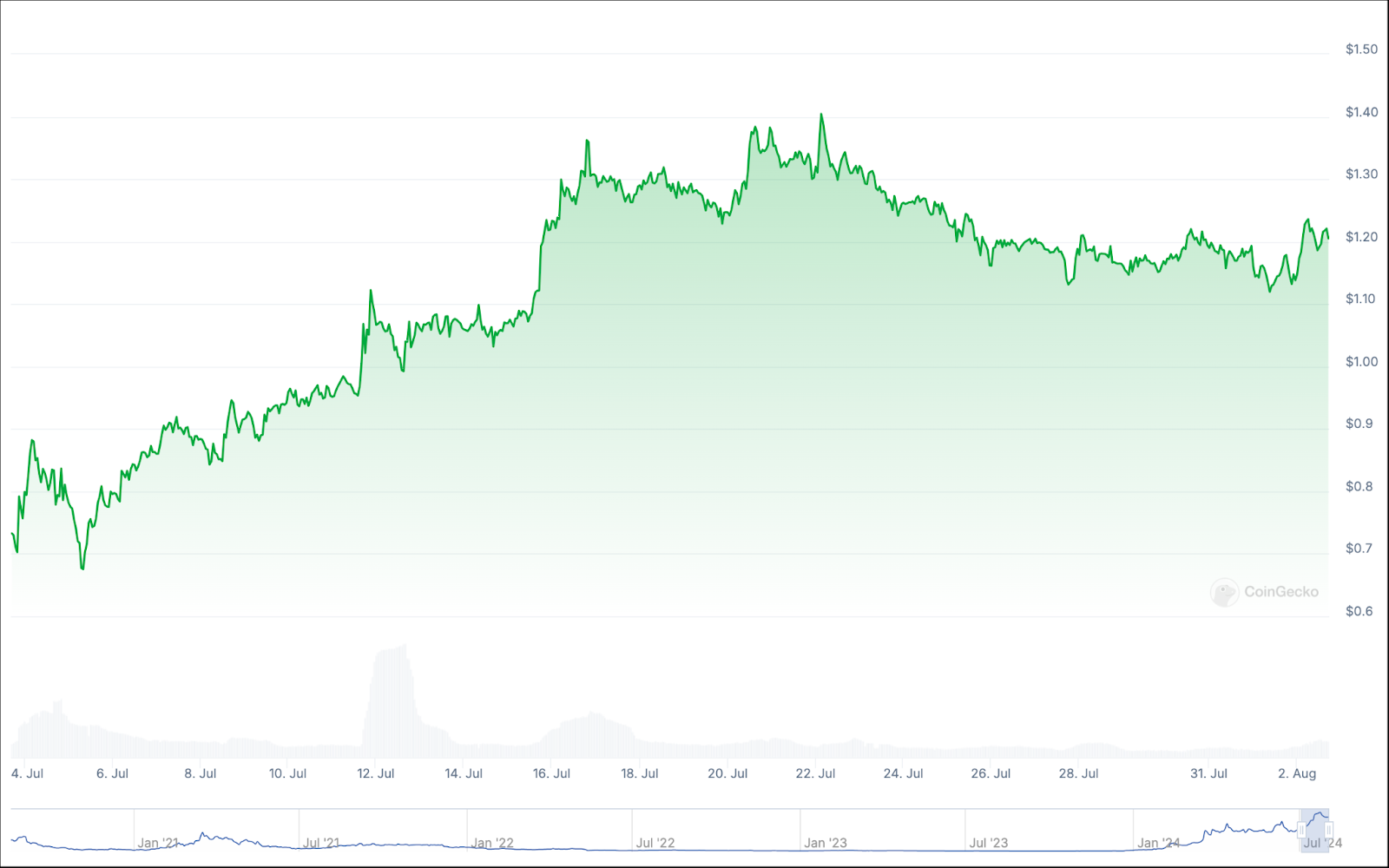

MANTRA (OM) +42.5%

Mantra has been the undoubted major winner of the month of July, as the end-of-month gain of over 40% does not fully describe the picture for the coin and its investors.

OM reached as much as $1.40 in July, which is nearly 15% higher than its price by the end of the month.

This means that holders of MANTRA had the opportunity to cash out on nearly 60% of gains this month, which is remarkable, especially during a period when such major price surges are less common.

However, it is worth noting that the coin is unlikely to maintain such bullish momentum going forward, unless a drastic shift takes place on the market as a whole.

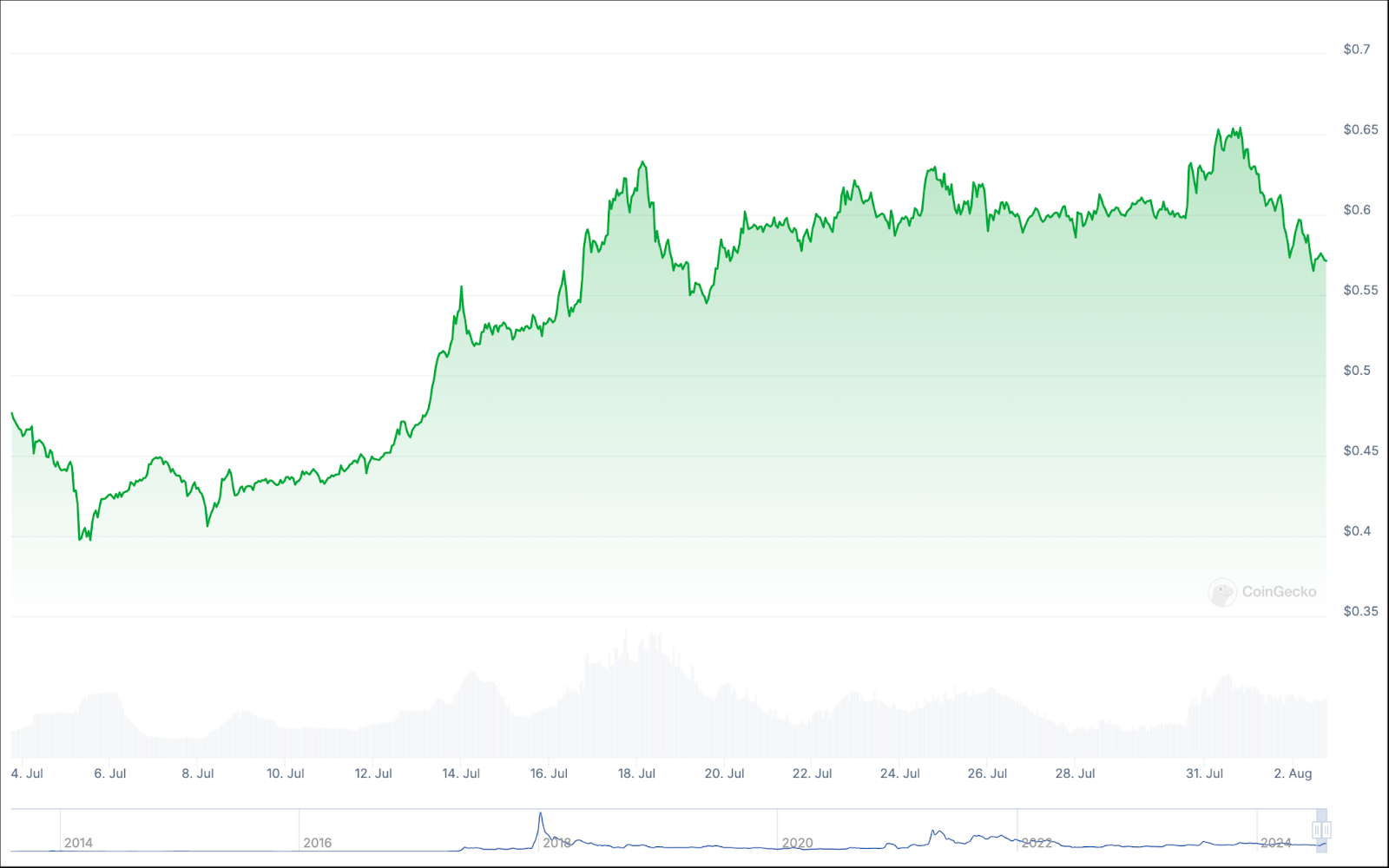

Helium (HNT) +39.8%

A recognizable name on the crypto market, Helium has been one of the hottest smaller crypto projects of the year.

HNT, which has gained just under 40% over the past 30 days, has nearly tripled when we look at the one year performance of the coin, which netted investors a 180% gain over the period.

While the overall bullish run on Helium has died down somewhat, the coin is still relatively actively traded, which could mean that such occasional bullish pushes are likely to occur again, once the crypto market sentiment turns firmly bullish.

Aave (AAVE) +19.9%

Aave is another smaller crypto project with an overall market cap of under $1 billion that has generated double-digit positive returns for its investors in July.

While its monthly returns have been quite good, the annual returns have been even better at 80%. Despite AAVE falling under the radar of most crypto investors, long-term holders have nonetheless benefited from investing in the coin since 2023.

Going forward, Aave’s prospects are unclear, as the coin is generally dependent on the overall market sentiment across major crypto holders.

XRP (XRP) +16.7%

One of the biggest cryptocurrencies on the market, Ripple’s XRP has been the one to watch in 2023. However, its fortunes have changed dramatically since the start of 2024 and its

While this is not good news for long-term XRP investors, short-term traders will be delighted to cash out on double-digit growth, as the crypto has gained over 16% throughout July.

The staganting crypto market, coupled with overall economic uncertainty, have not helped XRP grow in value in 2024. Therefore, much of its fortunes will depend on the stabilization of the global economy, as well as a shift in market sentiment, which has been hampering the crypto market since the start of summer 2024.

Kaspa (KAS) +11.3%

Another popular entry on our list, Kaspa has seemingly exploded onto the scene in 2024, with an annual gain of over 360%, making it one of the top-performing cryptocurrencies of not only the month of July, but the entire year of 2024 so far.

While July was relatively modest for Kaspa investors — returning little over 11%, the overall sentiment towards the coin has been nothing short of amazing. Kaspa mining has also grown significantly over the past few months, which could mean that a price correction is looming on the horizon for long-term Kaspa holders.

Overall, KAS is one of the most active cryptocurrencies on the current market and is likely to shift massively, depending on the direction of the market in the coming months.

Top 5 Losers for July

July has seen more losers than gainers, despite the Fear and Greed Index moving closer to a value of 60. A large number of smaller crypto projects experienced double-digit declines, as investors cashed out on their gains during an uncertain period on the market.

Fantom (FTM) −29.9%

Fantom has been one of the hardest-hit cryptocurrencies on the market in July. The DeFi ecosystem has seen its coin tumble over the past 30 days. However, the annual returns of the crypto have remained firmly in the green, with a

This is a significant metric, as it shows that the cumulative returns before the start of July were closer to 100% — meaning investors could have doubled their investment in a year with Fantom.

Such positive price history could also indicate that FTM will be among the fastest gainers once the crypto market turns bullish and fears subside among investors.

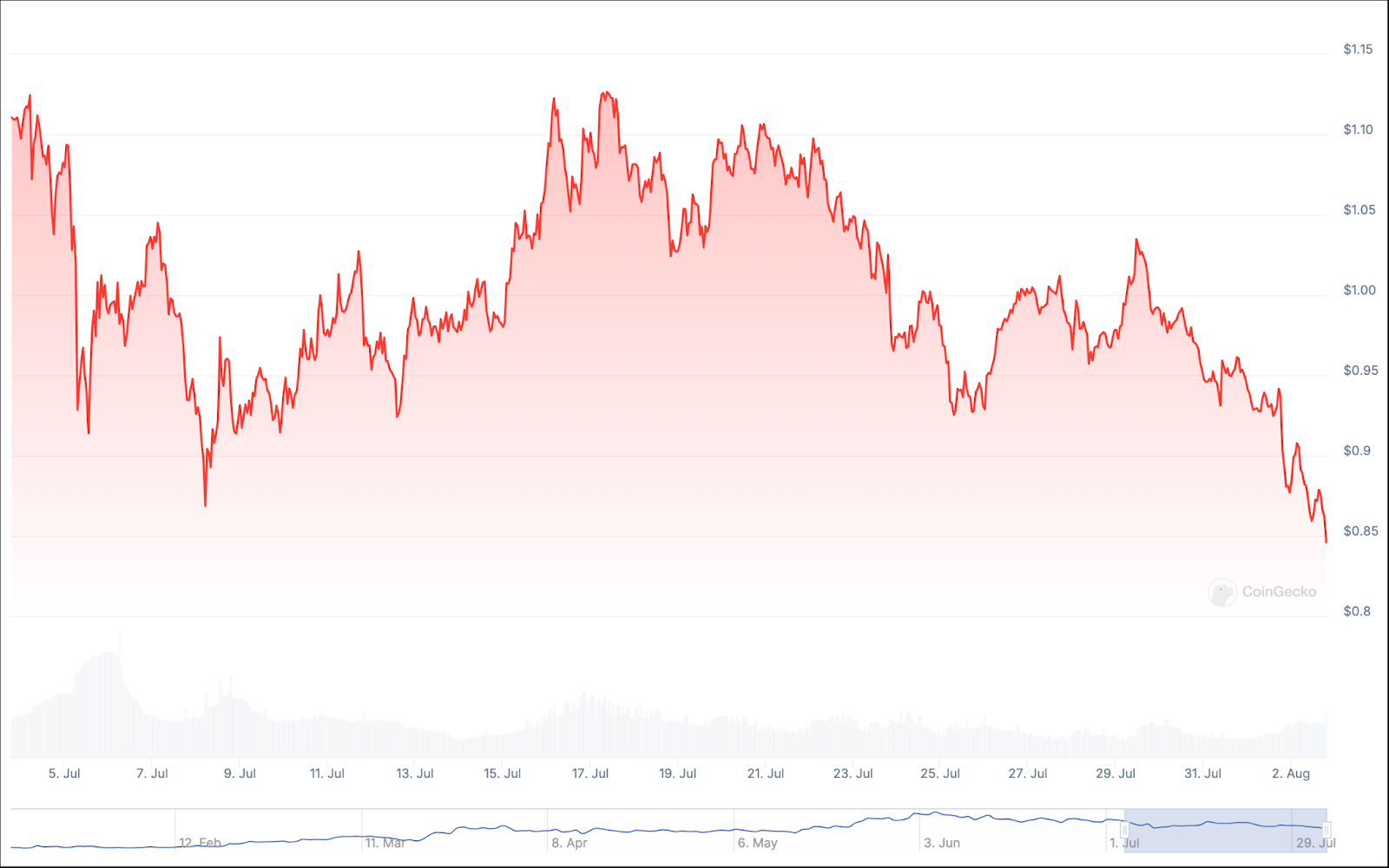

Starknet (STRK) −27.6%

Unlike some other entries on our list, Starknet’s monthly and annual returns are quite similar. July has seen the coin lose over 27% of its value, which amounts to an annual decline of over 30%.

It is also worth mentioning that a bulk of the decline seen on Starknet’s price chart is attributable to the period after 20 July, which means that investors had time to cash out on the coin before its downfall.

While the short-term returns look grim for Starknet holders, a market-wide bullish turnaround is unlikely to leave the coin unaffected. However, this dependence on market trajectory is unlikely to inspire much confidence in prospective investors of the project.

Ondo (ONDO) −26.8%

In a similar fashion to Starknet, Ondo has also experienced declines in July that are comparable to its

This raises some questions regarding the long-term viability of the Ondo Finance infrastructure and its ability to meet the demand for fixed-income securities on the crypto market.

However, if interest rates are to continue rising, the demand for Ondo’s services is likely to grow as well. Therefore, much of the success of Ondo and its investors depends more on the decisions made by the Federal Reserve, as opposed to factors specific to the crypto industry as a whole.

Akash Network (AKT) −26.7%

On the contrary to our previous two entries, Akash Network has been one of the top-gainers of the crypto market over the course of 2024. While the coin may have lost over 25% throughout July, its

This may mean one of two things for AKT investors:

-

The coin has amassed some staying power and is likely to withstand bearish pressures

-

A full-blown bear market could wipe out most of the gains seen by investors over the past year

Which one of these sentiments are true remains to be seen, but a short-term bump in the road is unlikely to dissuade AKT bulls from holding onto their investments.

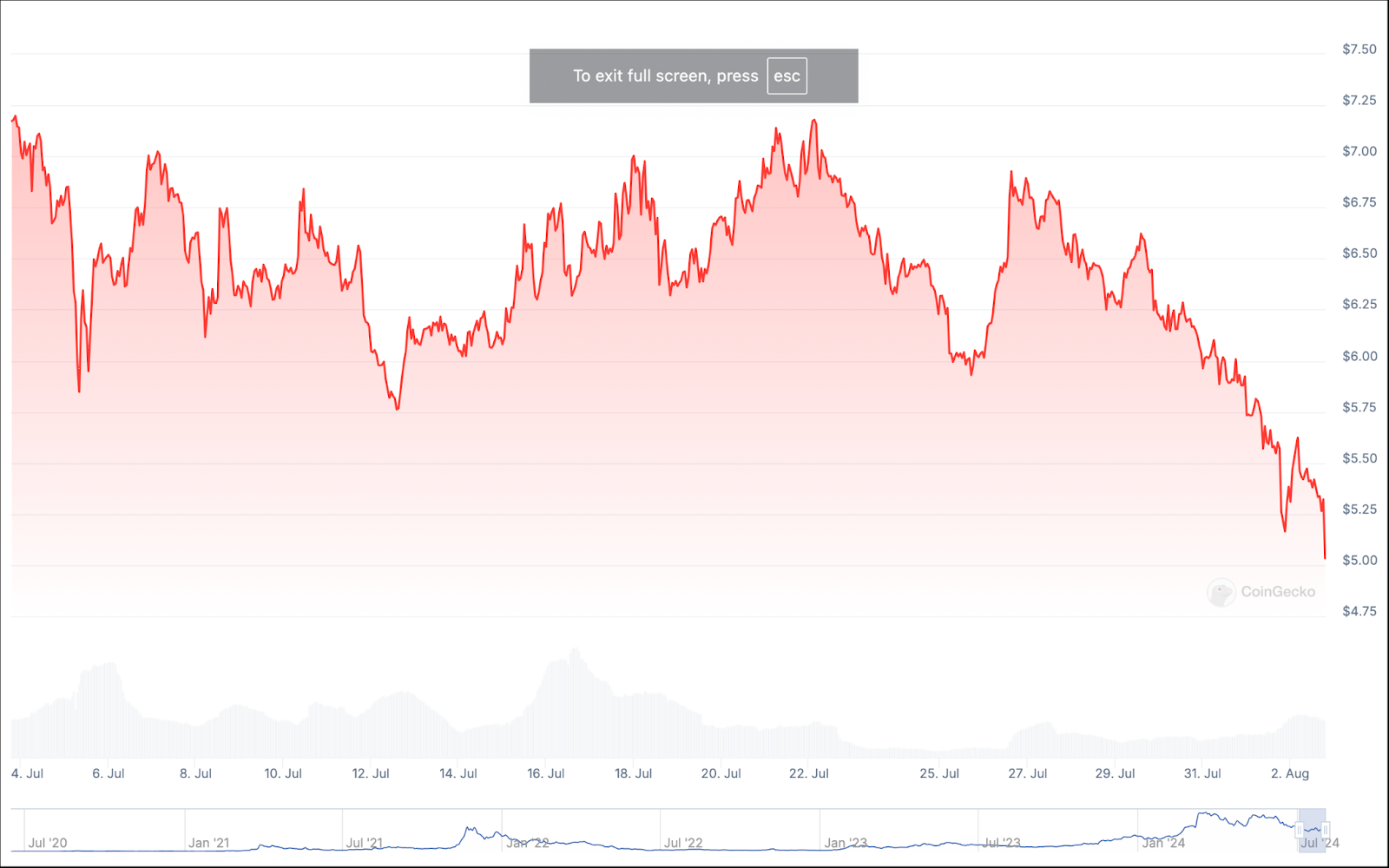

Render (RENDER) −25.8%

Render, which has changed its ticker from RNDR to RENDER, is a decentralized GPU rendering platform with a cryptocurrency of the same name.

RENDER has lost over 25% of its market value over the course of July. However, its annual returns still stand at an impressive 180% — making Render one of the best-performing cryptocurrencies of the past 12 months.

What stands in the favor of Render is the utility of its platform outside of the cryptocurrency market, which means that further double-digit declines in its price are unlikely in the coming months. However, a weaker demand for tech could be an issue RENDER investors should look more closely into when assessing the long-term prospects of the project.

Conclusion

While the month of July may not have been the most lucrative period for crypto investors, no serious signs of a crypto pullback can be observed, as investors show more caution and take note of the fundamental economic factors affecting the global crypto market.

Going forward, further asset price drops are not to be ruled out, as the overall market sentiment is still not entirely bullish — with major and minor cryptocurrencies still experiencing double-digit declines on occasion.

However, once sufficient tailwinds have been accumulated, some of the losers on our list are likely to turn their fortunes around and deliver explosive growth to their long-term investors that chose to stick with the projects of their choice.

cryptonews.net

cryptonews.net