The past week has been marked by a decline in cryptocurrency market activity, highlighted by a 4% drop in global market capitalization recorded in just the past 24 hours.

However, some assets have witnessed a surge in crypto whales attention as these large investors attempt to trade against the general market trend in anticipation of a rally in the coming weeks.

Toncoin (TON) Sees Uptick in Crypto Whales Count

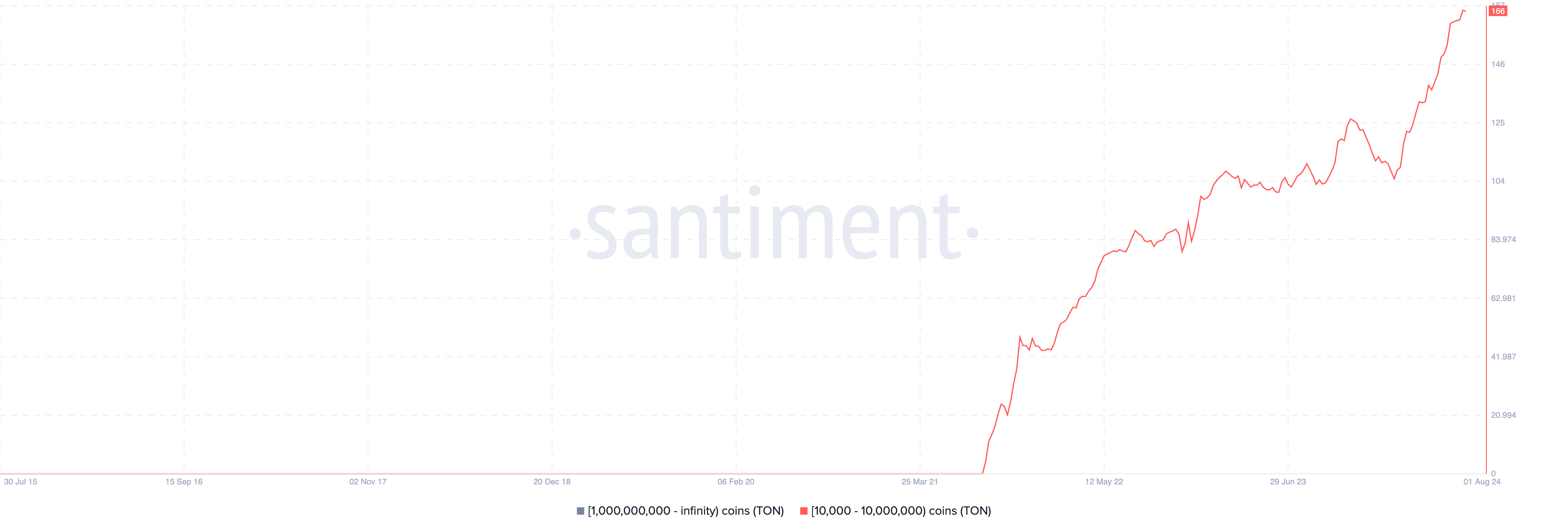

The price of Toncoin (TON), the cryptocurrency linked to the popular messaging app Telegram, has suffered a 17% price decline in the last month. However, on-chain data suggests that this has presented a buying opportunity, which the whales have noted.

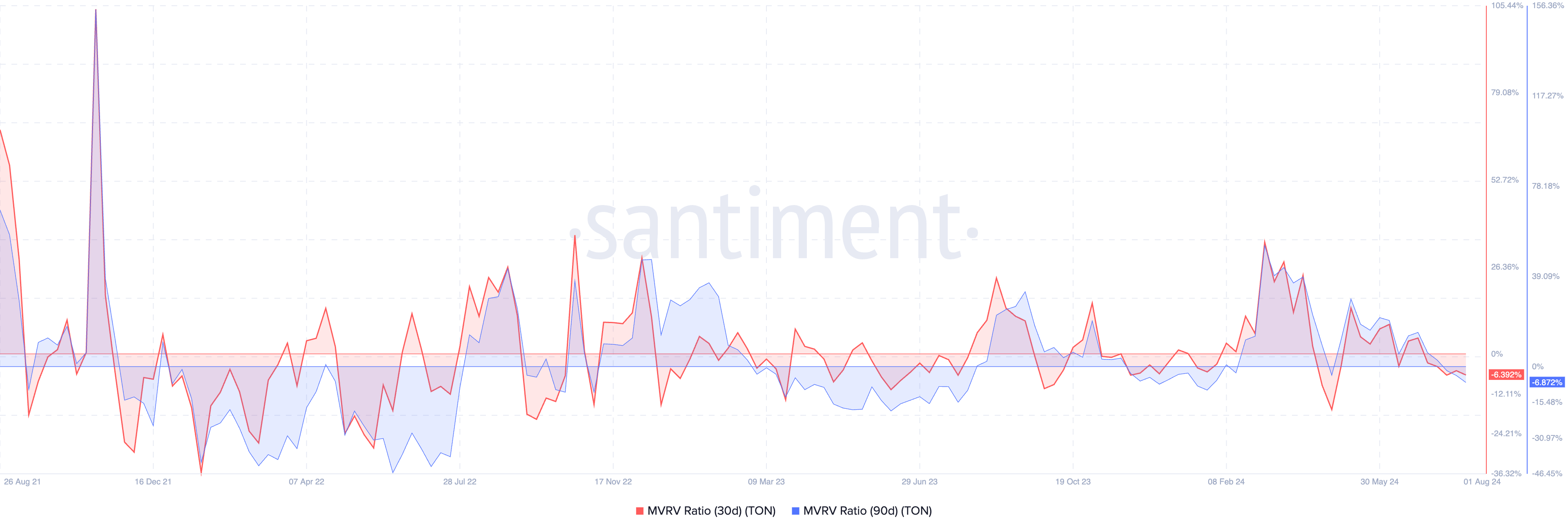

Readings from TON’s Market Value to Realised Value (MVRV) ratio show that the altcoin is currently undervalued, flashing a buy signal.

At press time, the token’s MVRV ratios assessed over different moving averages are negative. Its MVRV ratios for the 30-day and 90-day moving averages are -6.39% and -6.87%, respectively.

This metric measures the ratio between an asset’s current price and the average price at which all its coins or tokens were acquired. When it is below zero, the asset’s current market value is less than the price at which most investors acquire their holdings.

Historically, negative MVRV ratios offer a buying opportunity for traders looking to “buy the dip” and hoping to sell high at a later date.

As TON’s price craters, its whales have increased their accumulation. According to Santiment, the number of TON whales holding between 100,000 and 10,000,000 tokens has increased by 2% in the last month. The number of addresses comprising this cohort of TON holders is currently at an all-time high.

An increase in TON’s whale demand can also spike the interest of retail investors.

If this happens and the token initiates an uptrend, its price may climb to $6.81.

Large Holders Increase Their Tron (TRX) Holdings

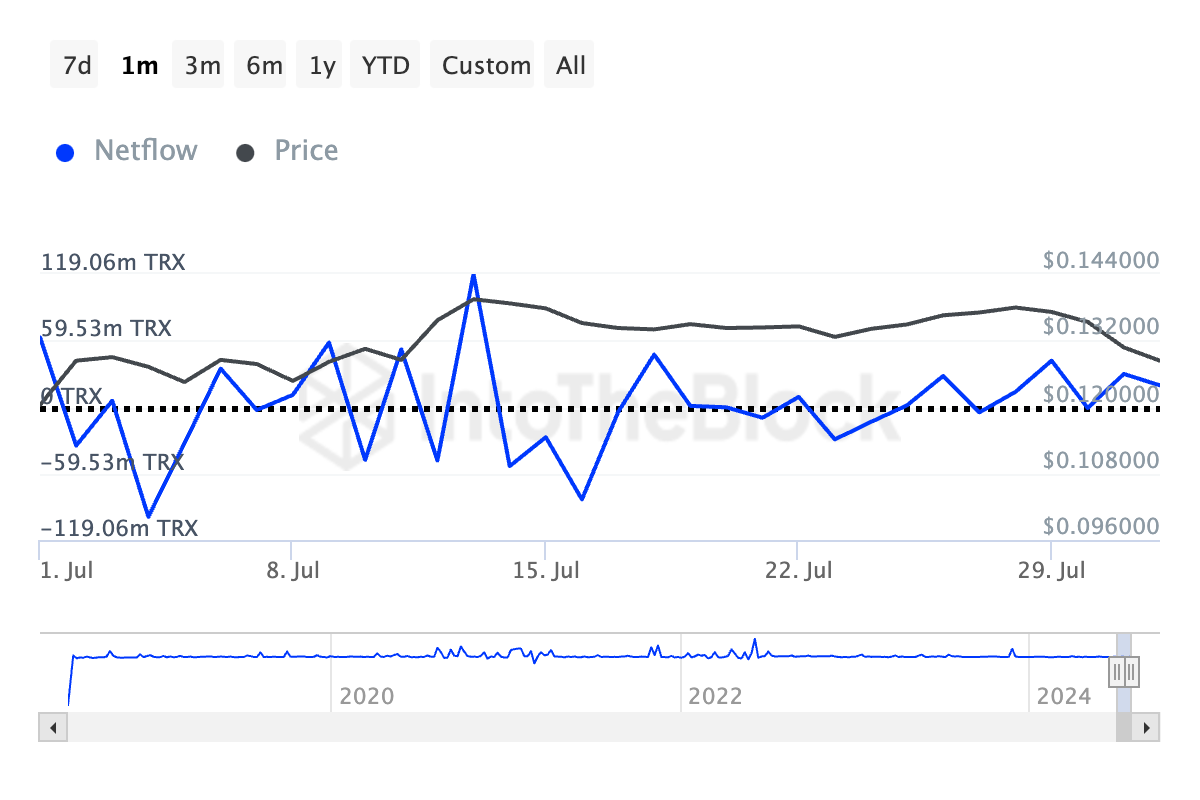

On-chain data from IntoTheBlock has revealed a significant 243% increase in TRX’s large holders’ netflow over the past 30 days.

Large holders refer to addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow measures the the difference between the coins these investors buy and the amount they sell over a specific period.

When it rises, it means that crypto whales are buying more coins. It is regarded as a bullish sign which hints at a potential price rally.

It is key to point out that TRX’s whales have increased their accumulation despite the coin’s sideways movements in the last month. Readings from its daily chart show that the altcoin trended within a horizontal channel throughout July and broke below the lower line of this channel on the last trading day of the month.

If whale accumulation persists, it can trigger a more widespread demand for the coin. This may lead to a price rally, which can cause TRX to trade at $0.13.

Binance Coin (BNB) and Its Emerging Bullish Divergence

The relative balance between BNB’s buying and selling pressures has prevented its price from trending strongly in either direction over the past few weeks.

However, the coin’s Chaikin Money Flow (CMF) has maintained an uptrend during that period. This indicator measures money flow into and out of an asset’s market. As of this writing, BNB’s CMF is 0.24.

A sideways price movement while CMF is rising suggests a potential bullish divergence. It indicates a growing influx of money into the asset, often a sign of accumulation by larger investors.

Even though BNB’s price is consolidating sideways, its rising CMF suggests that the coin’s underlying strength might be increasing.

If BNB successfully breaks out of this range upward, its price may touch $617.

beincrypto.com

beincrypto.com