Over the last 48 hours, the crypto market has experienced significant volatility, with Solana (SOL) and other altcoins being particularly affected. This instability has triggered substantial liquidations, highlighting the ongoing battle between buyers and sellers.

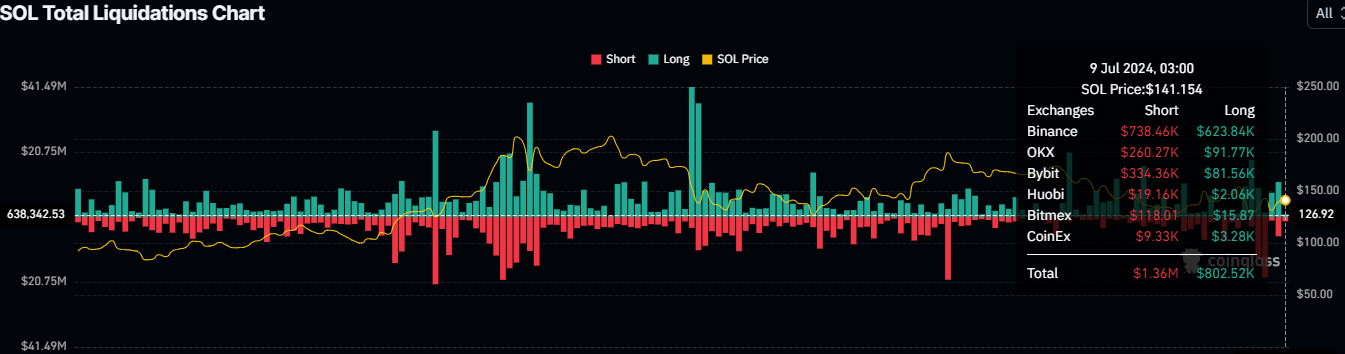

Recent analysis from Coinglass reveals that Solana’s market endured liquidations exceeding $2.16 million, with a staggering $1.36 million attributed to short positions near the $141 level. This indicates that many traders, anticipating a price dip, were caught off guard by the swift rise to an intraday high of $143.68. Meanwhile, SOL’s 24-hour trading volume surged by 9.12% to $3.17 billion, reflecting increased market activity.

Source: CoinGlass

This unexpected surge forced short sellers to liquidate their positions, further fueling market volatility. Amid this turbulence, Solana’s on-chain metrics reveal a concerning trend: a steady decline in the number of active addresses, mirroring the recent market downturn.

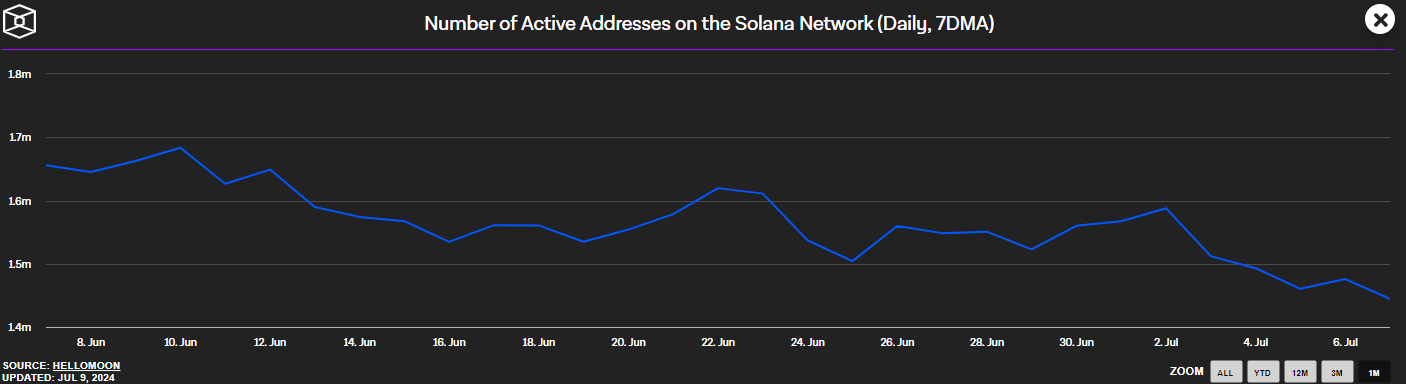

Solana’s Active Addresses Plummet

From a weekly peak of 1.68 million, the active addresses plummeted to a low of 1.44 million. This decline includes 368,335 users with wallet balances between 1 and 10 SOL and 117,910 users holding between 10 and 100 SOL.

Source: The Block

The decline in active addresses suggests waning investor engagement, reflecting a growing sense of caution in the current market climate. This trend could foreshadow an additional decrease in Solana’s market value.

Amidst the current market turbulence, speculative anticipation exists regarding approving a spot Ethereum ETF. Should this approval come through, it could serve as a powerful catalyst for the market, reminiscent of the substantial capital influx witnessed with Bitcoin earlier this year.

Such a development could usher in a wave of investment into the cryptocurrency sector, significantly impacting Ethereum and potentially boosting other digital assets like Solana. The prospect has traders and investors on edge, eagerly anticipating the ripple effects that could transform the market landscape.

What’s Next for Solana?

Following a rebound from an intraday low of $135.27, SOL has shown resilience, climbing back to $141. This marks a 0.62% increase compared to the previous day, signaling a potential recovery. Consequently, Solana’s market cap has risen by 1.02% to $65.952 billion, securing its position as the fifth largest cryptocurrency.

Source: TradingView

Despite this upward movement, SOL has yet to escape its bearish trend. The weekly and monthly charts still reflect a decline of 5% and 11%, respectively. If the current momentum weakens, SOL could fall to the $130 support level, with further potential dips to $119 and even $110.

However, if market optimism strengthens, SOL might overcome resistance at $153 and $161. This could pave the way for a reversal of its bearish trend, offering a glimmer of hope for investors anticipating a potential rally in the near future.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com